Investors who invested in the Singapore stock market should be happy last year. The Straits Times Index rose more than 22% for the past one year. The rise was mainly led by banks and other blue – chip stocks such as SGX, ST Engineering etc

The STI index close above 3800 points at the end of last year. This put the index near its all-time high of 3,906 achieved back in October 2007. Many investors will be wondering whether the index is poised to surpass its all-time high this year.

Many bloggers and analysts are bullish on the Straits Times Index this year and have forecasted that the index will surpass its all time high and even will rise above 4000 points. In this article, I give my 2 cents view that it may not happen.

The Straits Times Index will definitely not close above its all time high by end of this year or at most it will surpass its all time high for just a short while, sometime in the first quarter of this year. Here are the following reasons why I am bearish on the index especially after the 2nd half of this year.

Trump Tariffs

The US has confirmed to impose tariffs on imports from Canada and Mexico. US neighbors will be hit with 25% tariffs. This might potentially set the stage for a damaging trade war between the US and two of its biggest trading partners.

In addition, Trump also threatened to follow up with a further wave of tariffs against the European Union. As the picture suggest, it will result in a lose lose situation between the US trading partners.

At the point of writing this article, Canada has said that it intend to retaliate with a forceful response. Mexico has also drawn up plans, but declined to provide details.

Higher tariffs usually result in higher prices for consumers and a higher cost of living. In addition, higher tariffs will also lead to the US being less competitive as more consumers will be forced use locally made products and thus leading to lower productivity.

Consequently, Singapore being a very export dependent country will be at the losing end and might lead to lower economic growth and consequently lower stock prices.

Sticky inflation

As a result of the tariffs imposed by the US, inflation will remain sticky in the US. In fact, though inflation in the US has came down from the high of 9.1%, it still remain firmly above Fed target of 2%.

I have said repeatedly in my articles, that inflation will remain elevated and I was right. In December, Core PCE inflation which is the Fed’s preferred inflation target rose 2.8% and is now at its highest level since May 2024.

Many bloggers and analysts were saying last year that inflation will come down to the Fed 2% target. As usual, they were wrong again. This year, inflation will remain elevated and the Fed will find it hard to cut rates. This will lower economic growth in the US with the persistent high borrowing costs.

With elevated inflation, REITs will remain depressed this year. As a number of big cap REITs are components in the Straits Times Index this mean that the index may not perform well this year.

US enters a recession

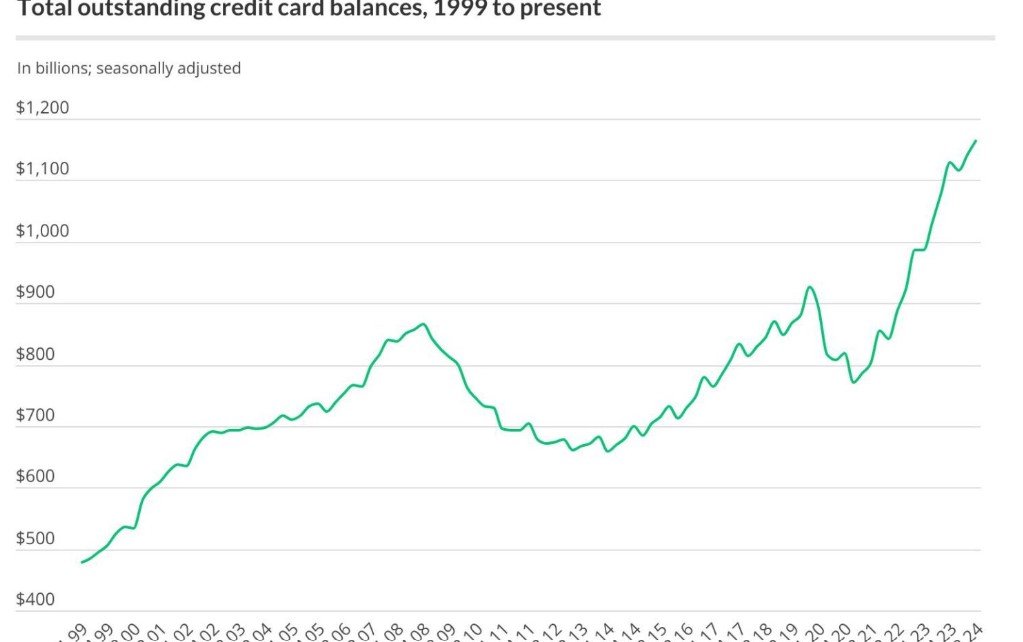

At the point of writing, US consumers are already experiencing difficult times due to higher cost of living. In fact, US consumers credit card balances are at record highs since 1999 as shown in the picture below.

As of August 2024, US credit card debt was $1.14 trillion. This is a staggering amount. However, consumers may not be able to last that long once US enters into a recession and more people lose their jobs. You can read more details here.

Though US current unemployment remain low at 4.1%, but this nice figure is mainly propped up by the massive employment of US Federal workers done by the previous administration.

However, with the current Trump administration, its totally different ball game altogether. In fact, Trump has offered federal workers the option to resign and receive pay for eight months, in a major effort to shrink and reform the US government.

His administration has asked almost all government employees to decide by 6 February whether they want to be part of a “deferred resignation” programme that will mean them leaving their jobs no later than the end of September.

This will inadvertently result in higher unemployment down the road. Singapore being a small and open country will definitely feel the effects if US enters a recession and this will impact banking stocks as well if Singapore enters a recession too.

In this article, I play the devils advocate and outline the reasons why the Straits Times Index could be in for a rough and volatile year and the index could end the year down instead of surpassing its record high.

However, before the downtrend happen, we could see a blow off top by first quarter of this year. The second half will be very volatile especially after August this and the bear market will last through 2026 once Singapore enters a recession later this year or early next year.

Hence, investors should not trust those written by bloggers and analysts and should instead do their due diligence in knowing the macroeconomic environment before investing.

Disclaimer: Please note that this is not a financial advice and investors need to do their own research before investing.