When I first encountered Contract for Difference (CFD) trading, the concept of trading on margin was both intriguing and daunting.

Like many beginners, I was drawn to the flexibility of CFDs, but I quickly realized that understanding the nuances was key to leveraging their benefits.

Hence, I am happy to come up with this guide because it is what I wish I had when I first started. It will take you through the basics of CFDs, highlight some personal lessons I learned, and even explore some strategies that can benefit both beginners and experienced traders.

What is CFD Trading?

CFDs are financial derivatives that allow traders to predict on price movements of various assets – such as stocks, commodities, and indices – without owning the underlying asset.

Unlike traditional trading, you do not own or take delivery of the underlying asset, but instead agree to exchange the difference in price between the opening and closing positions of your trade.

In essence, when you trade CFDs, you’re entering into an agreement to exchange the difference in price of an asset from when the position is opened to when it is closed.

This also means that you can profit from both rising and falling markets, as well as access a wider range of markets with lower capital requirements.

CFD Trading Explained: 3 Key Benefits

There are several reasons why CFDs became so popular. From my experience, here are the top three:

-

The Ability to Go Short and do Hedging

Unlike traditional investing where you can only profit from rising prices, CFDs allow you to predict on falling markets as well.

This means that investors can sell an asset when its price is high and later buy it back at a lower price.

In addition, CFDs can be used as a hedging tool – often referred to as “buying insurance” -for a main portfolio. This involves taking an opposite position to your existing stocks to mitigate losses during short-term market downturns.

For example, suppose you hold $100,000 worth in your entire portfolio.

And due to breaking news of a potential recession, you’re predicting that the stock markets will have a temporary price drop.

But yet, if you’re unwilling to liquidate your entire portfolio on a whim, you might explore using CFDs like the US Tech 100 to do “hedging” aka protect your downside.

US Tech 100 instrument as shown on IG trading platform

If your portfolio falls by 10%, the loss in your portfolio’s value would be offset by gains in your short-sell CFD trade.

This strategy allows you to protect your investments without the hassle and expenses of liquidating your stock holdings.

-

Access to a Wide Range of Assets

Next up, CFDs offer unparalleled access to a wide range of markets,

Through CFDs, I was able to explore global asset classes that I otherwise wouldn’t have had access to, expanding my portfolio beyond my initial expectations.

With a platform like IG you can explore over 13,000+ markets and extended hours for CFDs on 70+ key US stocks.

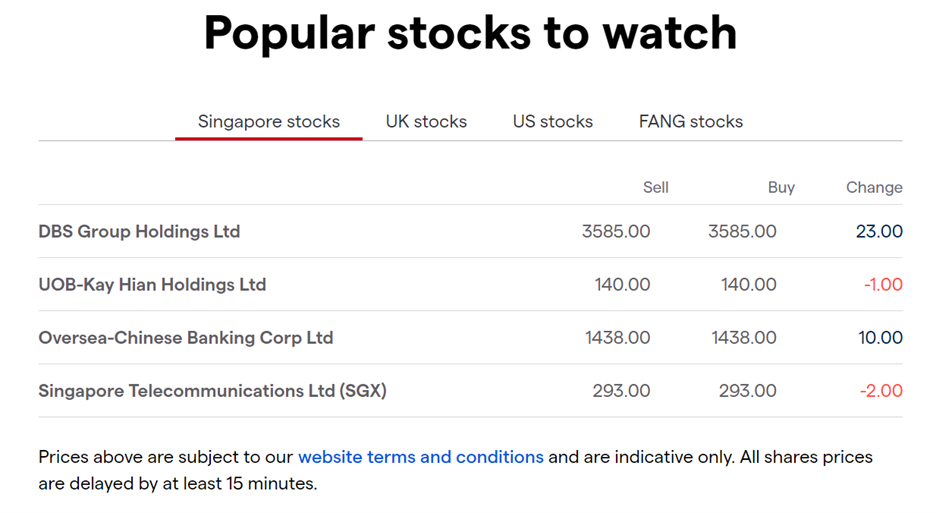

Source: IG.com/sg

Let’s also not forget our popular local stocks in the list including DBS Group, OCBC and Singtel!

-

The Power of Leverage

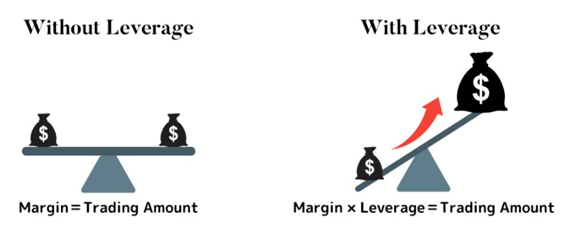

The third and one of the key reasons why people adopt CFDs is due to the ability to amplify their trading power through leverage.

This means you can control larger positions with a smaller initial investment, known as margin.

Hence, the primary allure of leverage is the potential for amplified returns. If the market moves in your favor, the profits from a leveraged position can be significantly higher compared to non-leveraged trades.

*Important Note for Beginners: Start small and prioritize risk management!

However, while leverage can boost profits, it also magnifies losses. It’s essential to manage risk carefully – which is what we want to cover below.

Risks Involved in CFD Trading Explained

For beginners, the most significant risk is often over-leveraging without fully understanding the implications.

In my early days, I learned this the hard way when a single trade wiped out a significant portion of my account.

However, as I gained experience, I began to see that the real risk lies in not having a solid risk management plan, regardless of experience level.

Here are 2 quick pointers you need to consider:

- Leverage Risk: As mentioned earlier, leverage can magnify losses significantly.

- Market Volatility: Rapid price movements can quickly erode your capital.

To mitigate these risks, it’s essential to use risk management tools such as stop-loss orders, which automatically close your position at a predetermined level to limit losses.

Additionally, maintaining a disciplined approach to position sizing and not over-leveraging your trades can help protect your capital.

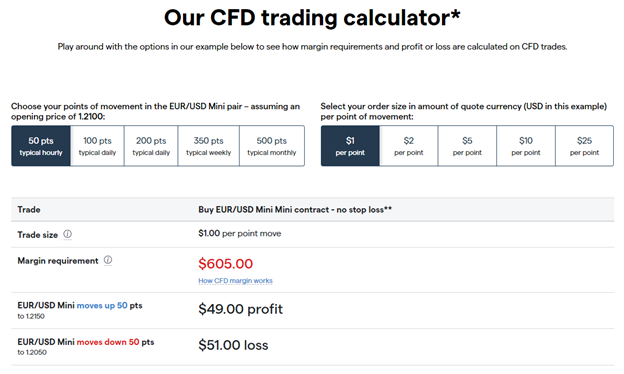

This is where IG shines as it provides an online calculator as shown above, with certain presets that allow you to simulate how margin requirements and profits or losses may change, even before you start your trading journey.

An Example of CFD Trade for Beginners [Demo]

Now, let’s move on to a quick demo to see how you can execute a CFD trade seamlessly.

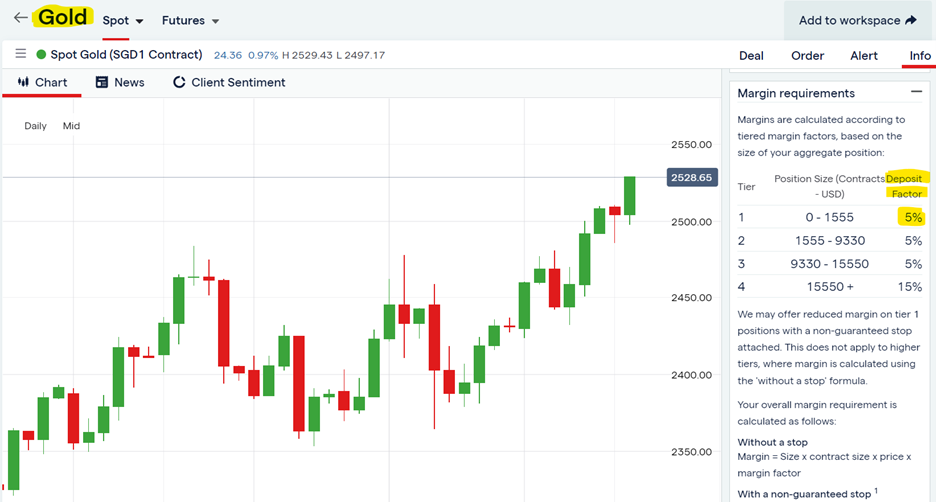

Let’s assume that you are interested in the Gold instrument and want to capitalize on the sharp increase given the geopolitical tensions and the looming interest rate cuts.

Source: IG trading platform

Moreover, with a 5% deposit factor (20:1 leverage) as shown above, you could potentially trade $10,000 worth of Gold commodity contracts shares with just a $500 deposit as margin.

The below is a step-by-step guide on how I will go about entering the trade.

Source: IG trading platform, My Demo Account

- Step 1: Confirm on a trend and do a technical setup using trendlines and price action.

- Step 2: Determine the strategy (i.e. long/short), size and price level.

- Step 3: Set a stop loss level for this trade i.e. 25 pts away will be equivalent to a S$2,500 loss upon triggered.

- Step 4: Decide on a ‘Take Profitlevel called Limit i.e. 150 pts away

- Step 5: Place limit order – and that’s it!

You may also have seen the “Knock-Outs” section just above the “Place limit order”.

So let me explain what is this Knock-Outs together with some other advanced features IG offers.

Unlocking the Power of IG’s Advanced Trading Tools

As someone who’s always looking for an edge in the markets, I’m constantly on the lookout for platforms that offer more than just basic buy and sell options.

That’s why I’m a big fan of IG – they go beyond the essentials and provide advanced features that can truly elevate your trading experience.

Here are 3 that are real game-changers for me:

#1 Knock-Outs: Built-In Protection for Volatile Markets

During earnings season, we often see US stocks jump double digits, which can be both exciting and risky.

That’s why IG’s Knock-Outs feature has been such a crucial addition to my trading toolbox. With its built-in guaranteed stop level, Knock-Outs provide a powerful way to manage risk in these highly volatile periods.

On that note, IG offers a range of risk management features to help you trade with confidence. To get the full picture, you can check out this link for more details.

#2 Guaranteed Stop-Loss Orders for Peace of Mind

On top of that, anyone who’s traded during volatile periods knows the frustration of slippage.

Which is why having this safety net is crucial. IG’s guaranteed stop loss ensures that my positions are protected against slippage, giving me the confidence to trade more assertively.

Knowing that I can control my risk exposure, even in the most volatile conditions, has transformed the way I approach trading.

#3 Free Trading Signals: My Personal Analyst

Let’s face it, analyzing charts and identifying trade opportunities can be time-consuming.

One of the standout features I’ve come to rely on is IG’s free real-time trading signals provided by PIA first and autochartist. As someone who values efficiency, these signals have been invaluable in streamlining my trading process.

Signal Centre takes the legwork out of the equation by highlighting significant trends or patterns as they emerge. It’s as though I am enjoying a personal analyst by my side to not only save me time but also boosted my confidence in making informed trading decisions.

My Personal Review: Choosing the Right CFD Trading Platform

All in all, when I first got started in trading, my primary concern was ease of use and access to educational resources.

However, as my strategies grew more sophisticated, I began looking for platforms with advanced charting tools, real-time data, and a wide range of markets to trade.

This is where I think IG stands out as a reputable trading platform:

- User-friendly Interface: The platform is easy to use, customize and navigate with clear and intuitive menus, buttons etc.

- Educational Resources: Among its popular offerings I love is the IG Academy, where users can attend FREE live webinars with trading experts and learn from courses tailored to both beginners and advanced traders.

- Mobile App UX: Ain’t nobody got time sitting whole day to trade! That’s why having a good mobile app UX is so important – for me to trade on the go, from any device and location.

As you can see, choosing a suitable broker that provides all the features is no easy task.

After trying several platforms, I found that IG offered the right balance of both beginner and advanced tools, making it suitable for traders at all levels.

Whether you’re just starting or are looking to refine your strategies, IG provides the resources and support needed to succeed in CFD trading.

On top of that, I feel safe trading with IG with their strong brand presence seen island wide – be it in the train, during webinars or even social media.

Start practicing your trading skills by opening a demo account with IG today. Alternatively, you can sign up for a free IG account here to begin exploring.

Disclaimer

IG provides an execution-only service. The information in this article is for informational and educational purposes only and does not constitute (and should not be construed as containing) any form of financial or investment advice or an investment recommendation or an offer of or solicitation to invest or transact in any financial instrument. Nor does the information take into account the investment objective, financial situation, or particular need of any person. The content shared is based on personal opinion and experience only, and the views do not necessarily represent those of IG. Where in doubt, you should seek advice from an independent financial adviser regarding the suitability of your investment, under a separate arrangement, as you deem fit. While we strive to provide accurate and relevant information, we cannot guarantee the accuracy or completeness of the information contained in this article. No responsibility is accepted by IG for any loss or damage arising in any way from anyone acting or refraining from acting as a result of the information. Please note that the author may receive compensation from IG in connection with this article. All forms of investment carry risks. Trading in leveraged products, such as CFDs, carries risks and may not be suitable for everyone. Losses can exceed deposits. This advertisement has not been reviewed by the Monetary Authority of Singapore.