iFAST Corp Ltd is an investment holding company with assets under administration (AUA) of about S$18.6 billion as at 31 March 2022.

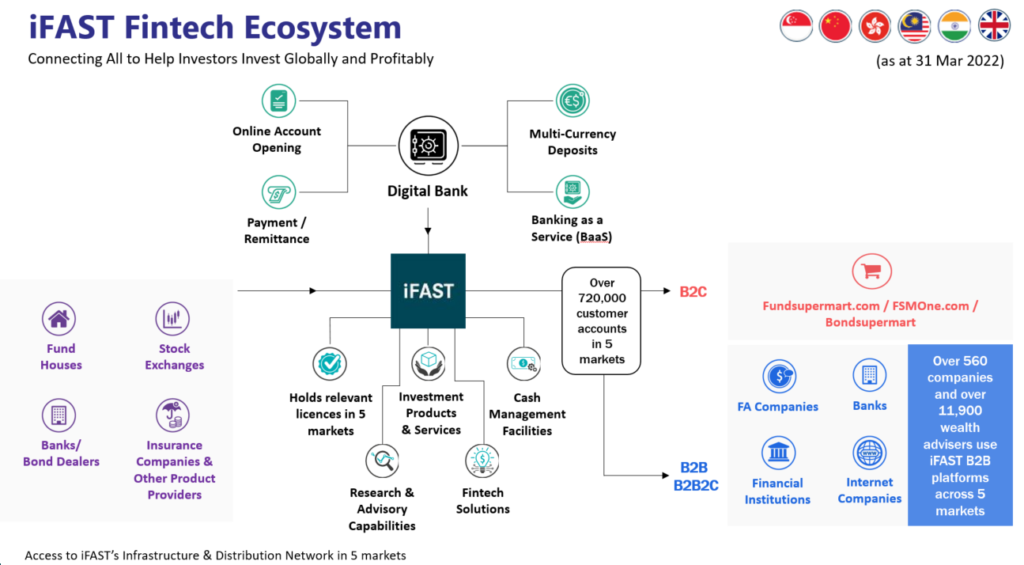

It is engaged in the development of software, marketing of unit trusts, exchange-traded funds, listed stocks, debt securities and Singapore government securities through websites and acting as an investment advisor, dealer, and custodian in the securities.

The company operates through geographic segments that are Singapore, Hong Kong, Malaysia, and China, India and the UK.

However, the Singapore region generates the bulk of the revenue for the company.

#1 Establishing a Diverse Fintech Ecosystem

The Group has continued to work on increasing the scale and quality of its platforms for both the B2C and B2B segments.

The B2B segment includes the Group’s in-house wealth advisory division iFAST Global Markets. It has achieved robust growth in the Group’s core markets including Singapore and Malaysia in 2021.

The company has provided a strategic four year plan and aims for Group AUA (Assets Under Administration) target of S$100 billion by 2028.

In the next four years, the Group targets to make progress towards its vision of being a top Fintech wealth management player with a truly global business model.

#2 Digital Banking

Unfortunately, it was a bumper that iFast failed in both its digital banking license bids in Singapore and Malaysia.

This was probably the reason why iFast Corp then focused on an acquisition of a UK-based fully licensed bank in March 2022. The bank has been renamed as iFAST Global Bank Limited (formerly known as BFC Bank Limited).

The acquisition of the UK Bank will enable iFAST Corp to add a digital bank to its Fintech Ecosystem, possibly offering more products than it can at the moment.

The total investment amount is £40 million representing about 3.2% of the Company’s market capitalization in 2022.

#3 HK’s ePension Division

The Group’s ePension division will involve providing operation and administration services for both the Mandatory Provident Fund (MPF) schemes and Occupation Retirement Scheme Ordinance (ORSO) schemes in Hong Kong, with the MPF schemes being the main contributor.

The ePension division will not add to the Group’s AUA numbers, but will add a strong stream of recurring service fees to the Group.

Based on the Net Revenue Target of HK$1.2 billion and a 33% PBT Margin, this pension will add around S$69 million profits before tax (S$210 million * 33%) annually by FY2025.

It is more than double the PBT of its FY2021’s figure and this is something that probably underpin its growth going forward.

#4 Risk Factors

There are 2 main risk factors involved for iFast too.

Firstly, the company has reported that it expects some initial start-up losses in 2022 and 2023 from the UK bank acquisition to the tune of S$4 million.

The AUA for iFAST declined sequentially by 1.9% q-o-q. This was on account of key market Singapore seeing redemptions mainly from the B2C segment due to the volatile global equity and bond markets. This meant that investors should see more weakness from the ongoing market rout.

Conclusion

iFast Corp stock has not been doing well in the last year with its share price coming down over 30%.

This is probably due to the poor market sentiment and its lofty >50x P/E ratio previously where the growth expectations are too high to reach.

Although iFast corporation is riding on the tailwinds of the Fintech revolution, there are also many other competitors with much stronger ‘sponsors’ like Moomoo from Tencent and Tiger Brokers backed by Interactive Brokers and Xiaomi.

iFast Corporation will need to maneuver its way around well as they all try to out-shine each other via heavy marketing dollars and campaigns.