CabNet Holdings Berhad is set to be listed on the ACE market of Bursa Malaysia on 22 May 2017 with an issue price of RM0.56. It had issued 21 million new shares for its IPO, aiming to raise RM11.76 million with 7 million shares will be issued to the Malaysian public.

You can find its IPO Prospectus here. We have also listed a short 5 minute guide to what you need to know about this new player!

Company Info

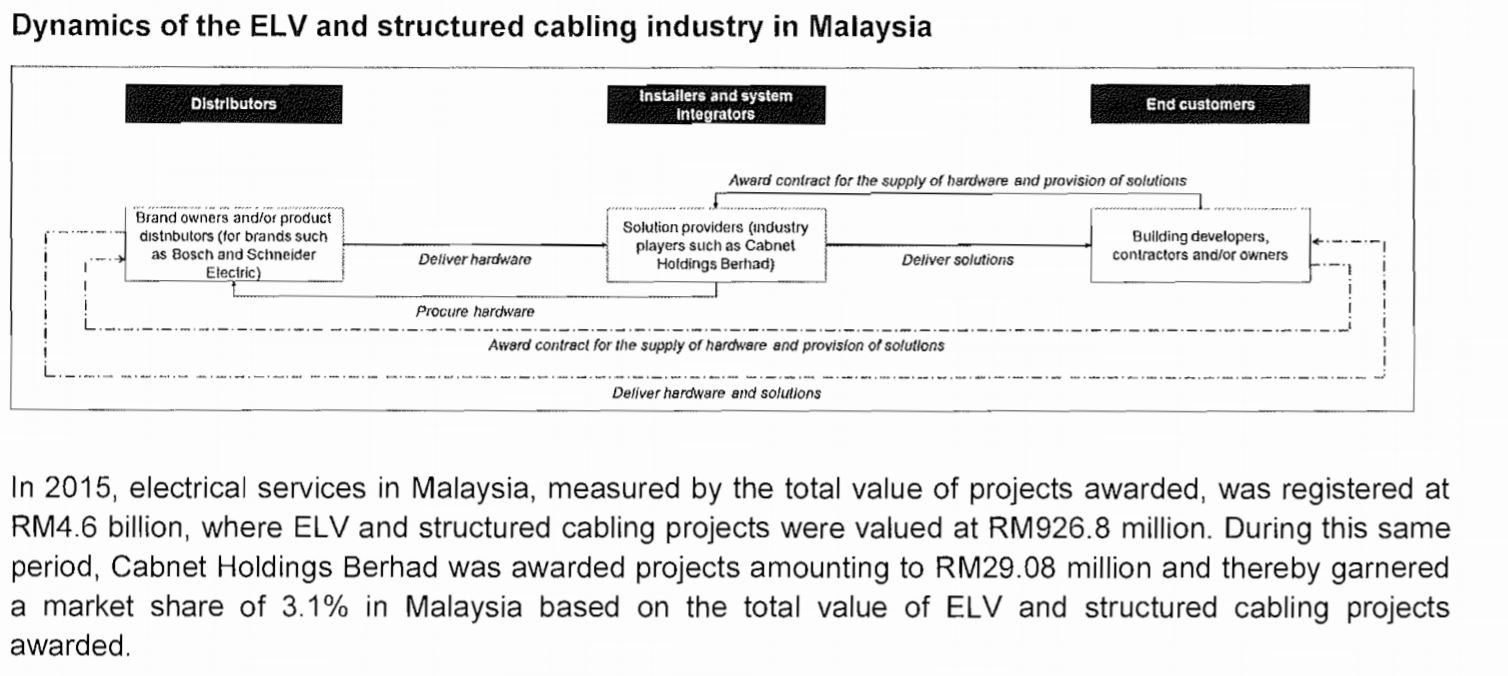

Let’s start with a simple introduction of the company. CabNet deals with the provision of building management solutions, which comprises of structured cabling works and extra-low voltage (ELV) systems.

It also provides IT services as complementary or standalone services. You can refer to the following image to find out more.

Use of Proceeds

The use of proceeds (totalled 11.76 mil) is as follows:

- 44.7% (RM5.26 million) for working capital and purchase of equipment components in its various divisions

- 25.5% (RM3 million) for listing expenses

- 25.5% (RM3 million) to repay bank borrowings

- 4.3% (RM500,000) will be used for research and development (R&D)

Financial Health

Revenue jumped from RM34.1 mil in FY2014 to RM50.8 mil in FY2016, marking a growth of almost 50%! Similarly, its net profits have increased in tandem, surging 42% from RM4.5 million to RM6.4 million in the same period!

As of Q12017, its total debt stands at RM5 mil, with its long-term borrowings accounting for RM2.13 million. Investors do not have to worry about the debt because its cash and cash equivalents is sufficient to cover it, standing at RM5.3 mil.

For its dividend policy, the Board aims to “recommend and distribute minimum dividends of 30% of annual PAT to shareholders”. However, this is not guaranteed and is subjected to various factors. If it works out, this will translate to an annual dividend yield of 2.6%.

Growth Prospects

It is important to take note that there are over 100 industry players in the ELV systems and structured cabling industry in Malaysia. Hence, the company’s ability to sustain its revenue is largely dependent on whether it can secure new projects.

As of now, the company plans to strengthen its ELV system segment and is eyeing to market its video surveillance cameras to townships and district areas.

SCA Take

According to the independent market research report, Cabnet actually only owns a 3.1% market share of the ELV and structured cabling contracts’ value in Yr 2015. It highlights the competitive nature of its industry and its future profitability hinges on whether the company can continue to secure contracts.

That said, it also means that Cabnet has a lot of room to grow. Imagine just achieving 10% of market share – it would translate to almost 3x of sales and profits! Thus, it is important to set itself apart from the competition and probably why the 500K allocation to R&D is of grave importance.

Moreover, you get 2.6% dividend yield while you are waiting for the story to play out. Its P/E ratio also stands at 9.26x – a rather attractive entry point for investors.

Sign Up for Our FREE Weekly Newsletter as we monitor the stocks’ latest news and update you when there is something interesting! On top of that, we will give you a book that teaches you the hallmarks of multi-bagger stocks and how to find them.

Receive your eye-opening FREE Ebook titled – “100 BAGGERS” by Christopher W. Mayer by clicking today!