Industrial REITs has been one of the most resilient sectors within the REITs sector. The rising trend in e-commerce and advance manufacturing has resulted in surging demand for logistics, industrial and Hi-Tech properites.

Investors who like to invest in REITs for income can consider investing in industrial REITs. We highlight 4 Singapore industrial REITs with dividend yield of 6% or More

ESR-Logos REIT

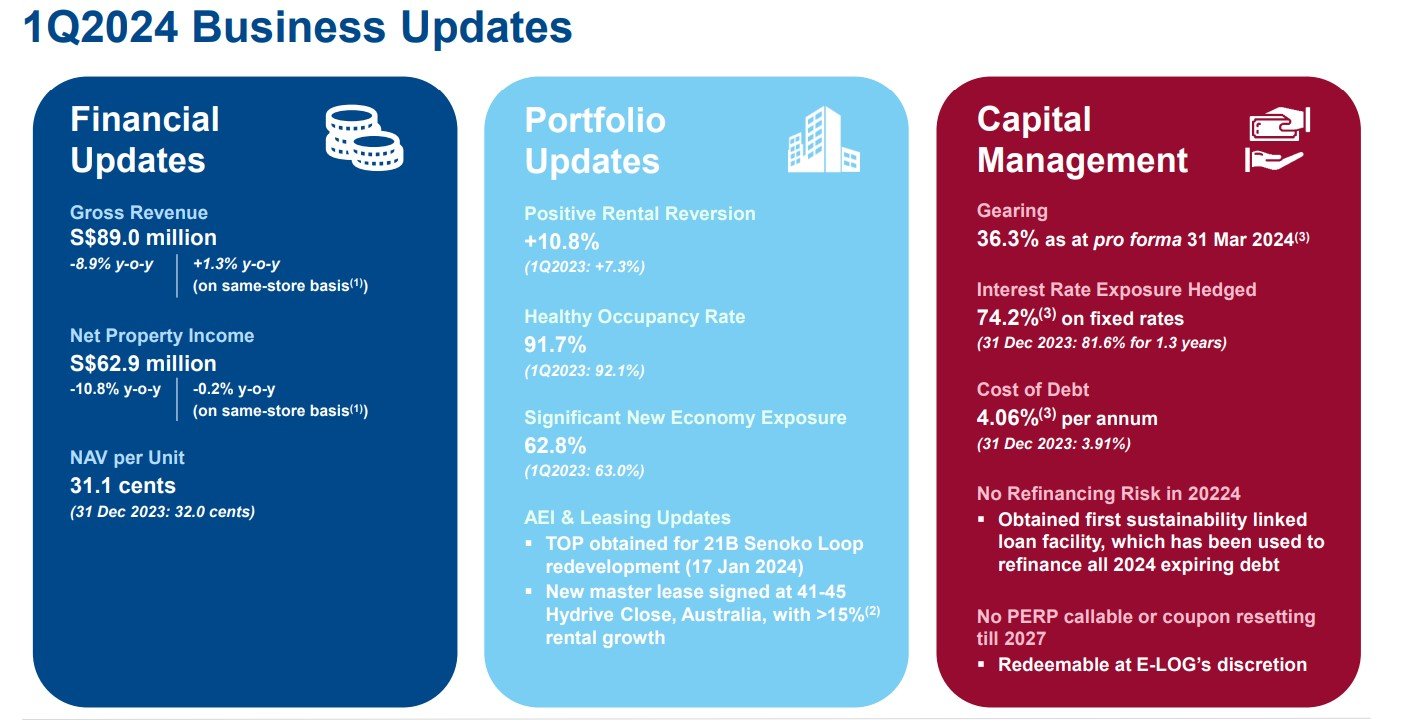

ESR-LOGOS REIT has a diversified portfolio of logistics properties, high-specifications industrial properties, business parks and general industrial properties with total assets of approximately S$5.1 billion.

Its portfolio comprises 72 properties located across the developed markets of Singapore, Australia and Japan. In its latest business update for 1Q2024, ESR-Logos reported net property income declined by 10.8% to S$62.9 million.

Rental reversion is positive 10.8% while portfolio occupancy remain healthy at 91.7%. Gearing ratio is manageable at 36.3% with 74.2% of the debts on fixed rates. This bodes well for ESR-Logos compared to other REITs.

ESR-Logos also took proactive debt management with no refinancing risk in 2024. The FTSE REIT index has dropped by 10.7% year to date while ESR-Logos dropped by 10.94% which is not too bad.

The drop in share price is way much lower than Mapletree Logistics Trust which suffer a drop of 21.05% in share price. ESR-Logos has an attractive dividend yield of 8.9% and hence is one the 4 Singapore industrial REITs with dividend yield of 6% or more.

You can view the REIT website here.

Sabana Industrial REIT

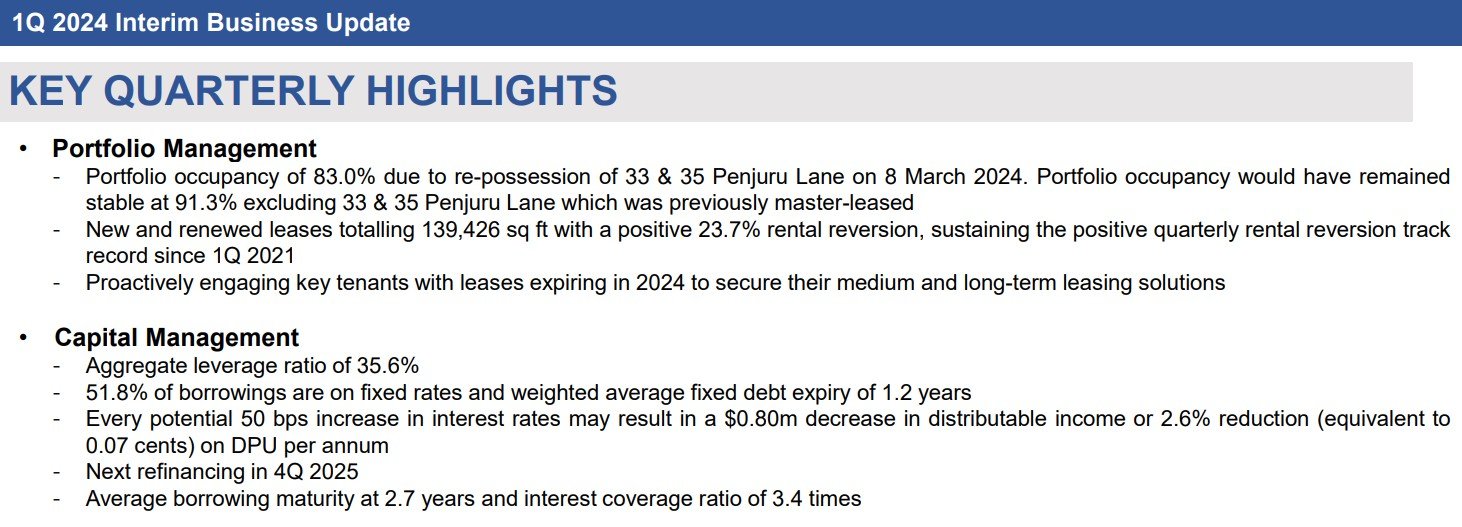

Sabana Industrial REIT invests in income-producing real estate used for industrial purposes in Asia. Sabana has a diversified portfolio of 18 properties in Singapore, in the high-tech industrial, warehouse and logistics, chemical warehouse and logistics.

Sabana reported portfolio occupancy of 83.0% mainly due re-possession of 33 & 35 Penjuru Lane. However, new and renewed leases were made with a positive rental reversion of 23.7%.

Gearing ratio remained low at 35.6% with 51.8% of borrowings on fixed rates. Interest coverage ratio is 3.4 times. Sabana share price has dropped 13.41% year to date and giving investors dividend yield of 7.7%. You can view the REIT website here.

AIMS APAC REIT

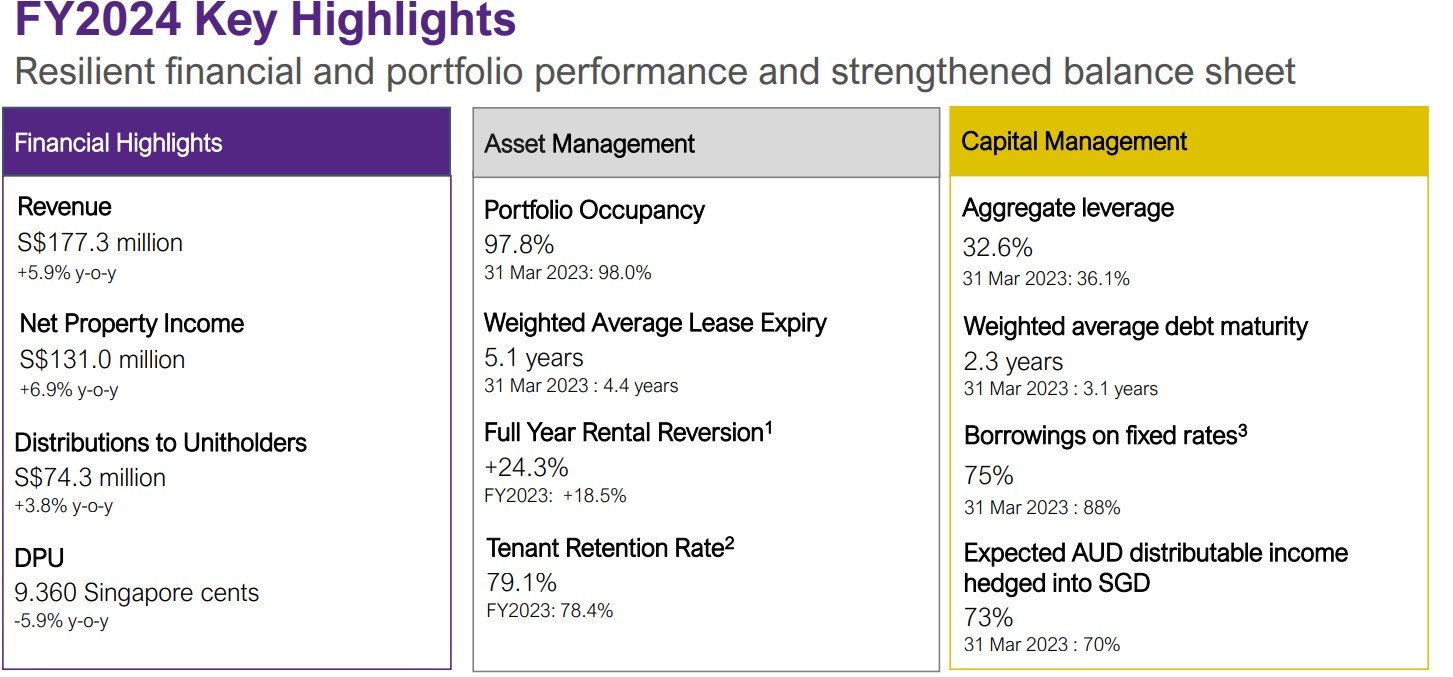

AIMS APAC REIT (AA REIT) owns a portfolio of logistics, warehouse, business park, industrial and hi-tech space properties in Singapore and Australia.

In its FY2024 results, AA REIT reported net property income increase by 6.9% while DPU decline by 5.9% to 9.36 cents. Portfolio occupancy remained healthy at 97.8% with WALE of 5.1 years.

Full year rental reversion is robust at positive 24.3%. Gearing ratio is at 32.6% with 75% of borrowings on fixed rates. AA REIT is one of the most resilient REITs this year. The share price only dropped by 3.03% compare to the FTSE REIT index drop of 10.7%.

At the current share price of $1.27, AA REIT has a dividend yield of 7.3% and is definitely one the 4 Singapore industrial REITs with dividend yield of 6% or more. You can view the REIT website here.

Mapletree Logistics Trust

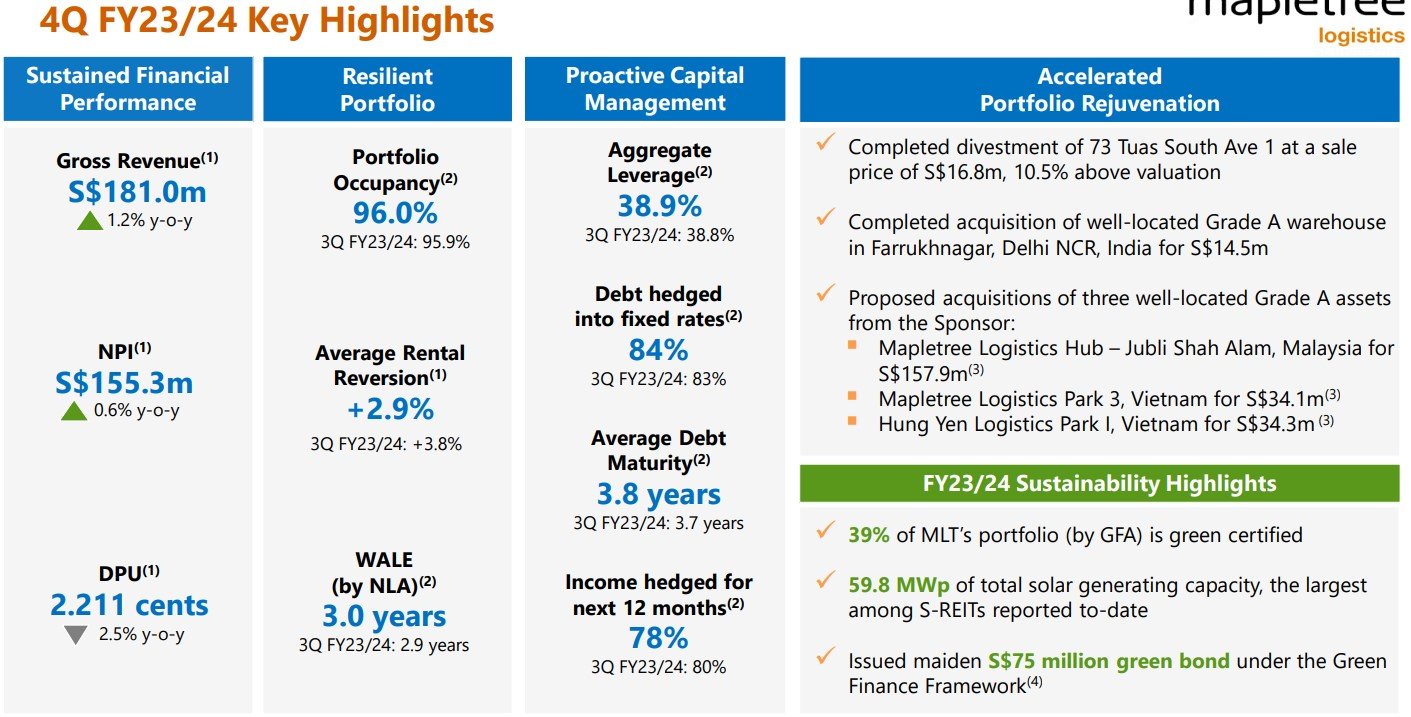

Mapletree Logistics Trust (MLT) owns a diversified portfolio of logistics properties in Singapore, Australia, China, Hong Kong SAR, India, Japan, Malaysia, South Korea and Vietnam.

MLT reported 4Q FY23/24 net property income increase by 0.6% to S$155.3 million. DPU dropped by 2.5% to 2.211 cents. Portfolio occupancy improved slightly to 96.0% with average positive rental reversion of 2.9%.

Gearing ratio remained manageable at 38.9% with 78% of the debts on fixed rates. MLT is one of the worst performing REIT this year. The share price drop by 22.22% far worse than the FTSE REIT index fall of 10.7%.

Investors maybe scratching their heads that a REIT with such a strong sponsor can drop so much in share price. This is because the management has made silly mistakes by acquiring China properties at such high valuation.

Hence, this further proved what I have said many times in the past but investors and even bloggers never choose to listen which is investors must never invest in a REIT purely on sponsor name alone. MLT was a case in point.

In addition. the REIT has been very active in acquiring and disposing properties at the expense of shareholders. Now that the CEO has resigned, shareholders can look forward to better future for MLT.

With the drastic decline in share price, MLT is now trading at 6.7% dividend yield. You can view the REIT website here.

Conclusion

These are are the 4 Singapore industrial REITs with dividend yield of 6% or more. Investors need to do their due diligence before investing in these 4 REITs.