Clean Energy is all the rage these days as the world grapples on how to save the earth.

The ‘Electric Vehicles’ segment is probably the one of the most commonly known, largely due to the immense popularity of Elon Musk and his company Tesla.

That said, it is clear that many other renewable energy sources are also attracting a lot of attention and investment boosts as well.

In fact, if you have read about this article on how offshore & marine companies are pivoting towards wind energy sector to be part of the massive growth opportunities.

One such company that caught my eye is none other than Marco Polo Marine. Below, I will give a brief description of what the company is about and highlight a few main reasons why it looks like a deep value stock to me.

1. Marco Polo Marine Company Profile

Listed on SGX Mainboard since 2007, Marco Polo Marine is a reputable regional integrated marine logistics company which principally engages in shipping and shipyard businesses.

The Group’s ship chartering business provides Offshore Supply Vessels (OSVs) as well as tugboats and barges, which are deployed in regional waters for its customers in the offshore oil and gas, mining, commodities, construction and infrastructure sectors.

The Group’s shipyard business undertakes shipbuilding and maintenance as well as repair, outfitting and conversion services in Batam, Indonesia.

Tapping on its core expertise in the shipping industry, the Group is pivoting to the renewables sector, providing customized solutions in the chartering, development, fabrication, and construction of bespoke renewable energy assets for its customers.

2. Turnaround Bearing Fruit

Still remember the unprecedented event when oil prices went negative due to record low demand?

Yes, COVID-19 has hit oil prices adversely as the whole world grapples with economic slowdown. In turn, it affected O&G-related companies like Marco Polo Marine.

That said, oil prices have recovered since then and economic activities have restarted albeit at a slower pace.

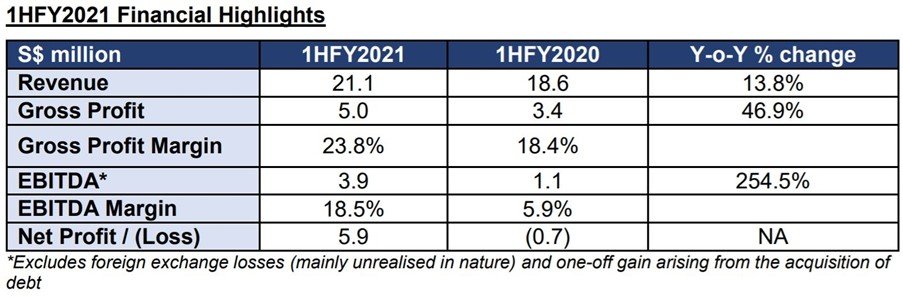

In fact, Marco Polo Marine (MPM)’s revenue increased 13.8% y-o-y to S$21.1 mil in 1H FY2021, largely driven by an increase in ship repair jobs as well as the commencement of the construction of two smart fish farms.

Furthermore, the company’s gross profits jumped 47% to $5.0 million in 1HFY2021, due to the absence of one-off reactivation costs incurred for its fleet of offshore vessels.

Excluding foreign exchange losses and this one-off acquisition gains, the group’s EBITDA increased 254% from $1.1 million in 1H FY2020 to $3.9 million in 1HFY2021.

MPM CEO Sean Lee is sanguine about the performance and commented,

“Despite the industry’s challenging backdrop, we were able to register a creditable performance for 1HFY2021, returning to profit excluding unrealised forex, from a net loss in the previous period”.

He also pointed out positive signs indicating that sector downturn may be bottoming-out gradually.

3. Pivot to Sustainables Sector

While the Oil and Gas Sector will remain as the Group’s bread and butter, the renewable sector presents huge opportunities as countries and organisations increasingly turn to green energy sources.

In fact, according to the International Renewable Energy Agency (IRENA), wind energy was the second-largest driver of the expansion in the global renewable energy capacity last year.

This bodes well for MPM as it is able to increase utilization of its fleet and also boost profitability, in particular from offshore wind farms.

On this note, investors are also asking whether company have the capability to build wind farm vessels during the AGM 2021?

The company’s gave a solid response by saying that the group has the capability to build vessels to support windfarm projects. In fact, the specifications required for these vessels are lower than the vessels that are used to support oil exploration projects.

Moreover, the Group has successfully secured OSV charter contracts for windfarm projects in Taiwan in 2020 and will continue to actively pursue charter contracts in relation to windfarm projects for its OSVs and as well as projects related to windfarm fabrications.

4. Potential Deep Value Play

Although Marco Polo Marine is now a shadow of its past glory, it seems that the worst is over and the future potential not priced in by the market yet.

In fact, MPM’s last traded price of S$0.019 is below that of the equity raising exercise done with a group of 9 white-knight investors in 2017. For those uninitiated, Marco Polo was given a clean slate in FY2018 after raising around S$60 million from 9 strategic investors at a share price of S$0.028.

With a share price of S$0.019, MPM has a market value of about S$67 million and trades at a P/B of 0.63x. The book is primarily backed by hard assets including cash (11% of assets) and PPE (56% of assets). The Group owns a shipyard in Batam (occupying more than 34 ha of land area) as well as 11 OSVs, 2 MWVs and 24 tug and barges.

In 2017, Vesselsvalue estimated that the 12 OSVs owned by Marco Polo was worth over US$50 million (S$66 million). Vesselsvalue highlighted that while the resale market may be slow, vessels sold piecemeal have obtained higher prices than in a transaction for the entire fleet. In FY2019, the Group successfully sold an OSV and recorded a gain of S$4.5 million, suggesting deep value in Marco Polo’s books.

Conclusion

In conclusion, there are several things looking up for Marco Polo Marine be it the rising vessel utilisation, focus on renewable energy sectors and the successful debt restructuring.

With a strong focus on cost and cashflow management, the Group is now well-positioned to scale greater heights going forward.