On 29 April 2022, 5E Resources Ltd issued its IPO Prospectus and offered to the public an opportunity to subscribe its IPO shares at S$ 0.26 per share.

Upon its listing, 5E Resources would lift its market capitalization to S$38.3 million. The period to subscribe its IPO shares would close on 10 May 2022.

Here, I’ll summarize 8 key things to know about 5E Resources before investing in it.

#1 About 5E Resources

5E Resources was incorporated in 2006 and started its operations in 2008 with two plants: PLO 83 and PLO 317. In 2015, 5E Resources began operations of its third plant: PLO 738. In total, 5E Resources has 3 waste management plants operating in Johor, Malaysia.

Since its commencement, 5E Resources had accumulated 34 Waste Codes out of 77 Waste Codes under the EQ (SW) Regulations in Malaysia.

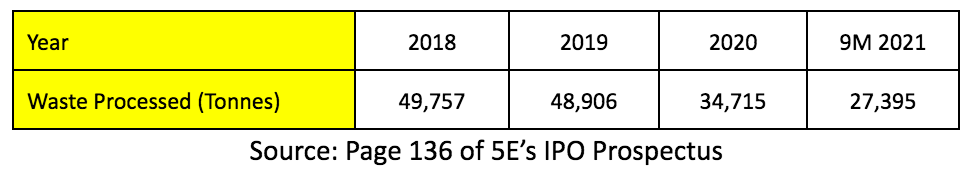

Hence, 5E Resources is allowed to work on the processing of a wide array of waste, which include waste oil, solid waste, waste coolant, waste acid, waste catalyst, contaminated rags, and containers. In the last 3 years, the amount of waste processed by 5E Resources are:

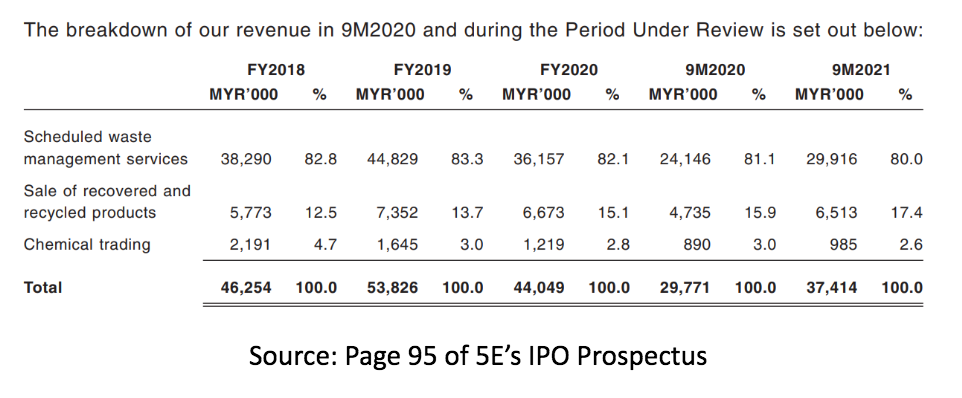

5E Resources earns income from offering scheduled waste management services to clients mainly in the electronics, petrochemical, semiconductor and palm oil industries in Malaysia.

In addition, 5E Resources earns additional revenues from sales of recovered & recycled products and chemical trading activities in Malaysia.

#2 Financial Results

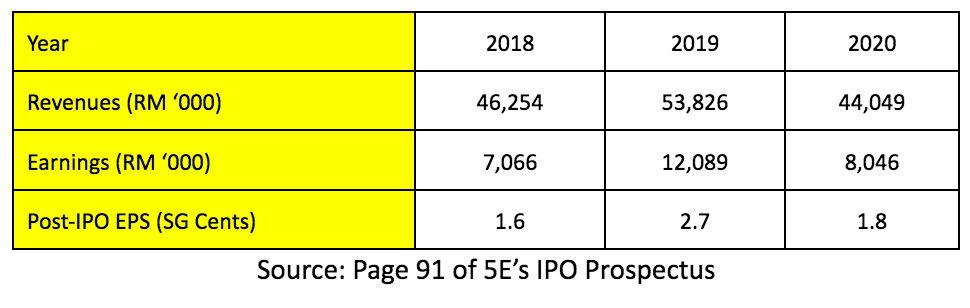

In 2019, 5E Resources had recorded its highest revenues and earnings in the 3-year period (2018-2020).

This is because 5E Resources had generated RM 12.0 million in revenue from ad-hoc projects namely

- The Kim Kim River Project valued at RM 5.9 million and

- The Johor Port Project valued at RM 6.1 million.

The Kim Kim River Project is related to waste treatment at Kim Kim River, which was caused by illegal dumping of toxic chemical waste. Whereas, the Johor Port Project is related to waste treatment, attributed to a marine accident in Johor, Malaysia.

From 2018 to 2020, 5E Resources has recorded RM 40+ million in group revenues. However, there is a big fluctuation in the earnings where it shot up to RM12 mil in FY2019 and declined back to RM8 mil in FY2020.

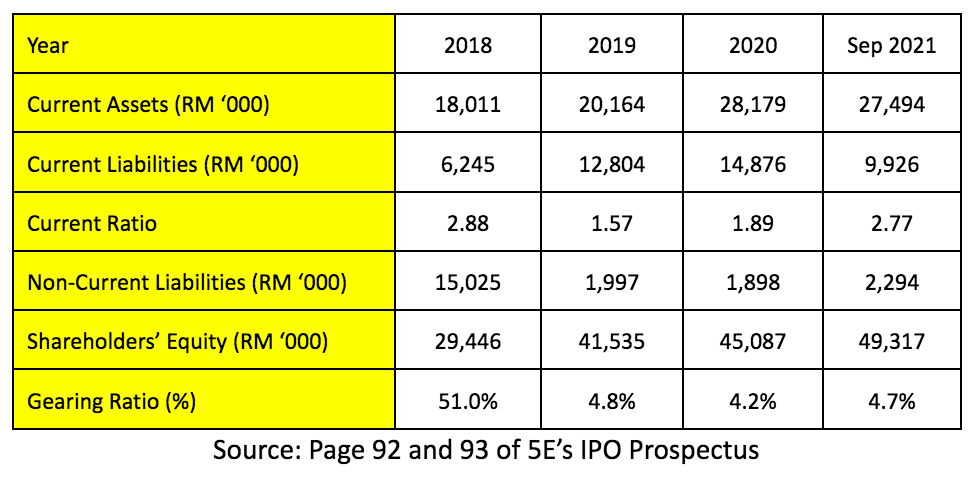

#3 Financial Strength

It shows that the company has adequate financial resources to pay bills and debts both in the short-term and long run.

#4: IPO Proceeds

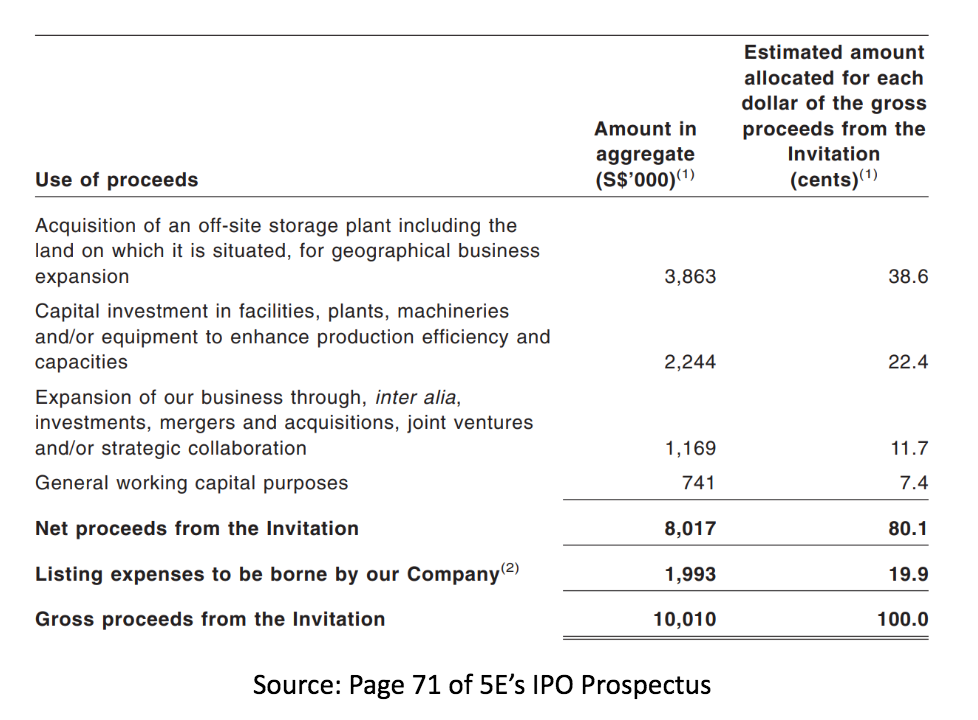

5E Resources intends to raise S$10.0 million in gross proceeds from its IPO listing, where it plans to utilise it in the following manner:

1. Acquisition of an off-site storage plant (S$ 3.9 million)

As of 18 March 2022, 5E Resources has identified a parcel of land on which a storage plant is situated in Central Peninsula Malaysia.

5E Resources allocates S$ 3.86 million to be used for the acquisition of the site, its environment impact assessment (EIA) and also some modification works to this site.

2. Investments into Facilities, Plants and Machineries (S$ 2.2 million)

They would include:

a. 1 rotary system and air pollution system to treat high organic content waste.

b. 1 solid mixer, magnetic separator, crusher, conveyor, and X-ray fluorescence analyser machine to process waste residue.

3. Expansion via acquisitions, joint ventures & strategic alliances (S$ 1.2 million)

#5 Key Risks

Apart from foreign exchange risks, 5E Resources has revealed that it is quite dependent on foreign labour for its operations.

In addition, the amount of waste treatment on a monthly basis is subjected to quote stipulated under its 34 Waste Codes.

If 5E Resources exceeds these quotas, it risks having these Waste Codes being revoked.

#6 Major Shareholders

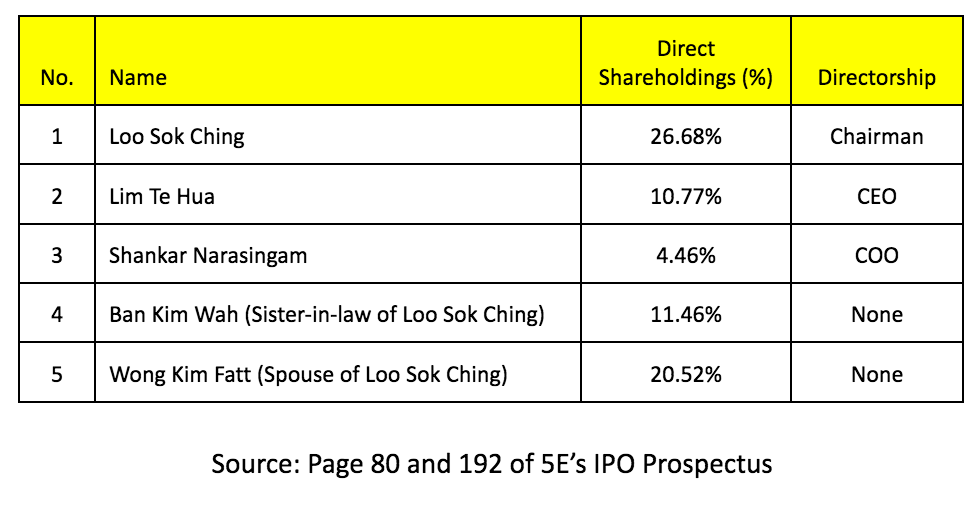

There are 5 main shareholders of 5E Resources which include:

From the above, we can see that this is a very family-run business like Challenger Technologies and Old Chang Kee.

One needs to be beware of their compensation package especially when things are going tough to see if they are aligned with shareholders.

#7 Dividend Policy

5E Resources revealed that it plans to distribute at least 25% of its profits after tax (PAT) to its shareholders in the form of dividends in 2022-2024.

Thus, based on post-IPO EPS of 1.8 cents in 2020, 5E Resources would recommend at least 0.45 cents in dividends per share (DPS), which works out to be 1.7% per annum in initial dividend yield.

#8 Valuation

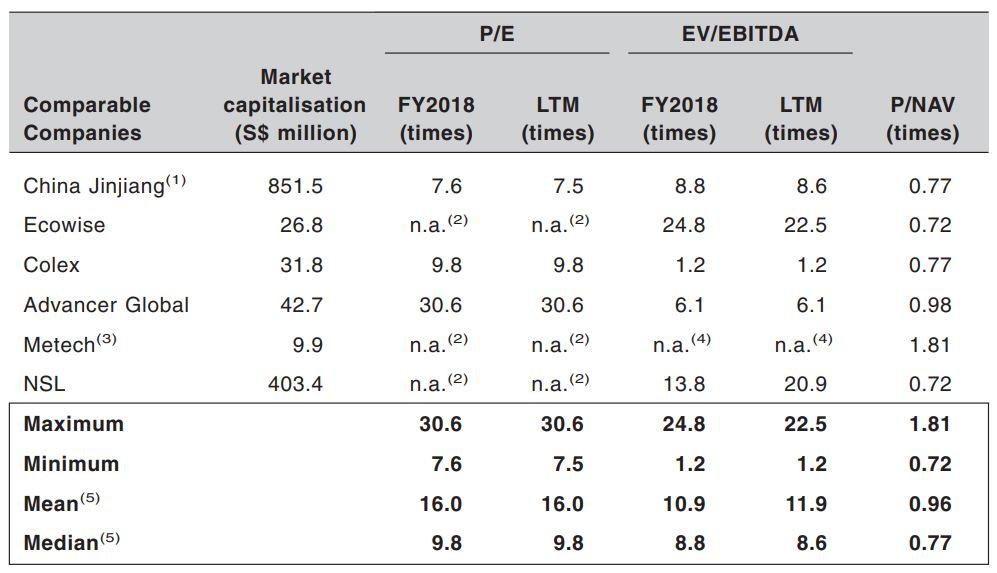

Based on S$ 0.26 a share, the offer is valued at 14.4x its post-IPO EPS in 2020 of 1.8 cents and 1.6x its post-IPO net asset value (NAV) in September 2021 of 16.3 cents.

In order to find some peers for comparison, we look towards the time when 800 Super is delisted.

From the table above, we can see that Colex and Advancer Global would be more comparable peers. Both of them are also trading at around 0.8x and 1x P/NAV.

This may indicate that 5E Resources is valued at a slightly high multiple at 1.6x P/NAV.

Our Take on 5E Resources

5E Resources is an established waste management company which has obtained 34 Waste Codes in Malaysia.

In 2020, 5E Resources is one of the 4 of the top 10 players to attain 30+ Waste Codes in the country.

On a whole, 5E Resources remains profitable and has a strong balance sheet since 2019. That said, its valuation is slightly above average compared to the peers at 1.6x P/NAV.