Dividends are attractive because they represent cash flow that flows straight into your bank account. Income investors have a great selection of dividend-paying stocks on the local stock market.

The key in investing income stocks is that the dividends you receive must be consistent and grows steadily. In this article, I highlight 4 Singapore stocks well-positioned to pay out higher dividends in 2025.

DBS Group Holdings

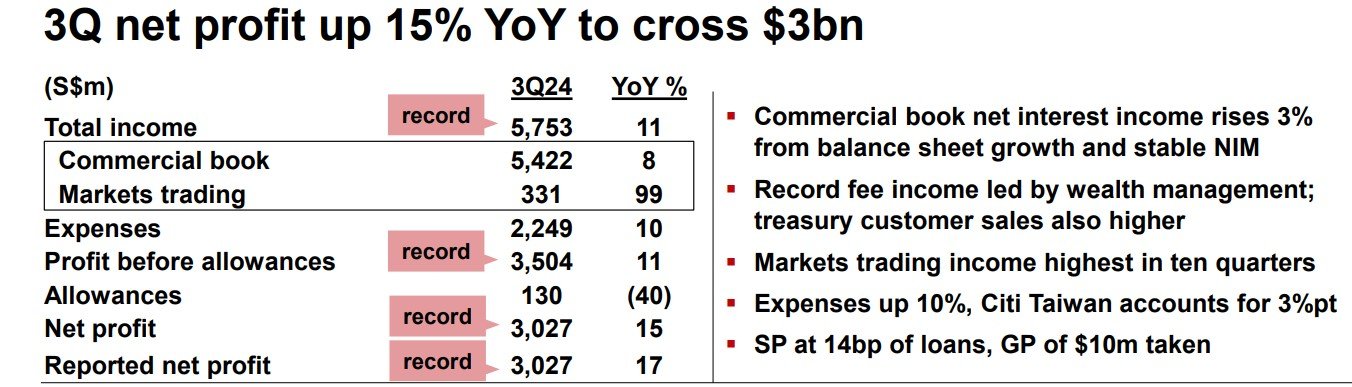

DBS reported its 3Q 2024 results on 7 Nov 2024.

Total income was up 11% to $5.75bn from broad-based growth. Commercial book NII rises from balance sheet growth and stable NIM of 2.83%. Record fee income led by wealth management; treasury customer sales also higher. o Markets trading income highest in ten quarters.

Net profit is up 15% to a record S$3.02 billion. DBS declared an interim dividend of 54 cents in 3Q 2024 which is higher than 44 cents that was paid out in 3Q 2023.

DBS net profit for 2025 is expected to be below 2024 levels due to global minimum tax of 15%. However, DBS remain well positioned to continue delivering healthy shareholder returns.

Hence, DBS is one of the 4 Singapore stocks well-positioned to pay out higher dividends in 2025. You can view the bank website here.

Oiltek International

Not many investors have heard of Oiltek as it is considered a small cap company. I first mentioned Oiltek way before analysts discovered it. You can read the article here.

Oiltek is an established integrated process technology and renewable energy solutions provider in the vegetable oils industry, providing solutions that cater to all types of vegetable oils, including palm oil, soybean oil and rapeseed oil, which are some of the major agricultural commodities in the world.

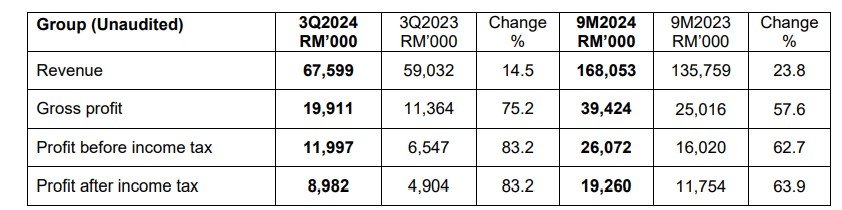

Oiltek reported its 3Q2024 business update on 19 Nov 2024.

For 3Q2024, Oiltek reported revenue is up 14.5% to RM$67.6 million. Net profit is up a whopping 83.2% to RM8.9 million. The company did not declare an interim dividend as the it had already paid an interim dividend of S$0.009 cents for 2nd half.

Oiltek remain confident about the long-term outlook of the Edible & Non-Edible Oil Refinery segment with the global consumption of oils and fats growing in tandem with population growth.

Hence, Oiltek is one of the 4 Singapore stocks well-positioned to pay out higher dividends in 2025. You can view the company website here.

SIA Engineering Company

SIA Engineering Company (SIAEC) is Asia’s foremost Maintenance, Repair and Overhaul (MRO) provider.

With certifications from more than 20 airworthiness authorities, SIAEC’s global MRO network, including six hangars in Singapore and three hangars in Philippines, delivers turn-key integrated solutions to a large client base of international airlines and aerospace companies.

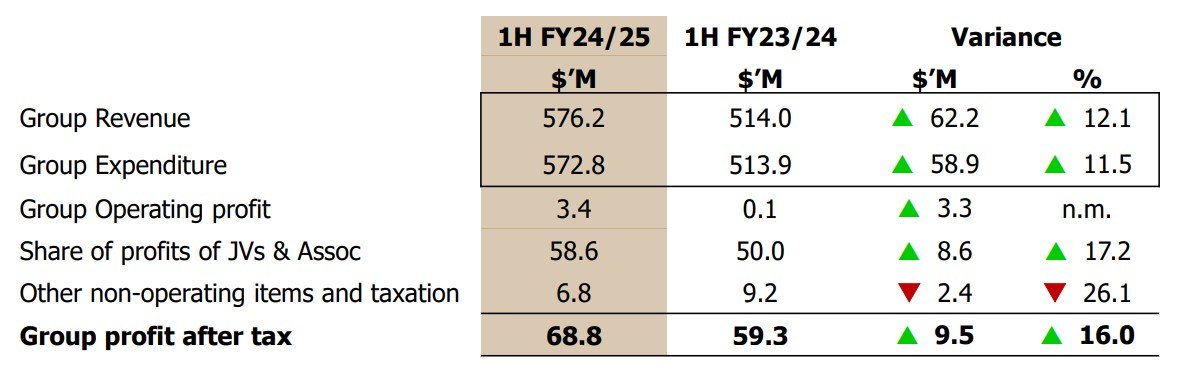

SIA Engineering reported it half year results ended 30 Sep 2024 on 6 Nov 2024.

Revenue is up 12.1% to S$576.2 million. Group profit after tax is up 16% to S$68.8 million. The company declared an interim dividend of 2 cents, unchanged from the previous year.

With the continued demand for MRO services due to healthy air travel demand and delays in the delivery of new aircraft, resulting in airlines keeping older aircraft in operation and needing MRO support for those aircraft, SIA Engineering is definitely one of the 4 Singapore stocks well-positioned to pay out higher dividends in 2025.

You can view the company website here.

SATS Ltd

SATS core businesses are of gateway services and food solutions. In food solutions, the business comprises airline catering, food distribution and logistics, industrial catering as well as chilled and frozen food manufacturing, besides linen and laundry services.

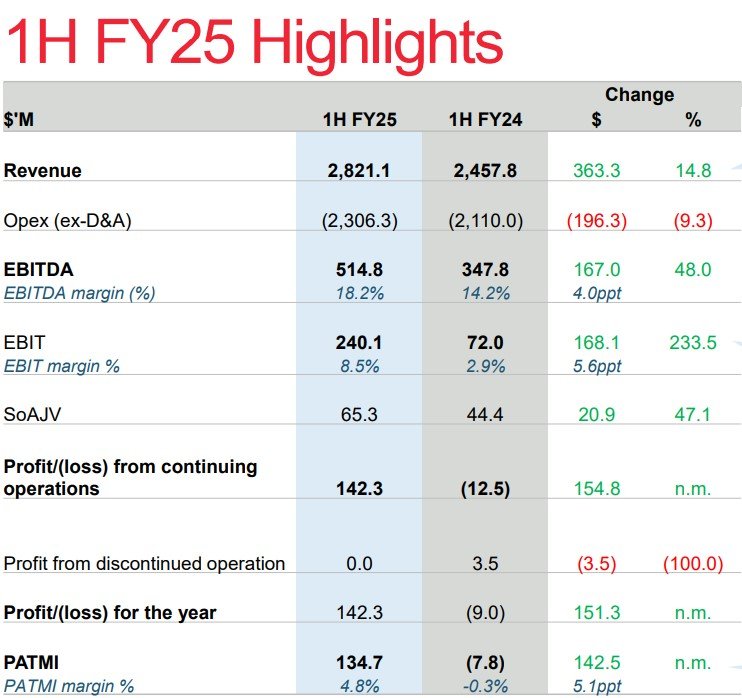

In gateway solutions, SATS offers a comprehensive range of airfreight handling, ground handling, and aviation security services. SATS reported its 1H FY2025 results on 7 Nov 2024.

Revenue is up 14.8% to S$2.8 billion. Net profit is at S$142.3 million. The increase in revenue and profit is due to increased business volume growth as well as rate increases from customers. The company declared an interim dividend of 1.5 cents per share.

SATS expects the positive momentum to continue next year as the demand for travel and cargo reaches its seasonal year-end peak. Hence, SATS is one of the 4 Singapore stocks well-positioned to pay out higher dividends in 2025. You can view the company website here.

Disclaimer: Please note that the stocks mentioned in this article are not a financial recommendation to buy and investors need to do their own research and due diligence before investing in any of these stocks.