Listed in 2004, Elsoft Research Bhd (Elsoft) (Bursa: 0090) is primarily involved in research, development and manufacturing of automated test equipment (ATE), burn-in systems, and application specific embedded control systems mainly for the semiconductor industry in Malaysia.

As I write, Elsoft is valued at RM 685.8 million in market capitalization. In this article, I’ll revisit its fundamentals, bring an update on its latest financial results, and assess its investment potential.

Here are 7 main things that you should know about Elsoft before you invest.

#1: Competitive Advantage

Since 2014, Elsoft has spent around 10% of its total revenues into research and development (R&D) activities to maintain competitiveness in a rapidly evolving environment. From it, Elsoft has made a key breakthrough in July 2017 when it delivered its new High Speed Tiles Tester and in August 2017 when it delivered the ATE for solar cells.

The High Speed Tiles Tester is an improved version of its existing product as the new is capable of achieving up to 5x faster in testing ability. Meanwhile, its ATE has served as a strategy for Elsoft to diversify its market away into solar related industry.

In addition, throughout 2017, Elsoft has been focusing its R&D efforts on creating new series ATE for the Smart Devices Industry. Its efforts started to contribute to Elsoft starting in Q3 and Q4 2017.

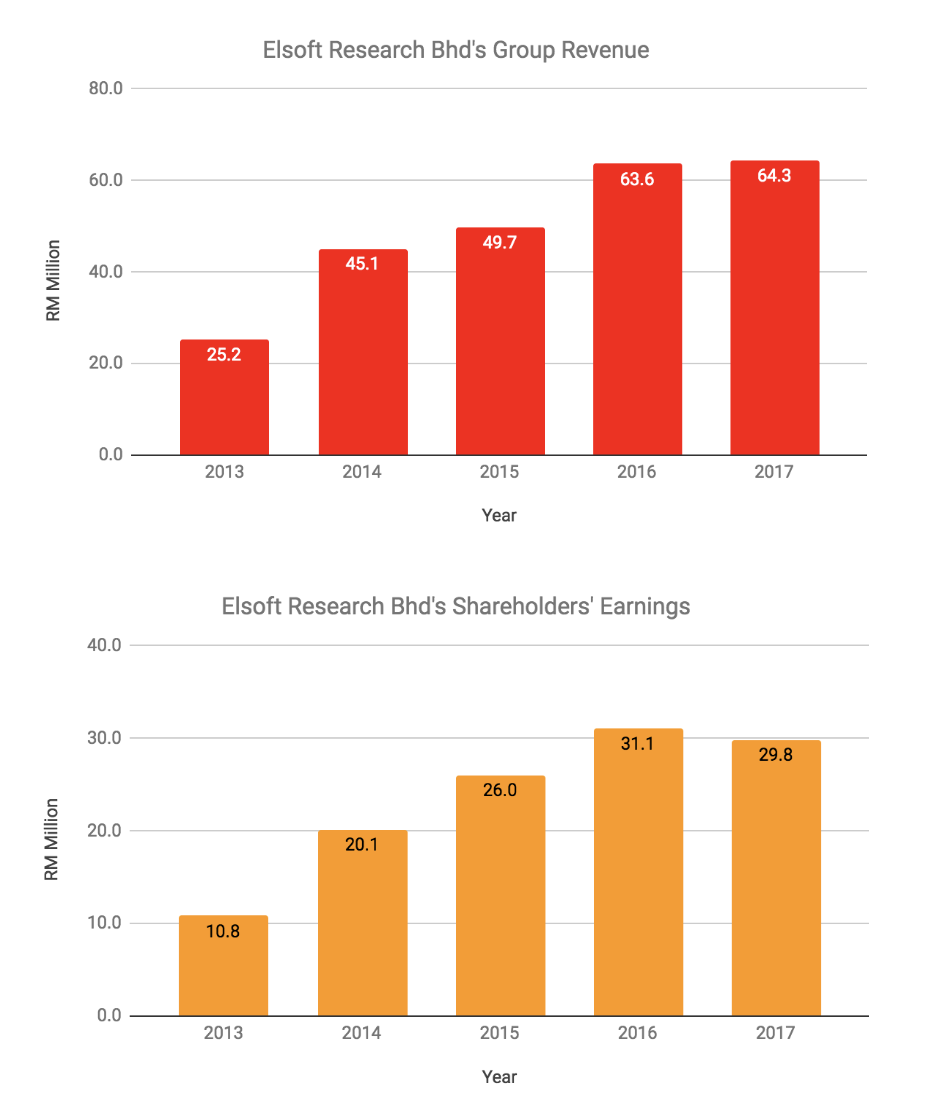

#2: Annual Financial Results

Elsoft has achieved rapid growth in both sales and profits over the past 5 years. Revenues have grown from RM 25.2 million in 2013 to RM 64.3 million in 2017. This is due to demand growth mainly from both smart devices and automotive industries, which contributed as much as 82% of Elsoft’s revenues in 2017.

As a result, Elsoft has increased its shareholders’ earnings from RM 10.8 million in 2013 to RM 29.8 million in 2017. Out of which, Elsoft has 5-Year ROE average of 27.18% per annum. It means, Elsoft had made RM 27.18 in earnings per year from every RM 100.00 in shareholders’ equity from 2013 to 2017.

Source: Annual Reports of Elsoft Research Bhd

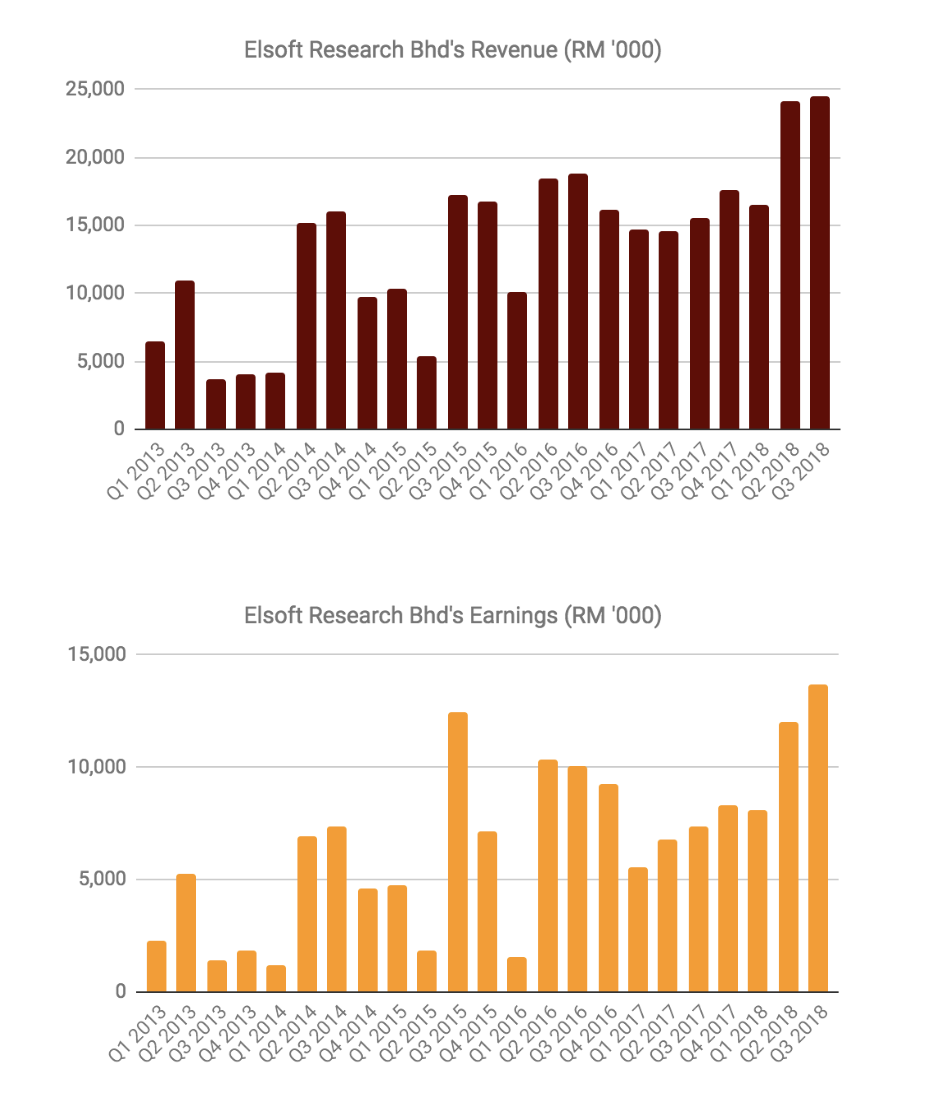

#3: Quarterly Financial Results

In the shorter view, Elsoft has continued its growth in sales and profits in 2018. This is evident as it delivered its highest quarterly revenues and earnings in Q2 and Q3 of financial year (FY) 2018 as shown in the graph below.

For the last 12 months, Elsoft has generated RM 82.7 million in revenues and RM 42.1 million in shareholders’ earnings or 6.32 sen.

Source: Quarterly Reports of Elsoft Research Bhd

#4: Balance Sheet Strength

As at 30 September 2018, Elsoft has a pristine balance sheet with zero borrowings. What’s more amazing is that the company has remained debt-free over the last 5 years and simply grew by compounding on its retaing earnings.

Presently, the company has current ratio of 4.65 where it has RM 11.3 million in cash balance and RM 56.1 million in other investment.

Elsoft’s other investments consists of quoted shares, unit trust and bond funds. It is the company’s strategy to place excess cash into Money Market Funds and Bond Funds to achieve greater after tax returns.

#5: Management

Below, we tabulated a list of the firm’s main shareholders and their titles as of 30 March 2018:

– Tan Chiek Eaik: 24.61% (CEO)

– Tan Ai Jiew: 13.80% (non-executive director)

– Koay Kim Chiew: 11.58% (CTO)

– Tan Ah Lek: 9.62% (non-executive director)

– Tan Chiek Kooi: 7.36% (Finance & Admin Manager)

#6: Key Risk

In 2017, Elsoft has derived RM 47.9 million in sales from a major customer. This accounts for 74.4% of Elsoft’s total revenue in 2017.

Any substantial changes in orders from this key customer would significantly impact its financial results for the future, for the better or for worse.

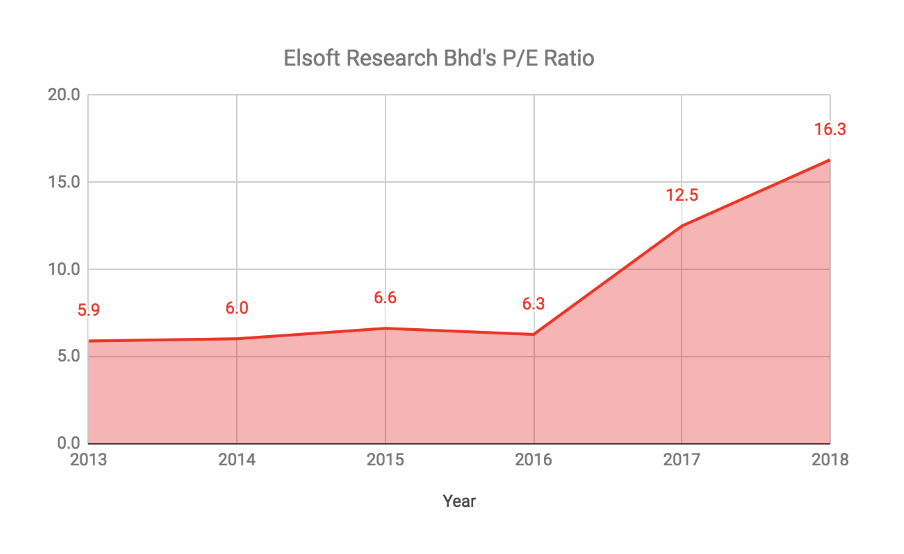

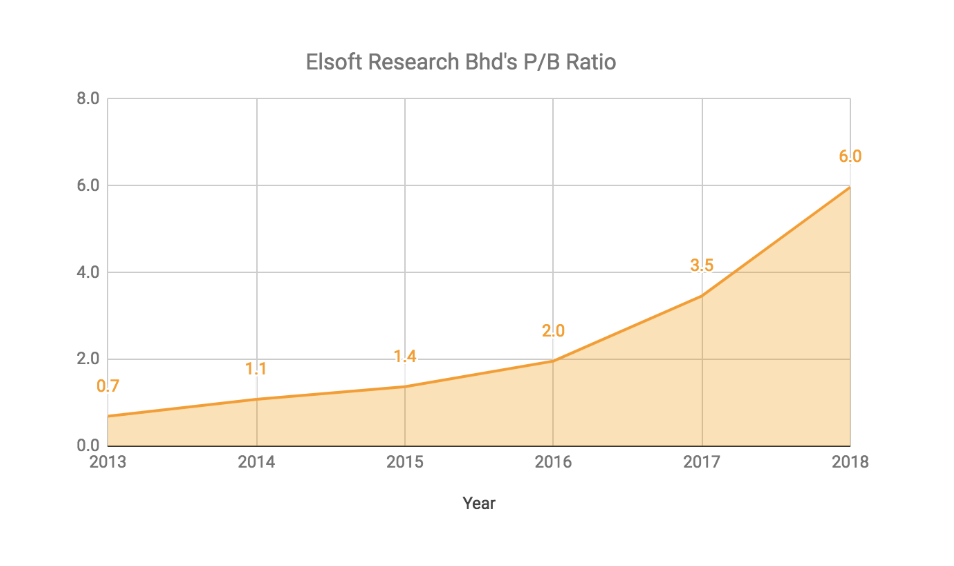

#7: Valuation

As at 26 December 2018, Elsoft is trading at RM 1.03 a share. Thus,

P/E Ratio

In Point 3, Elsoft has generated 6.32 sen in earnings per share (EPS). Thus, its current P/E Ratio is 16.30. Clearly, it is now trading at its highest P/E Ratio for the last 5 years.

P/B Ratio

As at 30 September 2018, Elsoft has shareholders’ equity of RM 114.9 million. Thus, its net assets a share is RM 0.173. Based on its current price of RM 1.03, its current P/B Ratio is 5.97, which is the highest over the last 5 years.

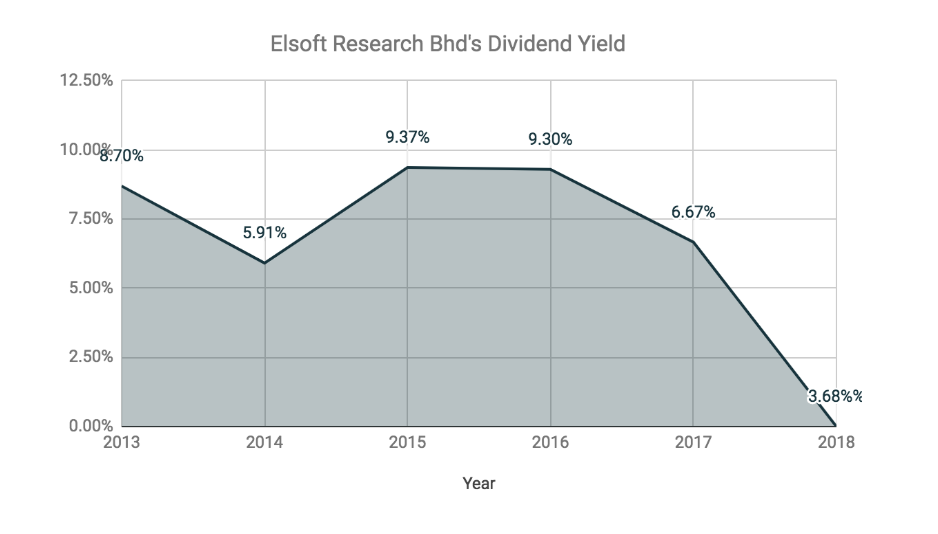

Dividend Yield

Elsoft has paid out approximately 60% of its earnings to its shareholders in the form of dividends. If Elsoft maintains its dividend payout ratio at 60%, it would pay out approximately 3.79 sen in dividends per share (DPS), based on Elsoft’s 12-Month EPS of 6.32 sen in Point 3.

As such, its dividend yield is 3.68% based on its current stock price of RM 1.03 a share, which is the lowest recorded for the last 5 years.

Conclusion:

Here, I’ll list down the pros and cons of Elsoft as a candidate for investment

Pros:

– Growth in Sales, Profits, and Dividend Payouts.

– Solid Balance Sheet with Zero in Gearing Ratio.

– Investments into Quoted Shares & Unit Trusts for Passive Income.

– Enjoys 100% Tax Exemption from Pioneer Status of Section 4D.

– High Return on Equity (5-Year Average: 27.18%).

– Elsoft’s Directors & Key Management are its Substantial Shareholders.

– Continuous Investments into R&D activities.

Cons:

– Dependence on One Key Customer for Sales & Profits.

– Involvement in Rapidly Changing Industry.

– Record High in P/E Ratio and P/B Ratio.

– Record Low in Dividend Yields.

So, should I buy Elsoft now at RM 1.03? Well, your answer will depend on the following:

– Are you optimistic about the semiconductor industry in the future?

– Do you like Elsoft’s competitive edge and its strategy for growth?

– Are you willing to take on its risk of over-reliance on one major customer?

– Are you happy with 3.68% in dividend yields?

– What is your plan if Elsoft drops in stock price in the future?

Looking to lead a comfortable retirement? You need to learn how to save and put those into work by investing well. Right here, You can develop your own Unique Investing System via a simple 10-Step Checklist.