As urbanization continues to accelerate and the demand for integrated facilities management (IFM) services grows, a company is quietly carving its mark and standing out among its peers: SGX-listed Alpina Holdings (SGX: ZXY).

In addition, as solar energy adoption gains pace in Singapore, there is a growing trend of zero-energy and energy-plus buildings in Singapore that adopt energy efficiency technologies.

Alpina has positioned itself as a key player in this highly fragmented facilities management industry and solar energy sector in Singapore with strong technical expertise, a solid track record and possession of relevant licenses required in Singapore.

Alpina Holdings’ Corporate Profile

Alpina Holdings, a veteran contractor headquartered in Singapore, excels in delivering comprehensive integrated building services (IBS), along with mechanical and electrical (M&E) engineering services, and alteration and addition (A&A) works, boasting a robust track record of over 20 years.

Their projects are mainly public sector projects, being projects in which the Singapore Government or a public university in Singapore is the project owner.

The company has achieved the prestigious L6 rating in the ME15 (Integrated Building Services) category, representing the apex grading for this classification.

This distinction empowers Alpina Holdings to engage in public sector IBS project tenders without any restrictions on tender or project values under this category.

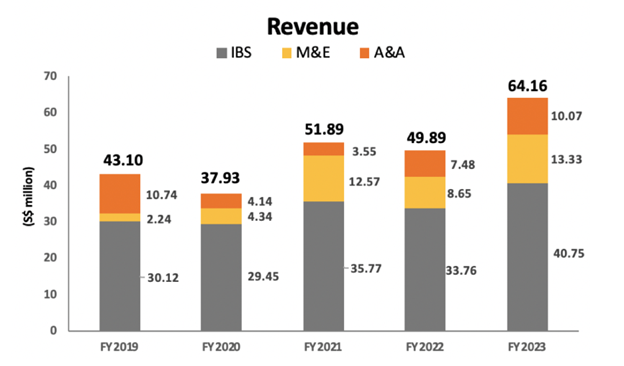

Financial Performance

Alpina Holdings has consistently achieved revenue growth over the past few years, driven by a combination of organic expansion.

For the financial year ending December 31, 2023, Alpina reported an all-time high revenue of $64.1 million, an increase of 28% compared to the prior year.

However, net profits were down during the same period because the Group had to hire additional manpower and subcontractors, particularly for projects secured prior to the COVID-19 pandemic as a commitment to its customers and to meet project deadlines.

This has impacted the firm’s financial performance in recent years but are likely to abate once the past projects are completed and the company continues to secure new projects in future.

On a bright note, the company also maintained a healthy balance sheet with current assets representing 83.4% of its total assets and it comprised the following key components:

- Cash and cash equivalents of approximately S$9.55 million

- Trade and other receivables of approximately S$10.67 million

- Contract assets of approximately S$32.38 million

- Inventories of approximately S$1.37 million

This prudent financial management enables Alpina to invest in growth opportunities and weather economic uncertainties.

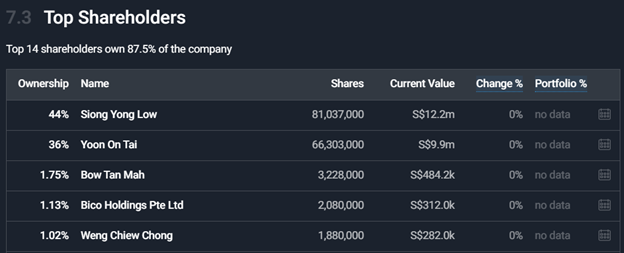

Management Team Experience and Ownership

Alpina Holdings is led by a seasoned and capable management team – Executive Chairman and CEO Mr. Low Siong Yong and Executive Director, Mr. Tai Yoon On, who boasts over 25 years of experience each in providing IBS, M&E engineering services and A&A works.

A quick glance at the shareholder ownership shows that both the CEO (Mr. Low) and Executive Director (Mr. Tai) hold a substantial stake in the company at 44% and 36% respectively.

The management team’s substantial insider ownership ensures they are well aligned with the interests of minority retail shareholders.

Tapping on Singapore’s Booming Construction Market

Singapore’s construction sector is booming, with the Building and Construction Authority (BCA) forecasting total demand to reach a staggering $25 billion to $32 billion annually between 2024 and 2027.

This positive outlook aligns perfectly with Alpina’s core competencies: Integrated Building Services (IBS), Mechanical and Electrical (M&E) engineering, and Alteration & Addition (A&A) works.

But Alpina’s potential extends beyond traditional construction. Singapore’s ambitious plans for a Green and Smart Nation represent a multi-billion dollar opportunity. As the nation strives to improve city services, reduce energy consumption, and optimize infrastructure, Alpina’s expertise positions them as a key player in these transformative initiatives.

Here’s why Alpina is uniquely positioned to capitalize on this growth:

- Proven Track Record: Alpina boasts a history of successful project execution, particularly for public sector clients like government ministries and educational institutions.

- Strategic Expansion: The recent foray into Integrated Facilities Management (IFM) through Digo Corporation demonstrates Alpina’s commitment to expanding its service offerings and capturing a wider share of the market.

- Alignment with National Goals: Alpina’s solutions directly address the priorities outlined in the Singapore Green Plan 2030, making them a natural partner in the nation’s green and smart transformation journey.

By leveraging these strengths and the strong tailwinds of Singapore’s growth, Alpina Holdings presents an attractive proposition for investors seeking exposure to this exciting market.

Alpina’s Bright Future in Solar Energy

Singapore basks in sunshine year-round, making solar energy a no-brainer for its renewable energy goals. Under the SolarNova programme, the city-state aims for a whopping 2 gigawatts of solar power by 2030, enough to juice up hundreds of thousands of homes.

Amid this green energy revolution, Alpina Holdings Limited is emerging as a significant player with promising prospects in the solar energy sector.

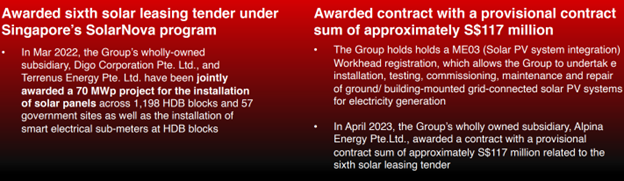

In March 2022, Alpina’s wholly-owned subsidiary, Digo Corporation Pte. Ltd., in collaboration with Terrenus Energy Pte. Ltd., secured a substantial 70 MWp project. This initiative involves installing solar panels across 1,198 HDB blocks and 57 government sites, alongside implementing smart electrical sub-meters in the HDB blocks.

Subsequently, in April 2023, Alpina Energy Pte. Ltd., another wholly-owned subsidiary, was awarded a contract worth approximately S$117 million related to the sixth solar leasing tender, marking another significant milestone in their growing order book.

Alpina’s expertise is further validated by its ME03 (Solar PV system integration) Workhead registration. This certification enables the company to undertake comprehensive services, including the installation, testing, commissioning, maintenance, and repair of grid-connected solar PV systems mounted on the ground or buildings.

As solar energy adoption accelerates in Singapore, the demand for maintenance and upgrading of solar systems is expected to rise. Alpina’s accumulated technical know-how and proven track record position the company to capitalize on these future opportunities.

Beyond installation, Alpina plans to generate and sell solar energy from its photovoltaic panels once operational, potentially creating an additional revenue stream through carbon credits.

Strong Order Book Expansion and Positive Developments

In FY2023, Alpina announced that it has secured a total of 21 contracts with aggregate provisional contract sum of approximately S$251.1 million.

More recently in June 2024, the Group announced that it participated in the tender alongside a consortium and the consortium was successfully awarded a contract worth approximately $115.7 million to provide integrated facilities management (IFM) services for a tertiary education institution in Singapore. This contract is set to commence in January 2025 and is expected to be completed by December 2028, with an option for the customer to extend the contract for an additional 4 years and 3 months.

The strong order book expansion over the past 2 years provides good visibility for the Group’s revenue pipeline ahead.

In addition, the Group completed the S$24.5 million acquisition of a workers dormitory located at 180 Woodlands Industrial Park E5, Singapore 757512, which will provide them more flexibility to control their operating costs and manage their manpower resources.

Conclusion

In conclusion, Alpina Holdings emerges as a formidable contender in Singapore’s facilities management sector, poised for sustained growth and profitability.

The recent multi-year contract win, coupled with the company’s proven track record, experienced management team, and strategic growth plans that aligns with Singapore’s green city initiatives, paints a bright picture for Alpina’s future.