Are these substantial shareholders and management teams making substantial moves on their companies?

Ah, the good old shareholding changes by majority shareholders and management/board. They probably know more about their companies than regular investors like us do. Hence, it makes sense that we should keep track of some of these buying activities from time to time.

If they are buying, it could mean three things.

- One, the company is now undervalued and they see a good opportunity to buy more.

- Two, the company’s prospects might be improving moving forward.

- Three, instill confidence in the company with more explicit support from the majority shareholders and management team.

Let’s take a look then at the major moves in the past few weeks for these 4 companies!

#1 CapLand India T (SGX: CY6U)

Temasek, which is Singapore’s sovereign wealth fund, increased its deemed interest in CapLand India Trust (CapIndia) from 22.6% to 24.1% through its stakes in CLA Real Estate and DBS Group. The share price rose by 2.9% from 15 May 2023 (Date of announcement) to 19 May 2023.

CapIndia is a property trust company focusing on owning income-producing real estate in India, especially in the IT industry.

It owns nine IT business parks, four data center developments, and two logistics and industrial facilities in Bangalore, Chennai, Hyderabad, Pune, and Mumbai.

CapIndia currently has about S$2.7 billion of assets under management, with Bangalore composing the majority of its assets at 33% followed by Hyderabad (25%) and Chennai (22%). Its occupancy rate stands at 92% in 2022, higher than 2021’s figure of 87%.

Its financial performance has been solid over the past couple of years despite the higher interest rates in India and the Covid-19 pandemic.

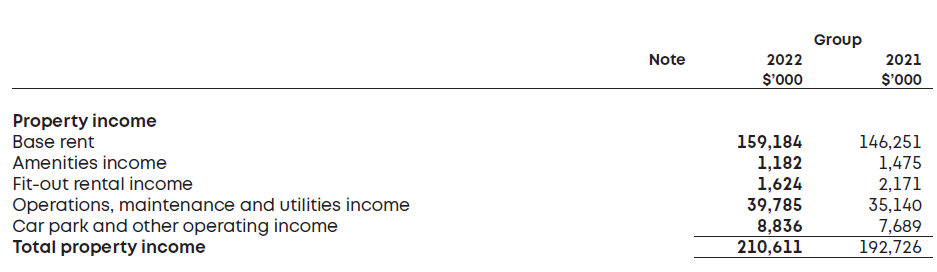

Revenue grew by 9.3% to S$211 million in 2022 from S$193 million in 2021, driven by higher rentals, operations, maintenance, and utilities income.

For CapIndia’s profits, it’s more suitable to look at its operating cash flow instead as its income statement is inflated by unrealized gains in its properties under management.

On this note, Cash from its operations is still strong at about S$145 million in 2022 compared to S$148 million in 2021.

Hence, Temasek’s increased interest in CapIndia could be due to the strong performance of its financials. However, that might not be the only reason.

- Emergence of India as a Key IT Business Industry in the World

India’s IT industry’s revenue grew by 15.5% to US$227 billion in 2022. By 2025, the IT industry’s contribution to GDP is projected to increase to 10% from 7% in 2022. - India’s Stock Market Rose in 2022 when Other Markets Declined

Contrary to other stock markets in the world, the BSE Sensex 30 (India’s stock market) rose by 4.4% despite the higher global interest rates.

At its current juncture, CapIndia has an OVERWEIGHT call with an average target price of S$1.30.

This implies a total upside of 28.4% with the inclusion of the dividend yield at 6.9%.

#2 AIMS APAC REIT

AIMS APAC REIT’s (AA REIT) Chairman, George Wang’s deemed interest in AIMS increased from 9.8% to 10.4% as 4.7 million shares were issued as payment for management fees.

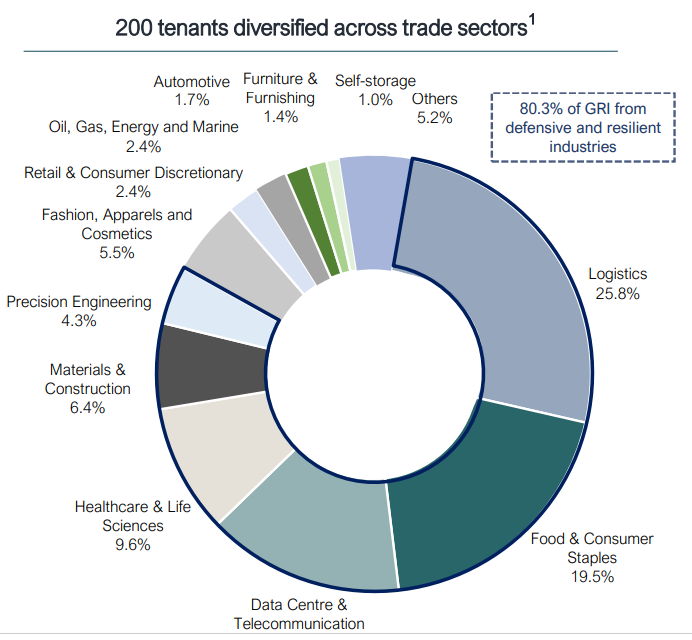

AA REIT is a real estate investment trust that buys and manages logistics, warehouses, business parks, and industrial and high-tech spaces in Singapore and Australia.

It has 26 and 3 properties in Singapore and Australia respectively, while managing S$2.3 billion in assets. Properties in Singapore generate the bulk of AA REIT’s revenue at 90%.

In terms of financial performance, AA REIT has remained resilient even throughout the pandemic years and high interest rates in 2022.

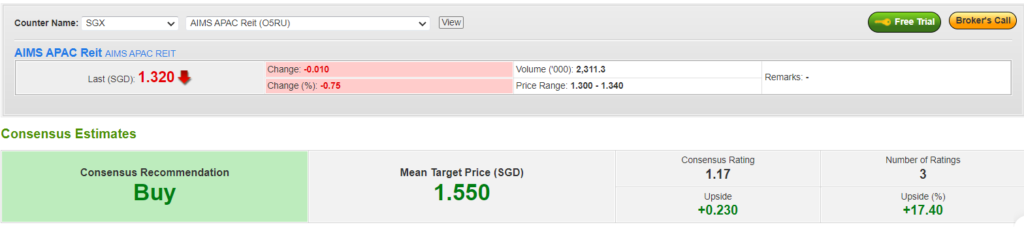

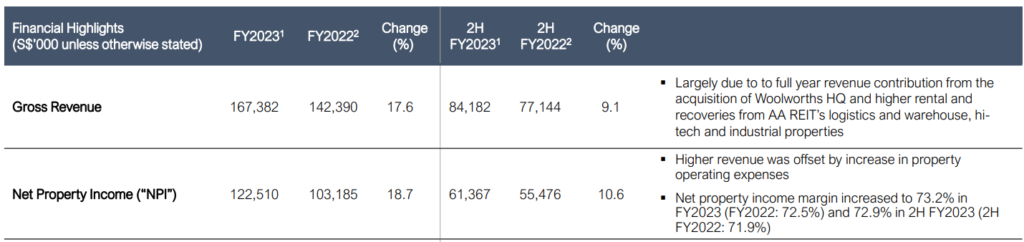

Revenue grew by 17.6% to S$167 million in 2023 (Mar 2022 – Mar 2023) from S$142 million in 2022 and was driven mainly by new acquisitions and higher rental from its logistics, warehouse, high-tech, and industrial properties.

With AA REIT’s tenants focused on the trade-oriented sectors in Singapore, 2022 has been a good year.

Total merchandise trade in Singapore continued to register double-digit growth of 17.7% in 2022 compared to 19.7% in 2021.

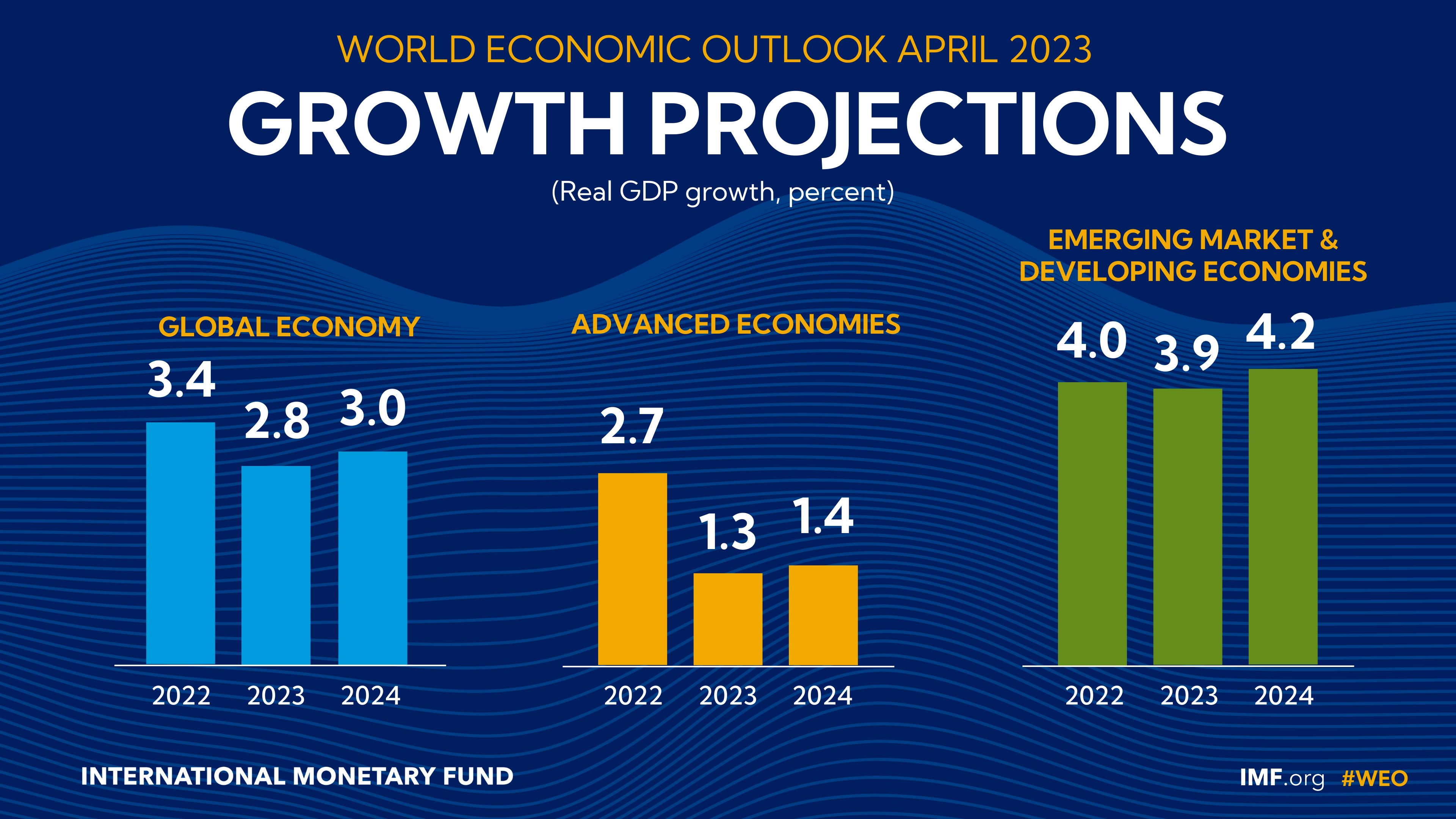

While 2023 is expected to be a down year for global trade, 2024 is expected to be a year of recovery as most economies around the world start to recover from the high-interest rate environment.

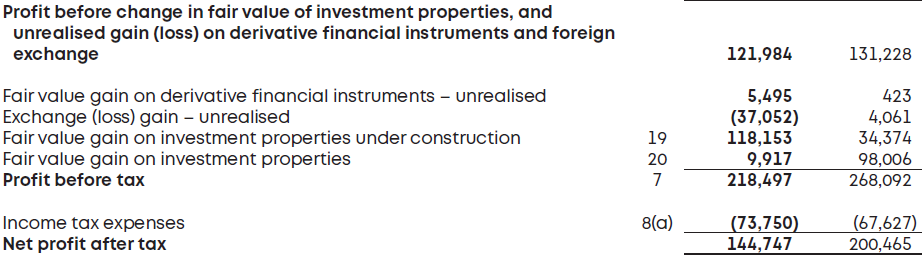

AA REIT currently has a BUY recommendation from analysts with an average target price of S$1.55.

This implies a total upside of 24.9%, with capital gains upside of 17.4% and current dividend yield of 7.5%.

#3 CapLand China T

Similar to CapLand India T, Temasek’s deemed interest in CapLand China T (CapChina) increased to 31.1% from 30.5% previously amid the payment of management fees in CapChina’s stocks to Temasek’s subsidiaries.

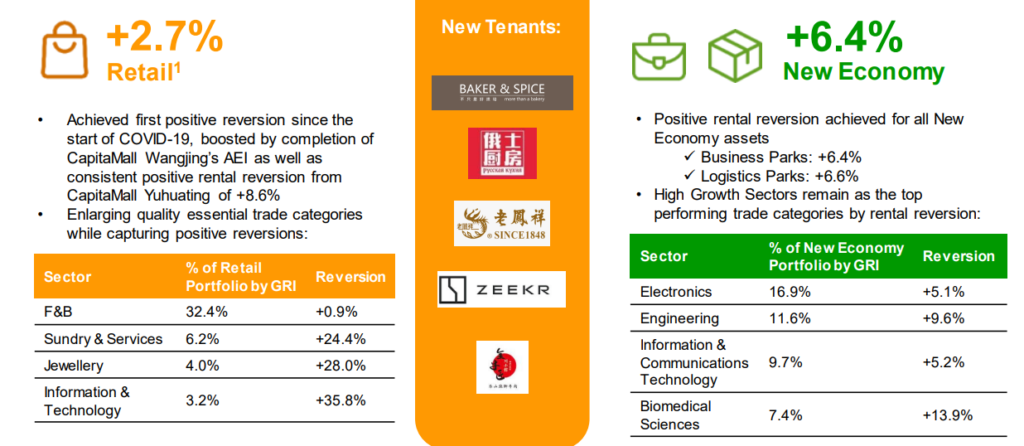

CapChina is a real estate investment trust focused on investing in shopping malls, business and logistics parks in China. It currently manages around S$5.2 billion in assets.

Its retail portfolio (shopping malls) is the biggest at 69% of its assets, followed by business parks (26%) and logistics parks (5%).

The occupancy rate for its retail portfolio is also the highest at 96.4%.

In 2022, CapChina has weathered the severe lockdown restrictions in China quite well.

After revenue rebounded by 79.5% in 2021, it further grew by 1.4% to S$383 million in 2022 from S$378 million in 2021, boosted by higher rentals for business and logistics parks.

In line with the reopening of China’s economy in 2023, the following factors could be the factors Temasek is not disposing of the additional shares that have been issued to its subsidiaries

- Strong Retail Sales Recovery in China

Retail sales grew by double digits in March and April 2023 at 10.6% and 18.4% respectively as Chinese consumption appetite recovers from the lockdown restrictions in 2022. - Steady Industrial Production Recovery in China

Industrial production growth continued to rise to 5.6% in April 2023 from 3.9% in March 2023.

Most analysts in the market have an OVERWEIGHT call on CapChina and an average target price of S$1.30.

This implies a total upside of 29.7%, with a capital gains upside of 23% and a current dividend yield of 6.7%.

#4 Aztech Global

Yew Mun Hong, Aztech Global’s (AG) Chief Executive Officer increased his stake slightly to 70.3% from 70.2% previously on 16 May 2023.

AG provides one-stop design and manufacturing services for products such as Internet-of-Thing (IoT), data communication, and LED lighting.

It currently has 4 research and development centers in Singapore, Hong Kong, and China and 3 manufacturing facilities in Malaysia and China.

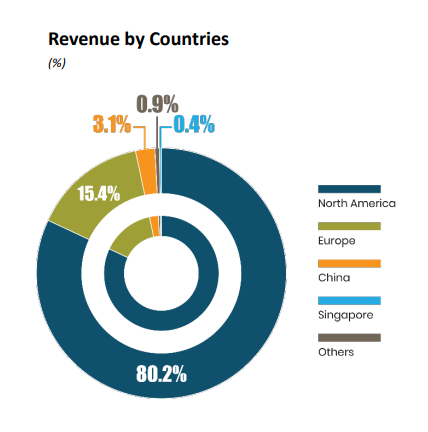

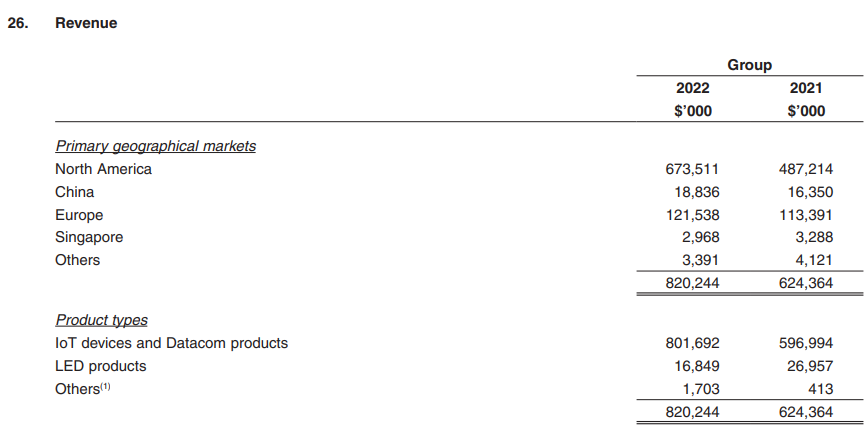

Most of AG’s revenue is derived from the United States, encompassing about 80%, followed by Europe (15%) and China (3%).

AG has been very impressive in its financial performance.

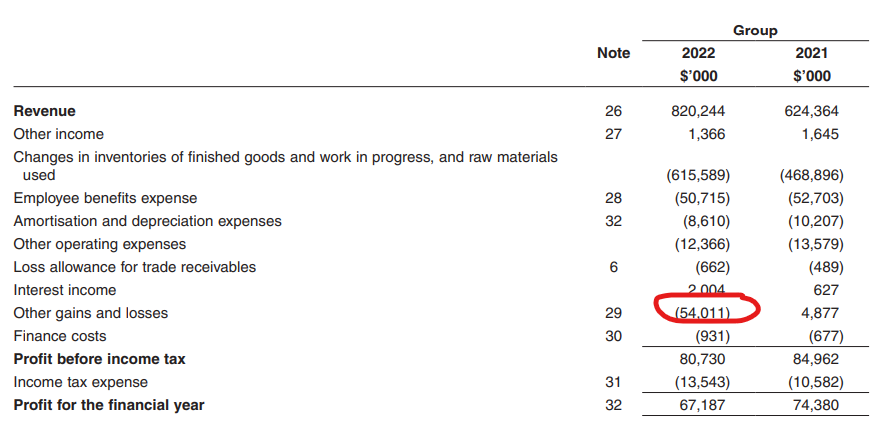

Revenue almost doubled from S$484 million in 2020 to S$820 million in 2022, and this was driven mainly by its IoT and data communications divisions.

However, its net profits declined from S$74 million in 2021 to S$67 million in 2022, due to foreign exchange loss that is recognised as it is not used for hedging purposes.

Hence, on an operating cash flow basis, cash from operations more than doubled to S$106 million in 2022 from S$42 million in 2021.

AG’s CEO might be confident in AG’s prospects due to the following reasons:

- Possibly higher demand from the U.S. as interest rate hikes reach the end.

Many market investors are expecting that the Fed’s interest rate hikes have reached an end in May 2023, and the Fed could reduce interest rates moving forward. This will be supportive of demand from the U.S. - IoT global market projected to grow at a strong rate

The global IoT market is expected to grow at a 6.7% average growth rate from US$88.2 billion in 2023 to US$106.1 billion in 2026.

Most market analysts have AG at a BUY investment call and an average target price of S$0.99.

This implies a total upside of 50%, with a capital gains upside of 44.8% and a current dividend yield of 5.2%.

Conclusion

As the legendary Fund manager Peter Lynch once said,

“Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.”

Hence, keeping track of insider buying can result in unexpected “yields” on top of the attractive dividend yields.