Do you want to examine what the market thinks are the best buys before you delve into them for more reseach?

Luckily, most financial and investment platforms keep track of the analyst consensus target prices for the stocks.

And given that analysts spend their time doing research for covering these companies, we can literally piggyback on them!

So, here are 4 overlooked stocks with high upside potential of over 20% (in a year)!

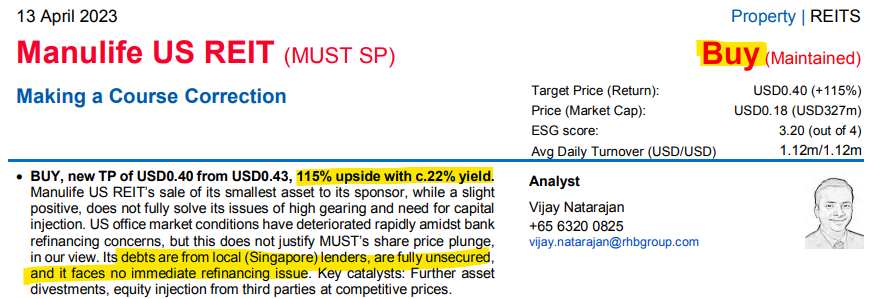

#1 Manulife REIT

156% potential upside!

That’s one of the highest in the Singapore market currently, as analysts in the market are projecting a target price of USD0.467 compared to the current share price of USD0.182.

MLife is a real estate investment trust which invests primarily in office real estates in the United States. It currently manages 12 office properties that are worth USD1.9 billion, where 88% of them are occupied by tenants.

MLife has performed well in the past years but unfortunately fell into the ‘death spiral’ where NAV valuations are coming down as i/r increases and they are too highly geared in the past.

You might be thinking that this is bad news for MLife but this is not the case. The loss was due to the value of their properties declining from USD2.2 billion in 2021 to USD1.9 billion in 2022, resulting in a “loss on paper”. If you recall back in 2022, the Federal Reserve was raising interest rates to decade-high levels of 4.75% which dampened the U.S. property market.

Let’s say your house price declined by 2% for some reason, but you are still generating rent from your tenants. On paper, you will declare that “loss” of 2% in the value of your house. However, as long as you are still holding on to the house and getting rent, you are actually not incurring any losses in your investment at the moment.

You will only do so if you exit the investment, and it is unlikely for MLife considering that 88% of its office spaces still have tenants and are generating consistent cash for the company.

On top of that, analysts are looking at the current issues and think that they don’t justify its share price plunge, especially given that Manulift REIT’s debts are fully unsecured from local SG lenders.

There are some reasons why MLife might be worth taking a look at:

- Indication from FED that interest rates hikes will be over in 2023

- Trading at distressed levels – price of US$0.18 vs NAV of US$0.55

- High dividend yield >6% to 9%

- Worst may be over as we see more stabilisation and recovery in the US office market?

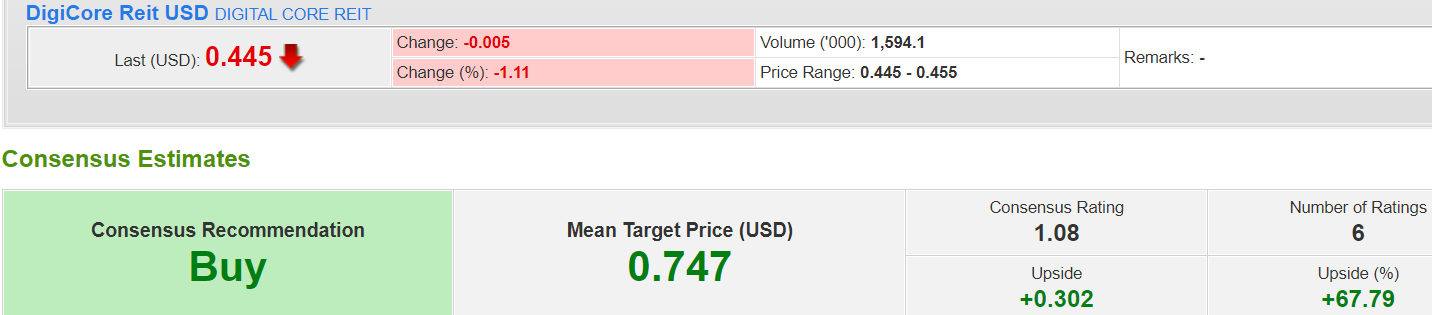

#2 Digicore REIT USD

Digicore REIT currently has an upside potential of 67.8% based on the average of 6 analysts.

Digicore is a real estate investment trust which invests in data centres-related assets globally. It currently has USD1.6 billion of assets under management consisting of 11 data centres in U.S., Canada, and Germany, with 98% of its spaces occupied.

As Digicore was just listed in 2021, only financial numbers for full year 2022 were available. Digicore ‘s revenue came in at USD115 million and it registered a net profit of USD7 million.

Similar to ManuLife, Digicore ‘s properties’ value declined by USD29 million over the year due to the Fed’s interest rate hikes but these losses were only on paper. From its operating cash flows, Dcore generated USD78 million in cash.

In terms of valuation, Digicore is currently trading at a lower price-to-book ratio of 0.54 times compared to the peers average of 0.94 times.

Digicore could be a good investment to consider for the following reasons:

- The expected stop in Federal Reserve raising interest rates this year will be positive to the property market.

- Steady dividend yields of 4.9%, quite high for a data centre REIT.

- Increase in demand for digital economy-related services = Increased demand for data centres in long run.

#3 Food Empire

Analysts are targeting for a price of SGD1.31 for Food Empire (FE) compared to the current share price of SGD1.01. This implies a potential upside of 29.8%, despite the share price going up pretty sharply.

FE is a food and beverage company that produces and sells instant beverage, frozen convenience food and confectionary products to over 50 countries in the world. Notable brands include MacCoffee, CafePho, Klassno, and Petroskaya Sloboda.

You will be glad to know that FE’s financial performance has grown to its highest level in 2022. Profits in particular tripled from SGD26 million in 2021 to SGD81 million in 2022. Meanwhile, revenue grew by 23.6% to SGD536 million in 2022.

In terms of valuation, FE is trading at a low price-to-earning ratio of 6.36x compared to the industry average of 17.69 times.

Hence, you could take a good look at FE for the following reasons:

- Strong growth in revenue during the pandemic. It grew by 48% from 2020 to 2022.

- The Russia war was a blessing in disguise for the firm because coffee demand actually went up!

- India’s freeze-dried factory and Vietnam’s demand are the twin growth engines today…

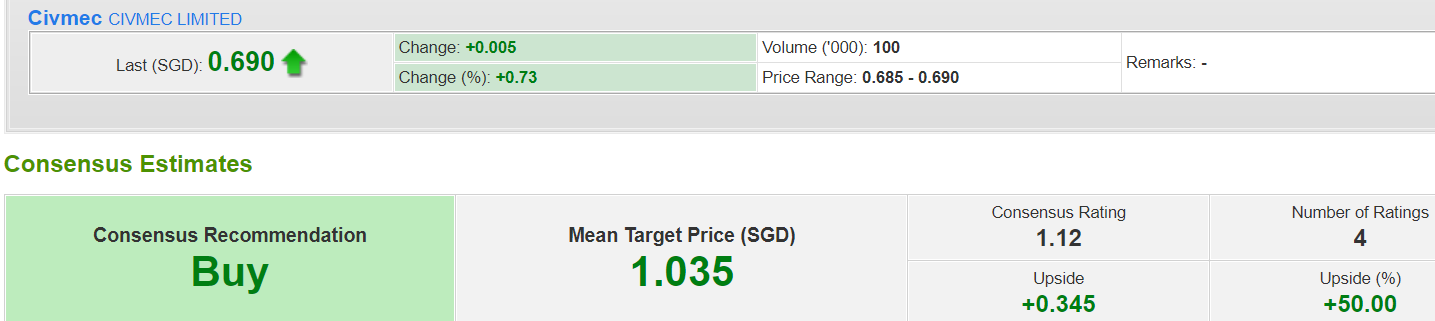

#4 Civmec Limited

Civmec Limited (CML) has an upside potential of ~50% with a price of SGD1.04 compared to the current share price of SGD0.69.

CML is based in Australia and provides construction and heavy engineering services to the oil & gas, mining, infrastructure, utilities, chemical, and power industries.

CML is finally back to its pre-pandemic financial performance. Revenue has recovered SGD776 million in 2022 compared to SGD739 million in 2019.

The good news is that profits are actually much higher at SGD48.7 million compared to SGD5.8 million over the same period.

When it comes to CML’s valuation, it is currently trading at a low price-to-earnings ratio of 6.6x compared to the industrial average of 13.1x.

Hence, CML could be worth taking a good look at for the following reasons:

- Cyclical at low valuations.

- Easing of coal export ban by China – a positive sign for Australia’s mining industry (Civmec customers).

- High return on assets of 8.3% compared to the industry average of 3.4%.

CML’s dividend yield of 4.4% in 2022 is higher than its historical average of about 1% to 2%, making this an attractive investment to hold for dividends.

Conclusion

Identifying companies that have good upside potential doesn’t have to be hard. There are always opportunities in the market no matter the conditions.

These 4 Singaporean companies currently have high upside according to the analysts; its time for you to do your research and take advantage of it!