SLB Development is a property developer which was spun off from one of the Singapore’s largest home-grown and well-known construction and property group, Lian Beng Group (SGX:L03).

SLB has a track record of over 17 years in the property development industry. It has undertaken property development projects spanning across the residential, mixed-use as well as industrial and commercial sectors, ranging from small to large scale.

You can find the IPO prospectus here.

1. SLB Development Limited Current Portfolio

The company has a presence in Singapore and China market. Its portfolio currently consists of 5 residential and mixed-use property developments including

- KAP & KAP Residences at King Albert Park

- NEWest at West Coast Drive, and

- 3 industrial property developments.

Its property development projects in the pipeline include 3 residential sites such as Serangoon Ville and Rio Casa, and 2 industrial property development projects.

The company also has a stake in a property development project in China’s Hebei province.

2. IPO Details

For the IPO, there will be 238 million shares on offer at S$0.23 per share. 8 million shares will be available for the public, while the remaining 230 million shares will be placed to certain investors.

Lian Beng Group, the parent company will retain a 73.93% interest in SLB Development Ltd after the IPO.

Based on the post-IPO share count of 913 million shares, SLB will have a market capitalization of S$210 million. The listing is set to raise net proceeds of S$51.4 million.

The IPO will close on 18 April 2018 (12:00 pm) and expected to start trading on 20 April 2018 at 9:00 am.

3. Use of Proceeds

The company plans to use the proceeds from IPO to… (see table below)

- Acquire new land sites and for overseas expansion,

- Fund existing property development projects in the pipeline,

- General working capital purposes and

- Repay a bridging loan.

4. Financials

In FY2015 and FY2016, SLB Development did not record any revenue from the sale of development properties as none of the development projects were completed and handed over to purchasers. Thus only for FY2017, SLB recorded a revenue of S$87.6 million attributed to the development property at Mandai Foodlink.

As per the nature of property developers, SLB Development has a rocky path when it comes to its profits. Net profit attributable to shareholders were $29.8 mil in FY2015, $69.4 mil in FY2016 and S$15.9 mil in FY2017. In case you are wondering how come there is profits recognized w/o revenue, it is due to SLB’s share of results of joint ventures and associates.

On the balance sheet front, SLB’s balance sheet is in a net debt position with S$26.3 million in cash and bank loans of S$106.7 million.

With a post-IPO EPS of 1.74 Singapore cents, SLB’s PE ratio comes up to an average 13.2x. Currently, the company do not have a fixed dividend policy.

5. Growth Prospects

The property development business in Singapore market is cyclical in nature. To mitigate the cyclical risk, SLB is looking for opportunities to carry out property development projects outside Singapore, such as Asia-Pacific, Western Europe and North America regions.

By tapping on relationships with JV partners and networks, SLB hopes to expand its revenue streams and reduce its full exposure to any single project.

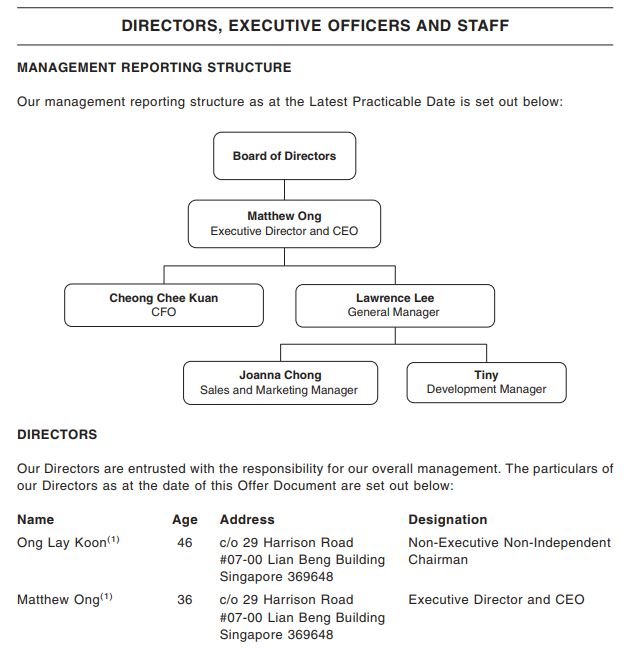

6. Management Team in Lian Beng and SLB Development

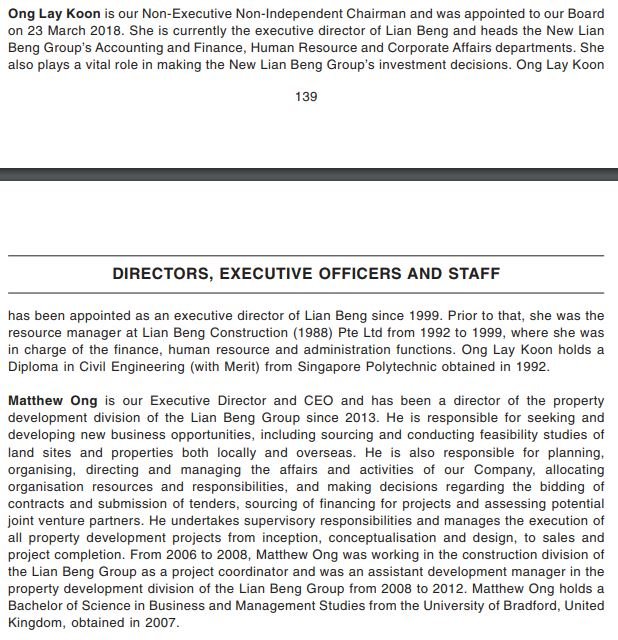

Looking at the management team, Ms Ong Lay Koon joined the Group in 1992, and heads the Group’s Finance and Human Resource Departments.

On the other hand, CEO Matthew Ong has worked in Lian Beng from the ground up (started off as project coordinator in year 2006). He is only 36 this year.

Overall, this gives us the feeling that the new generation is taking the lead at SLB Development (aka “New Lian Beng”) and time will tell if this is for good or bad.

Conclusion

Overall, I am positive in SLB for its short-term but neutral over its long-term potential.

Short-Term

Currently, it has a strong pipeline of residential projects to ride on the upcycle of the residential property market in Singapore.

SLB has a substantial portion of residential development projects among its land bank. It is expected to launch about 430,000 sqm of properties for sale in 2H 2018 which amount to S$892 million in gross development value. The estimated development profits are S$136 million, which provides earnings visibility in the near future.

Besides, the company is looking to expand its market in China to supplement its future growth and mitigate the company’s exposure to cyclical property development market. SLB currently has a 10% stake in Sino-Singapore Health City (Gaobeidian project), a mixed-use property development project in China, through a joint venture with Oxley, KSH and Heeton.

Illustration of Sino-Singapore Health City at Gaobeidian. (Source: Oxley)

Last but not least, there are only 8 mil shares for the public = S$1.84 mil to fight among so many rich retail investors here. Given that Lian Beng Group will retain a 73.93% interest after the IPO, not much supply (26%) is left for grabs. Thus, i think that demand will outstrip supply and push the share price higher.

Long-Term

The CEO will be up against the much bigger players if SLB Development intends to venture overseas for growth in future. Looking at how other bigger Singapore firms crash and burn due to the political or cultural reasons, I have my concerns on how he can gain an upperhand going forward.

Do you know that Master Investors like Warren Buffett has his own Unique Investing System which you can emulate yourself? We have distilled it into a simple 10-Step Checklist for you to decide how or when to buy/sell your stocks.

Simply click to receive your copy today!