There are several investment options for you to park your money for better returns. However, some of these options such as Treasury Bills and SSB may not help you to beat inflation.

For example, the latest yield on Singapore Savings Bonds is 2.81 which is a sharp drop from the 3.33% offered in the June 2024 issue. Similarly, the 6 month treasury yield has also dropped from a high of 3.8% in the March 2024 auction date to the present 3.04% for the November 2024 auction date.

However, the SSB and treasury yield has perk up recently due to the rising US 10 year treasury yield. Nonetheless, these yields seem low and there are investments that can provide a much higher yield.

In this article, we sieve out 4 Singapore REITs With Yield Higher than Treasury Bill and SSBs.

CapitaLand Ascendas REIT

In its latest business update for 3Q 2024, CLAR reported portfolio occupancy of 92.1% which is a lower compared the 93.1 portfolio occupancy in June 2024.

Portfolio rental reversion is a positive 14.4%. Gearing ratio remains healthy at 38.9% with cost of debt at 3.7%. Interest cover is at 3.7x with 80.2% of debt on fixed rates.

CLAR did not declare 3Q 2024 dividend as CLAR pays dividend twice yearly. Based on the half year dividend S$0.07524 cents, this translate to an annualised dividend yield of 5.7%.

Given that CLAR is one of the biggest market cap REIT, it qualifies as one of the 4 Singapore REITs With yield higher than Treasury Bill and SSBs. You can view the REIT website here.

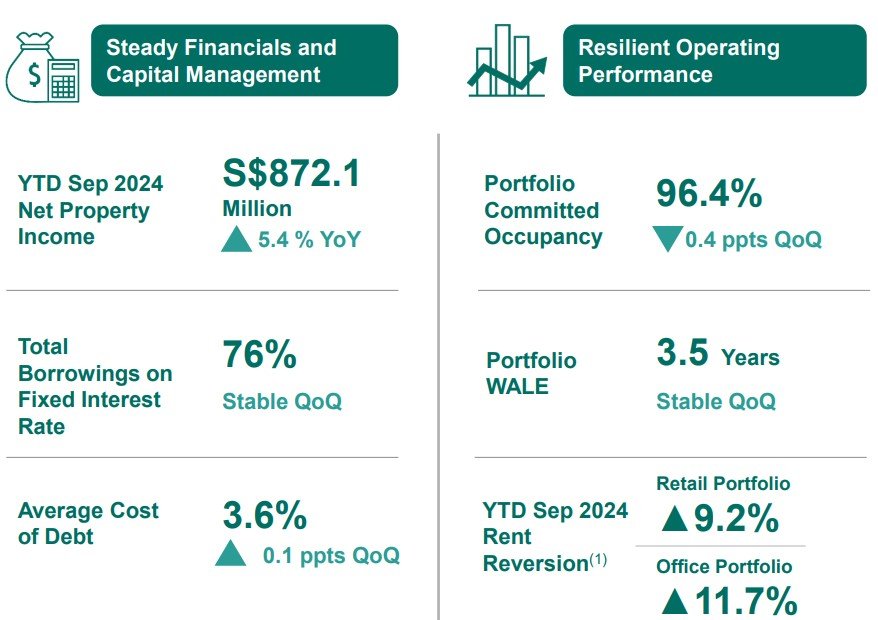

CapitaLand Integrated Commercial Trust

Frasers Centrepoint Trust

FCT reported its second half year and full year results ended 30 Sep 2024 on 25 Oct 2024. Net property income dipped 4.6% to S$253.39 million due to the divestment of Changi City Point.

Portfolio occupancy remains healthy at 99.7% with positive rental reversion of 7.7%. Tenant sales increased by 1.2% year on year while shopper traffic is up 4.2%.

Gearing ratio remained stable at 38.5% with average cost of debt at 4.1%. Interest cover is at 3.41x with 71.4% of debts on fixed rates. Full year DPU dipped slightly to 12.042 cents which translate to a yield of 5.7%.

FCT being a resilient REIT given its portfolio of suburban should be able to maintain its stable DPU going forward. Hence, it is definitely one of the 4 Singapore REITs with yield higher than Treasury Bill and SSBs. You can view the REIT website here.

Mapletree Industrial Trust

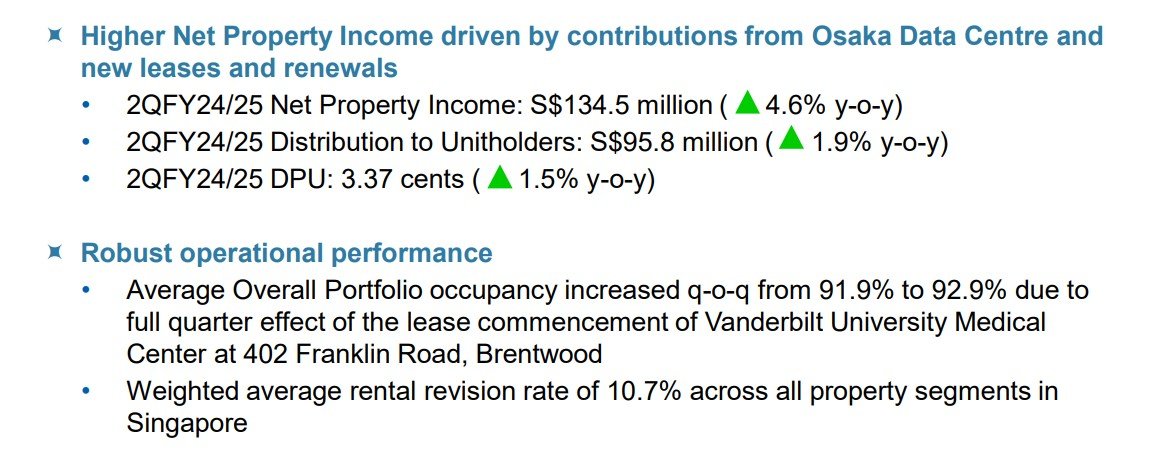

MIT reported its 2Q and 1H FY24/25 ended 30 September 2024 on 29 Oct 2024.

Net property income is up 4.6% to S$134.5 million while distribution to unitholders is up 1.9% to S$95.8 million. Portfolio occupancy increased from 91.9% to 92.9% with positive rental reversion of 10.7% across all property segment in Singapore.

Gearing ratio is 39.1% with 80.4% of debts on fixed rates. Average cost of debt is 3.2% adjusted interest cover of 4.3x. DPU declared for the 2Q is 3.37 cents which is up 1.5% year on year. Total first half DPU is 6.8 cents which translate to an annualized yield of 5.9%.

With its diversified portfolio of industrial properties and data centres, MIT could be one of the 4 Singapore REITs with yield higher than Treasury Bill and SSBs. You can view the REIT website here.

I have sieved out 4 Singapore REITs with yield higher than Treasury Bills and SSBs. However, investors need to take note with Trump winning the Presidential elections, inflation will rear its ugly head again as can be seen by the rising US 10 year treasury yield.

Hence, the FED may not have room to cut rates much further. Do not be fooled by financial bloggers and analysts that say interest rates are coming down and REITs will benefit.

Instead, investors need to monitor closely the US 10 year treasury yield and stay nimble when investing in REITs.