With the earnings season generally over, most blue-chip companies reported higher revenue and profits and most of these companies increased their dividends.

In this article, we sift out 4 blue-chip stocks offering an attractive mix of growth and dividends to help you achieve a solid total return on your investment portfolio.

Singapore Telecommunications

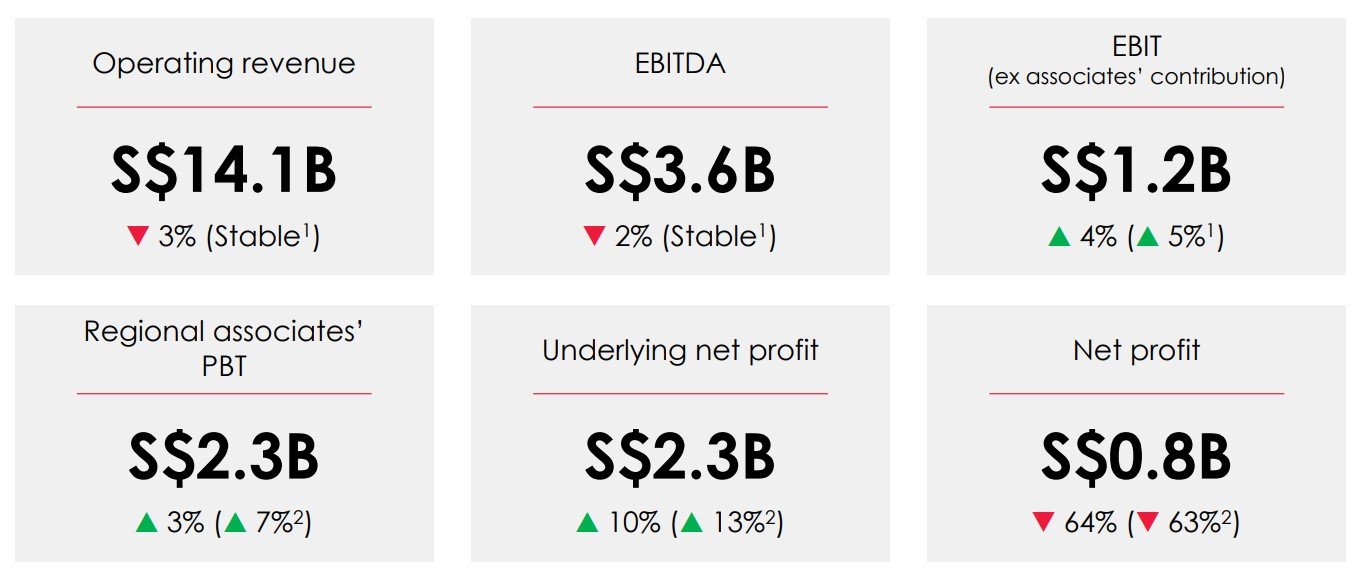

Singtel share price has been doing very well year to date with its share price up more than 28%. For FY 2024, Singtel reported a decent set of results.

Operating revenue is down 3% to S$14.1B while underlying net profit is up 10%. Balance sheet remain strong with net debt to EBITDA of 1.3X while interest cover is 17.8x. Singtel declared a total of 15 cents for FY2024 and is expected to grow further.

Singtel next phase of growth will be to capitalise on growth trends and reallocate capital and this will support its share price going forward. Hence, Singtel should be one of the 4 blue-chip stocks offering an attractive mix of growth and dividends. You can view the company website here.

Haw Par Corporation

Haw Par share price has seen its share price rose from its low of 9.50 and is more than 6% year to date. For half year ended 30 June 2024, Haw Par reported revenue increase by 6.3% to S$118.1 million while net profit is up 17.1% to S$122 million.

Haw Par balance sheet remains very strong and is in net cash position. Haw Par declared an interim dividend of 20 cents a share. You can view the company website here.

DBS Group Holdings

DBS share price has done well this year. Its share price is up more than 22% year to date. In its half year ended 30 June 2024, DBS reported a good set of results.

DBS reported 2nd quarter net profit is 4% YoY to S$2.8o billion with ROE of 18.2%. Commercial book total income is up 9% to S$5.3 billion. NPL ratio remains low at 1.1%.

DBS declared an interim dividend of 54 cents per share for the 2nd quarter of 2024. DBS expects net interest income growth to be mid-single digit percent while commercial book non-interest income growth to be in mid-to-high teens.

Hence, DBS definitely qualifies as one of the 4 blue-chip stocks offering an attractive mix of growth and dividends. You can view the bank website here.

Sembcorp Industries

Sembcorp Industries is a leading renewables player and an established industrial and urban solutions provider in Asia. Its business include gas and related services, renewable energy, integrated urban solutions and decarbonisation solutions.

For 1H2024, Sembcorp Industries posted a turnover of S$3.2 billion and group net profit before exceptional items (EI) of S$532 million. Sembcorp has a net debt of S$7.2 billion.

Sembcorp announces an interim dividend of 6.0 cents per share which is an increase of 1.0 cent from the previous year. Sembcorp full year net profit before exceptional items is expected to be fairly stable.

The Group is well-positioned to navigate the path of energy transition and grow its renewables portfolio. Hence, Sembcorp should be one of the 4 blue-chip stocks offering an attractive mix of growth and dividends. You can view the company website here.

Conclusion

These are the 4 blue-chip stocks offering an attractive mix of growth and dividends. However, when recession hit US next year which will definitely happen. the growth of these stocks may falter too. Hence, investors need to do their due diligence before investing.