With the recent market turmoil due to the yen carry trade and rising fears of a US recession, many investors might have fled the market or re-balancing their portfolio.

In times of economic uncertainty, REITs could be a great source of dividends for income investors and especially since the 10 year treasury yield has fallen below 4%.

With interest rates poised to come down when the FED is expected to cut rates in September, REITS could see their share price increase. However, investors need to be aware that when US fall into a recession next year, REITs could see negative rental reversion.

Hence, income investors should look for REITs with resilient business model that are able to withstand the impact of an economic recession and not listen to bloggers who keep harping on quality portfolios that are backed by a strong sponsor.

Here are 4 solid REITs with dividend yields of 4.0% or higher.

Frasers Centrepoint Trust

Fraser Centrepoint Trust (FCT) reported its business update for 3rd Quarter ended 30 June 2024 on 24 July 2024.

FCT reported a set of stable metrics for the 3rd quarter 2024. Portfolio committed occupancy is at 99.7% with shopper traffic increase by 4.1% for 3Q24.

Gearing ratio remain below 40% at 39.1% while average cost of debt us 4.2%. Adjusted coverage ratio is 3.26 times while 67.2% of debts are on fixed rates.

FCT is well-positioned to ride out the economic uncertainty as their portfolio are suburban malls with anchor tenants such as supermarkets and food courts. You can view the REIT website here.

CapitaLand Integrated Commercial Trust

CapitaLand Integrated Commercial Trust (CICT) reported a good set of results for 1H 2024.

Net property income is up 5.4% to S$582.4 million while DPU increased by 2.5% to 5.43 cents. Portfolio occupancy remains healthy at 96.8%. Yield to date reversion for the retail portfolio is 9.3% while the rental reversion for office portfolio is 15.0%.

Gearing ratio is 39.8% with 76% of debts on fixed interest rates. Interest cover is 3.0 times. CICT retail portfolio occupancy is higher than its office portfolio.

With a number of CICT retail properties in the heartlands such as Bedok Mall, Junction 8 and Tampines Mall, CICT should be able to perform better when recession hits next year. Hence, CICT could be one of the 4 solid REITs with dividend yields of 4.0% or higher.

You can view the REIT website here.

Parkway Life Real Estate Investment Trust

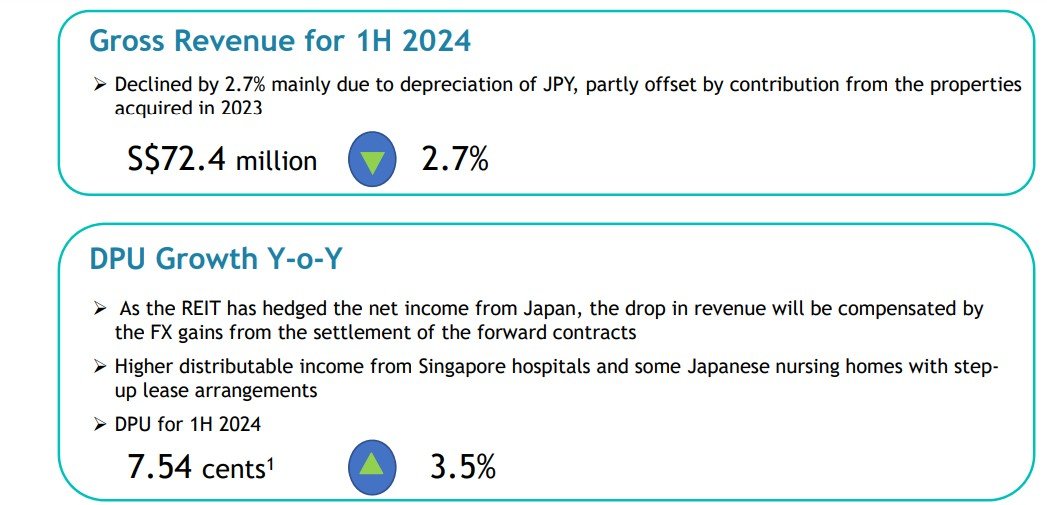

In its half year results ended 30 June 2024, Parkway Life Real Estate Investment Trust (PLife) reported that revenue decrease by 2.7% to S$72.4 millon while net property income dropped by 2.5% to S$68.3 million.

Balance sheet remains strong with no long-term debt refinancing needs till March 2025. Gearing ratio remains low at 35.3% with interest cover of 10.6 times

PLife REIT did not disappoint investors with DPU increase by 3.5% to 7.54 cents. PLife REIT has never decreased its DPU since its listing.

When economic recession sets in next year in the US, PLife REIT being in the healthcare business should be one of the 4 Solid REITs to ve considered in your watchlist. You can view the REIT website here.

AIMS APAC REIT

In its 1Q FY2025 business update, AIMS APAC REIT (AA REIT) reported net property income increase by 6.6% S$34.4 million while DPU dipped slightly by 1.7% to 2.27 cents.

Portfolio occupancy remains high at 97.3% with positive rental reversion of 12.8%. The tenant retention is also high at 91.3%. Gearing remains low at 33.1% with 74% of debt on fixed rates.

AA REIT has no refinancing requirements until 3Q FY2025 which will help AA REIT better manage its capital requirements. With its strong balance sheet, AA REIT is one of the 4 solid REITs with dividend yields of 4.0% or higher. You can view the REIT website here.

Conclusion

These are the 4 solid REITs with dividend yields of 4.0% or higher. These REITs should be able to withstand the storm when it comes next year and 2026.

PLife REIT and FCT, have gone through the financial crisis before in 2008. During 2008, PLife REIT and FCT provided stable DPU for investors even though the share price fell. CICT has not been tested since its merger and hence investors need to be aware.