As an investor, we are always looking for ways to outperform the stock market and make each of our investments profitable, right?

If not, why do we even try to actively invest our money?

We can just invest our money in a mutual fund and let the fund managers do their job.

The truth in investing is that it is not hard to make a profitable investment. You don’t need a high IQ to make money in the stock market. Here’s a quote from Buffett, the richest investor in the world,

“You don’t need to be a rocket scientist. Investing is not a game where the guy with the 160 IQ beats the guy with a 130 IQ. Rationality is essential.”

Here are 7 Simple Strategies that you can utilize to invest profitably.

1. Identify Your Goals

First thing first, you will need to define your goals. Sounds easy right?

Identifying your goals is crucial when it comes to investing. It helps you to understand better about yourself.

A well-clarified goal would guide you into considering investing style that suits you. Before moving on, let’s think about these questions.

- “What you do you really want to achieve through investing?”

- “How are you going to achieve it?”

I will give you an example.

Imagine if you are in your mid-20s, and just started out in your career. You have accumulated some savings and thinking about growing your money at a fast pace.

You have nothing to lose and hence has a higher risk tolerance.

In this case, investing in growth companies is your choice. You can allocate more of your capital into growth stocks and make compounding returns, such as 800 Super Holding (SGX: 5TG) or Cityneon (SGX: 5HJ).

However, if you are in your late 50s and about to retire in few years time. Your goals might be different with the younger counterparts.

You might be more concerned about the preservation of capital and would like to receive a stable dividend to fund your retirement years.

Also Read: How to Plan for Your Retirement using these 4 Simple Strategies

With that, investing in dividend stocks is a better option for you, such as Hong Kong Land (SGX:H78) or CapitaMall Trust (SGX: C38U).

P.s. Do take note of the dividend payout ratios and whether they are sustainable over the long run.

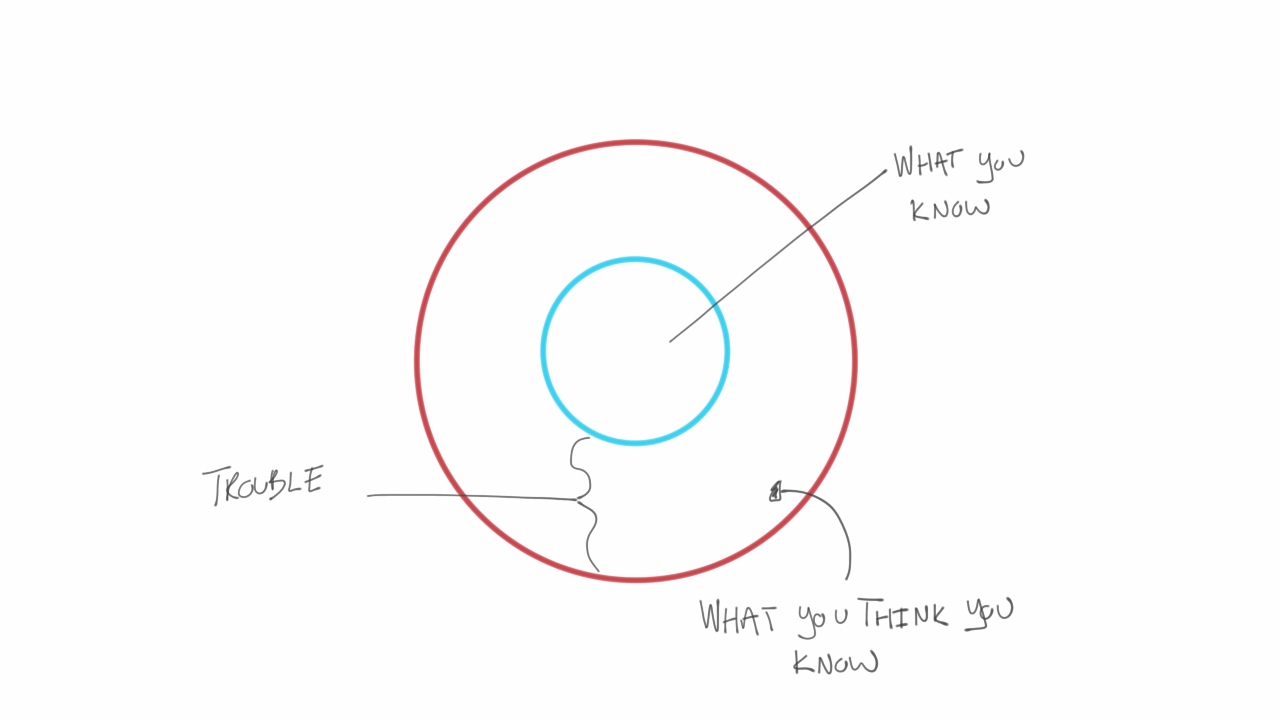

2. Knowing Your Circle of Competence

The edge of an investor is that you don’t have to be an expert on every company or a lot of them to be successful in investing.

It is not about how large your circle of competence is, but how accurately you can evaluate the selected business.

All you need to do is to focus on the areas that you know best.

Here are words of wisdom about Circle of Competence from Charlie Munger, the vice chairman of Berkshire Hathaway,

“You have to figure out what your own aptitudes are. If you play games where other people have the aptitudes and you don’t, you’re going to lose. And that’s as close to certain as any prediction that you can make. You have to figure out where you’ve got an edge. And you’ve got to play within your own circle of competence.”

Understanding your circle of competence helps you to avoid problems, identify opportunities for improvement, and learn from others.

One simple example is this:

Assuming you work in the Oil and Gas industry, you would be more in tune with that sector compared to the others. You can also gauge with better accuracy the sentiment of the industry, before KeppelCorp (SGX: BN4) or Sembcorp Marine (SGX: S51) starts to announce contract wins. It is things like this where you can invest earlier than others and catch some deep value bargains etc.

So… take some time to think about your circle of competence. To improve your odds of success in business and investing, define the perimeter of your circle of competence, and operate inside. You can also learn how to expand that circle as time goes by.

3. Acquiring Quality Business

Quality businesses perform better and compensate well to investors in the long run.

Imagine that if you had invested in Nestle (Malaysia) Berhad (Bursa: 4707) 10 years ago, your capital would have increased five-fold! A compounded annual growth rate of approximately 14%, excluding dividend yield.

No stock price performance can escape the quality of the underlying business.

Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns.

Hence, buying a good quality stock and keep for the long term is one of the proven ways to be profitable in investing.

Characteristics of high-quality business are such as having a high and stable return on equity (ROE), a high-profit margin and having some economic moat.

Companies with quality business are able to increase its goods and services to customers without losing sales volume.

Customers are still willing to buy their product even they increase the prices of their goods and services because they have a pricing power over their competitors.

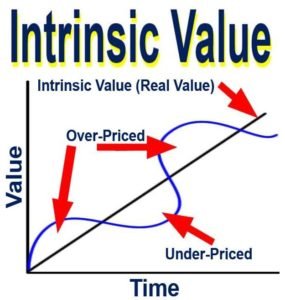

4. Focus On The Downside

Some of the greatest investors became great investors, not because they pick ideas with the most upside, but by avoiding grave mistakes.

It is a simple concept: buy companies that have a large margin of safety. It means that even some things go wrong with the investment, the investment could still work out.

If you purchase a stock with a really low price, it does not only create the potential gain for you. At the same time, it also limits the downside risks of your investment.

The bigger the discount from fair value, the greater the “margin of safety” an investment provides.

Lots of investors often focus too much on the return side of their investments, which could potentially end up making huge losses.

Ask yourself these questions before you decided to bet on a stock:

- “How simple is the investment thesis?”

- “Are there too many things that can go wrong?”

- “Do I really understand what the company does?”

- “Is this company even closes to profitability?”

“If we avoid the losers, the winners will take care of themselves.” – Howard Marks

5. Be Greedy When Others Are Fearful

“Be greedy when others are fearful but be fearful when others are greedy.”

It is the all-time famous quote from Warren Buffett but also easier to be said than done.

There seems to be a good reason for why most of the investors are tempted follow the herd.

If you think about our ancestors who lived in millions of years ago, they lived in a world with danger from other animals, natural disasters, wars and so on. It was our gene that made human species to survive in such environment.

We pay attention to noises, we react and flee when there are signs of danger arises. We just can’t get rid of them as those instincts are instilled within to protect us from danger.

Think about the stock market. If the market crashes tomorrow, what are you going to do? Chances are, most of the investors will let the emotion of fear rules over them.

It takes a lot of courage and willpower to stay in the market. Unfortunately, most retail investors will give up and follow the crowd.

However, if you look at the other side of the coin, the market crash is actually an opportunity for us to buy good stocks cheap.

In Chinese, the word “crisis” translates to be “危机”. It is being composed of 2 Chinese characters respectively signifying “danger” and “opportunity”.

If only you could overcome your emotion and act with rational in investing, you could avoid all those mistakes and invest profitably in the stock market.

6. Be Patient

Patience is possibly the most important virtue to be a great investor.

Patience is required throughout the investing cycle. You have to have the patience to do your research, be patient to wait for the right price to buy and finally, have the patience to wait for the stock to realise its value.

Being patient in investing means willing to ignore the short-term fluctuation of a share price. The market is like a voting machine in the short-term.

Share price might fluctuate aggressively in a few months. However, we should bear in mind that over the long run, the market will realise the value of the stocks.

One way for investors to overcome impatience is to think a stock as a fraction of a company instead of a ticker. When Capitaland drops in price, think of the event but not in terms of money that you have lost.

Do you really want to give up a stake in a wonderful company just because of others fleetingly believe it is worthless?

Also Read “How Investing is like Growing a Bamboo Tree“.

7. Continuous Learning

Successful investors keep learning, as lifelong learning is paramount to long-term success. You won’t succeed without it because you won’t get far based on what you already know.

Take a look at Warren Buffett, for example. His partner, Charlie Munger described him as a learning machine every day.

So, how to learn? You might ask.

Read. A lot.

Warren Buffett says, “I just sit in my office and read all day.”

He estimates that he spends 80% of his working day reading and thinking.

The ability to learn is like a compounding machine. The more you learn, the more you knowledge compounds. It is like compounding interest.

Besides, how you read matters. You need to be thinking while you learn. It requires the mental exercise of thinking about what you are learning, processing it and forming an opinion.

To get smarter, you need to acquire information; to get wiser you need to think about it.

Conclusion

As a conclusion, it is not that hard for normal people like us to make a profitable investment. The chances are that you can easily achieve all those 7 steps without much hassle.

Just remember that it takes time to be a successful investor. You won’t be a success overnight. But as long as you keep learning and keep trying, you will achieve it one day.

Want more deeper insights on how to invest wisely? Join our 400+ strong community in our Telegram Group @ https://t.me/InvestorsExchange today!

Do you also know that Master Investors like Warren Buffett has his own Unique Investing System which you can emulate yourself? We have distilled it into a simple 10-Step Checklist for you to decide how or when to buy/sell your stocks.

Simply click to receive your copy today!