As soaring inflation and interest rates continues to strike fear into the hearts of many investors, there is a silver lining – commodity companies are doing extremely well due to the high commodity prices.

In fact, a budding commodity stock called Angkor Resources Corporation (“Angkor”), trading on the TSX Venture (TSXV) with the symbol ‘ANK.V’, offers an oasis of optimism as the new year approaches.

First, it has scored a major oil and gas lease in southwest Cambodia, complimenting their existing gold and copper plays in the country. Furthermore, Angkor expects a profit generating carbon capture project in western Canada to go online this month (October 2022).

About Angkor Resources

Angkor Resources Corporation is primarily engaged in optimizing resources for the mineral and energy sectors towards cleaner more sustainable solutions.

In the energy areas, Angkor takes on carbon reductions and cleaner transitions for energy solutions, both in Canada and in SE Asia.

On the mineral side, they focus on precious and base metal prospects in northern Cambodia, working closely with Indigenous People and their communities, plus pursuing environmental sand clean-up in the Philippines. This illustrates the advancing mineral development while creating benefits across social and environmental platforms.

More importantly, Angkor seeks niche markets in the resource sector where it can exercise ‘best ESG practices’ and provide high demand products while delivering lower impact recovery methods.

Let’s look at how Angkor is riding the commodity boom in 3 big ways.

1. Onshore ‘Block VIII’ Energy License in SW Cambodia

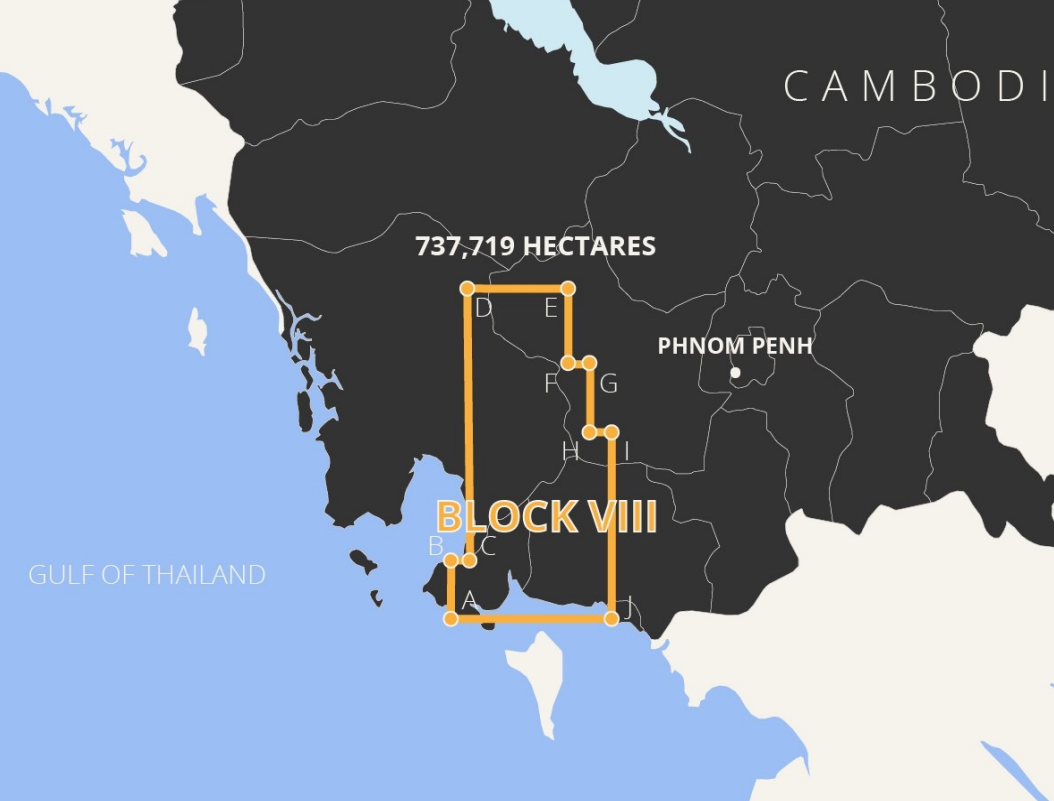

In October 2022, Angkor announced the approval of its onshore Block VIII lease after extensive negotiations with the Kingdom of Cambodia.

The lease encompasses 7300 square kilometers in southwest Cambodia. Geologists performing on-the-ground reconnaissance found numerous oil and gas seeps across the targeted areas.

Initial development work over the coming months will include seismic and magnetic exploration.

This new finding can be trailblazing because Cambodia is eager to establish its own energy sources after decades of importing nearly all of their oil and gas. A domestic energy source will propel the nation to their next level of development.

Delayne Weeks, CEO of Angkor, also emphasized how this lease can potentially create employment in the form of hundreds of jobs. Angkor’s best practices template will serve future resource and training development in Cambodia for decades.

2. Steady Cashflow for upcoming Carbon Recapture Project

The next big project is in Saskatchewan, Canada where Angkor expects its carbon recapture project involving 21 wells will kick off by the end of October 2022.

The carbon recapture works by feeding the waste gas from each well to a compressor station, where the gas is sold back to the provincial government for resale to homes across Western Canada.

Angkor’s compressor can accommodate up to 3 million cubic feet per day, but a second unit may be added in 2023 to double the output, with more wells around the region tied into the project.

Expected revenue is around $100,000 CAD per month, depending on the fluctuation of the gas prices. As winter approaches and the unfortunate conflict in Ukraine rages on, gas prices are expected to remain high over the next few quarters.

Green energy initiatives are the priority for most governments and consumers, and Angkor is happy to be a part of this through its carbon recapture project.

3. New license awarded for Copper & Gold mineralized system

The government of Cambodia also approved Angkor’s application for a copper and gold development license in northwest Cambodia in September 2022.

The lease area is 100 square kilometres and initial drilling and assay work several years ago revealed significant deposits of copper and gold. Initial steps will include more extensive survey and drilling work, along with an environmental and social impact assessment.

Angkor’s VP of Exploration, Dennis Ouellette, is optimistic about this “drill-ready target” because it allows Angkor to use the existing data to fast-track development rather than start from scratch.

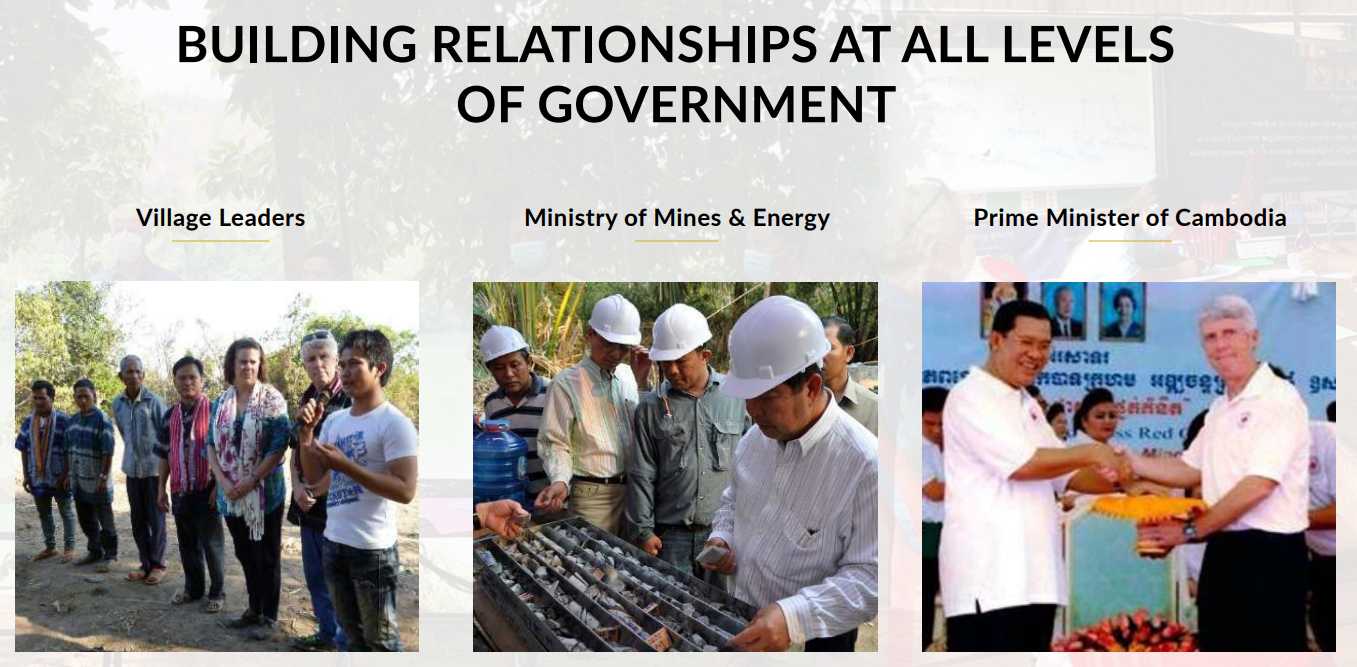

With over 10 years of mineral development experience in Cambodia, Angkor is perfectly suited to earn returns for investors while providing Cambodia with community development, human resource training and environmentally responsible revenue.

Conclusion

Despite being a small company, Angkor has made significant strides toward achieving its cash flow goals, while maintaining its strong ESG practices across all projects.

The 12 years of fostering relationships with the governments and communities in Cambodia and Canada have been paying off as the company manages to secure licenses and form partnerships with interested parties.

Angkor continues to work with both governments and communities to hire locally, provide education and on-the-job training, while maintaining an environmentally responsible approach.

Last but not least, Angkor management continues to put their money where their mouths are – its leaders own around 25% of Angkor shares.

The next few months will be a busy period as more developments start to bear fruit and we can expect year 2023 to be its most successful year to date.