If you are looking for stability when investing, blue-chip stocks are stocks that can provide steady capital appreciation and dividends for the long term.

These stocks usually has a long track record of operating even during economic recessions. Here are 3 undervalued blue-chip stocks that you could consider.

City Developments Limited

City Developments Limited (CDL) is a leading global real estate company with a network spanning 163 locations in 29 countries and regions. The company business include residential, commercial, hospitality and fund management.

Its income-stable and geographically diverse portfolio comprises residences, offices, hotels, serviced apartments, student accommodation, retail malls and integrated developments.

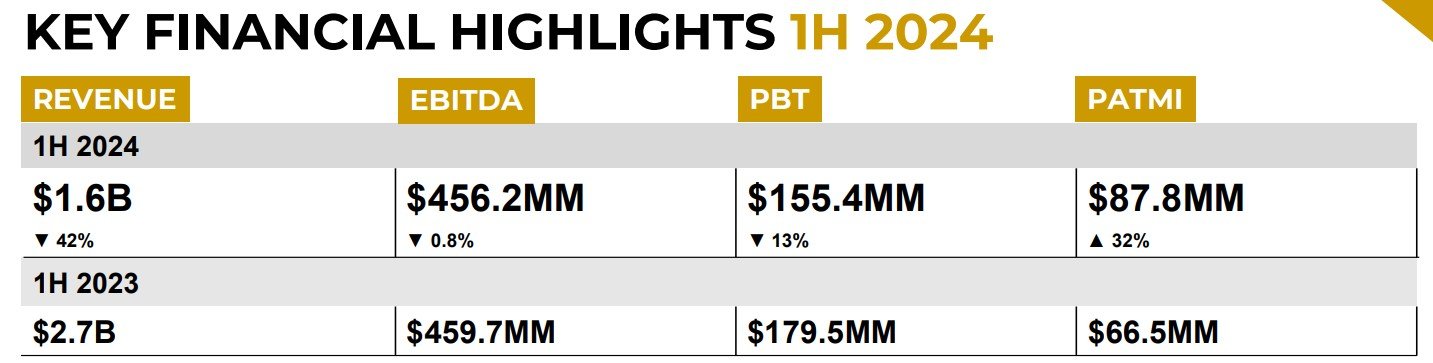

CDL reported its half year results on 14 August 2024. Revenue is down 42% to S$1.6B while EBITA is down 0.8% to S$456.2 million. However, PATMI is actually up 32% to S$87.8 million.

Revenue in 1H 2024 declined due to lower contributions from the property development segment. In 1H 2023, revenue was boosted by the full revenue recognition of $1B for the Executive Condominium (EC) project, Piermont Grand.

PATMI increased by 32%, supported by divestment gains as part of the Group’s capital recycling efforts. Notably, 1H 2023 profits included the full profit recognition of the completed EC project, Piermont Grand.

CDL NAV is S$10.12 which translate to a Price to book ratio of 0.51 which is considered low based on historical data.

With 78% of 512 units sold since January 2024 launch of Lumina Grand, strengthened development pipeline with GLS site acquisition at Zion Road and awarded collective sale tender for Delfi Orchard, of which the Group owns 84% of 150 units, CDL could be one of the 3 undervalued blue-chip stocks that you could consider. You can view the company website here.

DFI Retail Group Holdings

DFI Retail Group is a leading Asian retailer. The Group operates under a number of well-known brands across food, convenience, health and beauty, home furnishings, restaurants and other retailing. DFI Retail Group is a member of the Jardine Matheson Group.

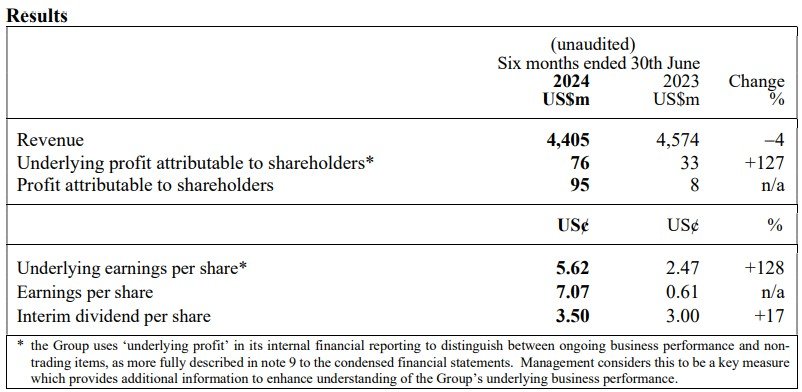

DFI reported its half year results on 1 August 2024. Revenue is down 4% to US$4.4 billion. However, underlying profit attributable to shareholders is up 127% to US$76 million.

This is due to good underlying profit growth in the Food & Convenience segment and robust profit contribution from Health and Beauty segment. DFI increased it half year dividend per share from US3.0 cents to US3.50 cents.

With its diversified business portfolio, strong brand equity, a sharpening focus on operating efficiency and revamped digital strategy, DFI is well-positioned to deliver sustained, profitable growth and shareholder returns in the long term.

DFI reiterates its guidance for 2024 underlying profit attributable to shareholders to be between US$180 million and US$220 million. DFI share price is up only 1.28% year is could poised for further upside.

Hence, DFI could be one of the 3 undervalued blue-chip stocks that you could consider. You can view the company website here

Jardine Matheson Holdings

Jardine Matheson is a diversified Asia-based group founded in China in 1832. JMH portfolio of market-leading businesses represents a combination of cash generating activities and long-term property assets.

JMH operate principally in China and Southeast Asia in a wide range of businesses in major sectors, including motor vehicles and related operations, property investment and development, food retailing, health and beauty, home furnishings, engineering and construction, transport services, restaurants, luxury hotels, financial services, heavy equipment, mining, and agribusiness.

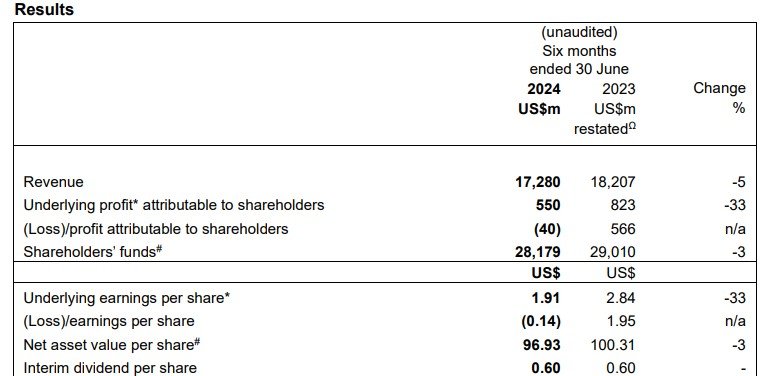

JMH reported its half year results on 1 August 2024. Revenue is down 5% to US$17.2 billion. Underlying profit attributable to shareholders is down 33% to US$550 million.

JMH delivered weaker results in the first half of 2024, impacted by impairments in Hongkong Land’s Chinese mainland Development Properties business and challenging market conditions in Indonesia and Vietnam.

Dividend declared remain unchanged at US$0.60 per share. NAV dipped slightly to US$96.93 which translate to a low Price to Book ratio of only 0.42 which is considered in terms of valuation.

Hence, it could be one of the 3 undervalued blue-chip stocks that you could consider putting in your watchlist. However, investors need to be aware that undervalued blue-chip stocks can remained undervalued for a very long time. You can view the company website here.