As global economies rebound and central banks contemplate policy tightening, interest rates are set to rise.

While higher interest rates can have varied impacts on different sectors, certain stocks are poised to benefit from this upward trajectory.

Here are 5 Singapore Stocks that can potentially benefit from Higher Interest Rates…

Banking Services

Banks typically benefit from a higher interest rate environment because they can charge more for loans compared to what they pay on deposits.

The net interest margin (NIM), which is the difference between the interest income generated by banks and the amount of interest paid out to their lenders, tends to widen in a rising rate environment.

1. DBS Bank (SGX: D05)

As per a report by DBS, banks are expected to be primary beneficiaries of rising interest rates.

Notably, DBS stands out amongst its peers, showcasing robust financial metrics. DBS reported just a 3% year-on-year decline in revenue amidst a volatile market in 1Q2022, indicating its resilience.

Furthermore, DBS has the highest potential boost in Net Interest Income (NII) from rising interest rates compared to other Singaporean banks.

An increase of one percentage point in interest rates will have a significant positive impact on DBS’s NII, more than double compared to other banks.

DBS is confident of surpassing S$10 Billion net income in year 2023 and has guided for a better dividend policy – be it through more share buybacks or higher regular dividends.

At the time of writing, DBS Bank is trading at a Price/Book ratio of 1.46x and offers an enticing 5.8% dividend yield.

2. UOB (SGX: U11)

UOB has showcased an impressive 9.1% year-on-year growth in its loan book and also reported a marginal increase in its Net Interest Margin (NIM) of 0.01 percentage points.

It suggests that the bank is well-positioned to capitalize on higher interest rates, given its increasing loan portfolio and stable NIM.

Moreover, UOB’s assets under management have surged by 7% year on year to S$130 billion, indicating strong growth momentum.

At the time of writing, UOB Bank is trading at a Price/Book ratio of 1.03x and offers an attractive 6% dividend yield

3. OCBC (SGX: O39)

OCBC, while having the lowest valuation metrics among the three banks with a P/B ratio of 1.07 times, could still benefit from the improving economic conditions and interest rate hikes.

The bank has reported a decrease in allowances, suggesting better economic conditions and lower credit risks. These favorable circumstances, combined with the potential for higher NII from rising rates, can be beneficial for OCBC in the long run.

At the time of writing, OCBC Bank is trading at a Price/Book ratio of 1.06x and offers a mouth-watering 6.4% dividend yield.

Brokerages and Investment Managers

As interest rates rise, the returns on money market funds and other short-term investment products can increase.

This can attract more assets and, in turn, generate more fees for investment managers and brokers.

4. Singapore Exchange (SGX: S68)

SGX is a leading global exchange that provides a platform for the trading of securities, fixed income, derivatives, indices, data and connectivity, and sustainable finance.

SGX is known for its robust and reliable trading platform, which offers a wide range of products and services to meet the needs of investors and traders.

According to the financial results released by Singapore Exchange Ltd (SGX), the company reported a net profit of $503 million for FY2023, mainly driven by a boost from net gains of long-term instruments due to the higher i/r environment.

The revenue for FY2023 was $1.19 billion, with an adjusted earnings per share of 47.1 cents.

The proposed final quarterly dividend per share was 8.5 cents, and the total dividend per share for FY2023 was 32.5 cents.

The management has commented that SGX is likely to grow its top-line by a single-digit range in the medium-term, underpinned by the multi-asset platform.

At the time of writing, SGX is trading at a P/E ratio of 18.3x and offers a decent 3.6% dividend yield.

Insurance companies

Insurance companies invest the premiums they collect in various securities, including bonds.

When interest rates rise, the income from new bond investments can increase, potentially leading to higher investment income for these companies.

5. Great Eastern (SGX: G07)

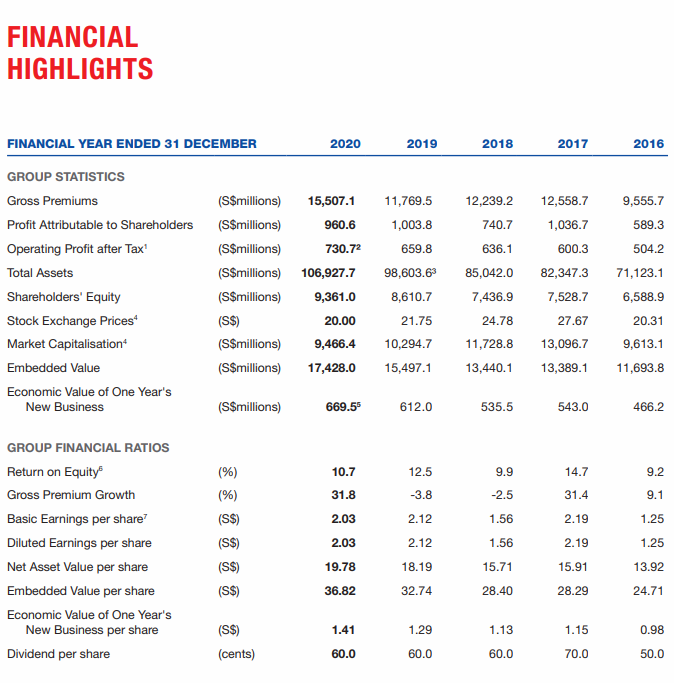

GE Holdings is a prominent insurance company with roots in Singapore. Operating under the umbrella of the OCBC Group, Great Eastern has been a reliable financial institution providing a wide range of insurance and financial solutions to its customers.

The Group observed an encouraging growth of 23%, bringing the Total Weighted New Sales to S$1,543.7 million compared to the same period of the prior year.

Serving as an indicator of the company’s long-term economic profitability, the NBEV (New Business Embedded Value) witnessed a 9% surge to reach S$669.5 million.

This upswing can be ascribed to Great Eastern’s compelling product range coupled with its widespread distribution network.

Additionally, the company has experienced consistent premium growth over the last two years, with rates reaching double digits.

Factors like product diversity, market strategy, and distribution efficiency have played a pivotal role in this growth.

Conclusion

While the trajectory of interest rates remains uncertain, certain stocks in the Singaporean market, especially the banking sector, appear to be well-poised to gain from rising rates.

Investors should, however, continually evaluate the economic landscape and other external factors before making investment decisions.