REITs have fallen out of favour with investors due to rising bond yield affecting REITs DPU. The persistent high treasury yield led to depressed REITs share price year to date.

Despite these challenges, CapitaLand Integrated Commercial Trust, Frasers Centrepoint Trust and First Real Estate Investment Trust have all shown commendable share price performance.

Although REITs share price has rebounded recently, the share price remained depressed. Amid this negative sentiment, there are 3 top Singapore REITs that are well-managed and could be a great opportunity for investors seeking long-term dividends.

You may wish to consider these 3 top Singapore REITs to be added to your watchlist.

Frasers Centrepoint Trust

Frasers Centrepoint Trust (FCT) has assets under management of approximately S$7.0 billion. FCT is one of the largest suburban retail mall owners in Singapore.

Its Singapore retail portfolio include Causeway Point, Century Square, Hougang Mall, NEX (effective 50.0%-interest), Northpoint City North Wing (including Yishun 10 Retail Podium), Tampines 1, Tiong Bahru Plaza, Waterway Point (effective 50.0%-interest) and White Sands.

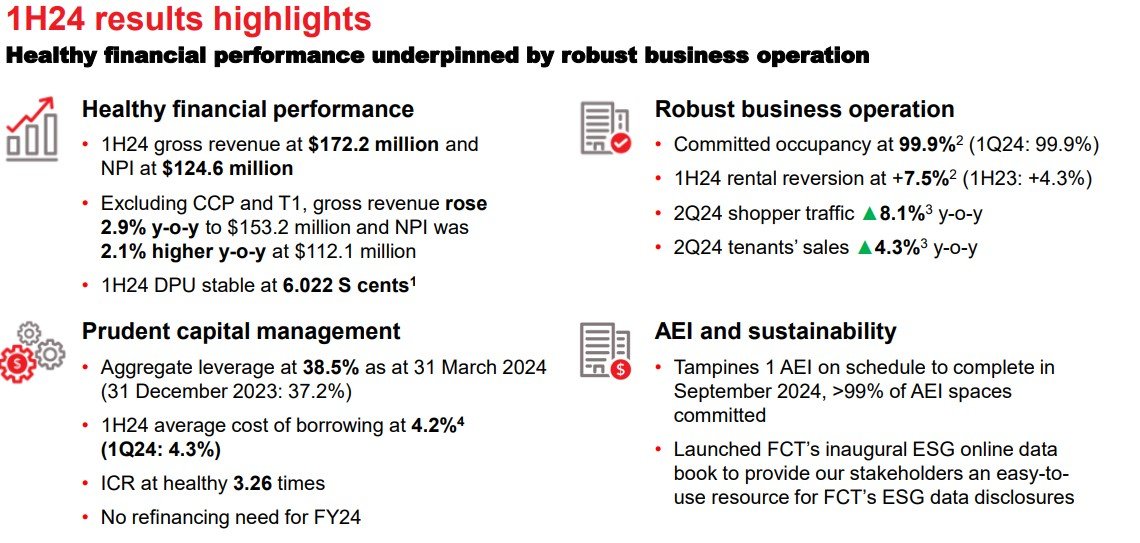

In its half year results ended 31 March 2024, FCT reported net property income of S$124.6 million while DPU is stable at 6.022 cents. Occupancy is at 99.9% which is very healthy while f. irst half rental reversion is a positive 7.5%

Gearing ratio is at 38.5% while interest coverage ratio is at 3.26 times. Borrowing cost for 1H24 is at 4.2%. There is no refinancing need for FY24.

FCT share price is down 2.19% year to date which in my opinion has proven to be very resilient. FCT being the largest suburban mall with tenants mostly in groceries and food will continue to be resilient in future.

Hence, FCT could be one of the 3 top Singapore REITs to consider now. You can view the REIT website here.

CapitaLand Integrated Commercial Trust

CapitaLand Integrated Commercial Trust (CICT) owns properties used for commercial (including retail and/or office) purpose, located predominantly in Singapore.

CICT’s portfolio comprises 21 properties in Singapore, two properties in Frankfurt, Germany, and three properties in Sydney, Australia with a total property value of S$24.5 billion based on valuations of its proportionate interests in the portfolio as at 31 December 2023.

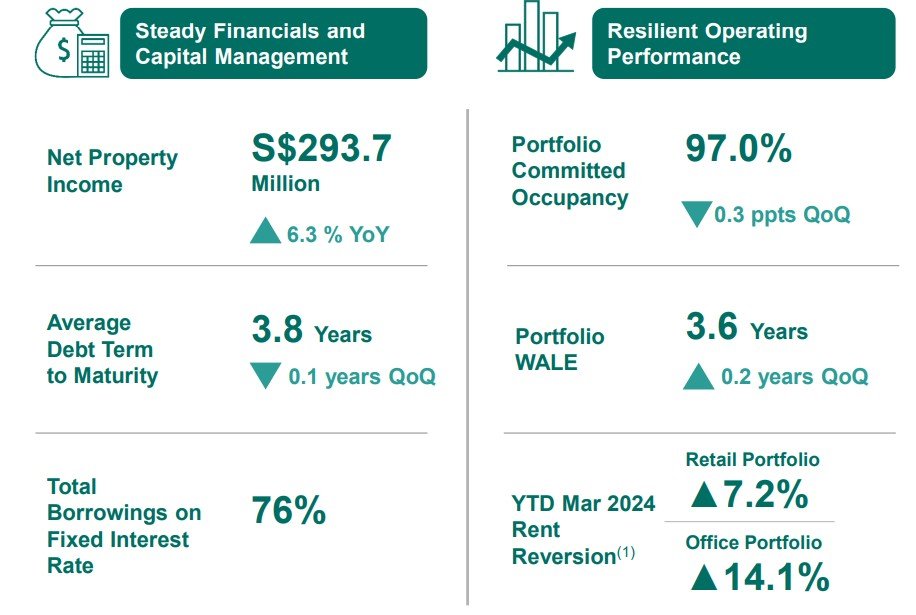

In the latest business update for 1Q 2024, CICT reported net property income up 6.3% to S$293.7 million. Portfolio occupancy is 97.0% with positive rental reversion of 7.2% for the retail portfolio and 14.1% for the office portfolio.

Gearing ratio is at 40.0% with 76% of the debts are on fixed rates. Average cost of debt is 3.5% while interest coverage is at 3.1 times. CICT put up a commendable performance year to date with share price edge out a small gain of 0.49%.

With a strong first quarter financial performance, CICT should be one of the 3 top Singapore REITs to consider now. You can view the REIT website here.

First REIT

First Real Estate Investment Trust (First REIT), owns a portfolio of healthcare and healthcare-related properties. The REIT has a portfolio of 32 properties across Asia, with a total asset value of S$1.14 billion as at 31 December 2023.

These include 15 properties in Indonesia comprising 11 hospitals, two integrated hospitals & malls, one integrated hospital & hotel, and one hotel & country club; three nursing homes in Singapore; and 14 nursing homes in Japan.

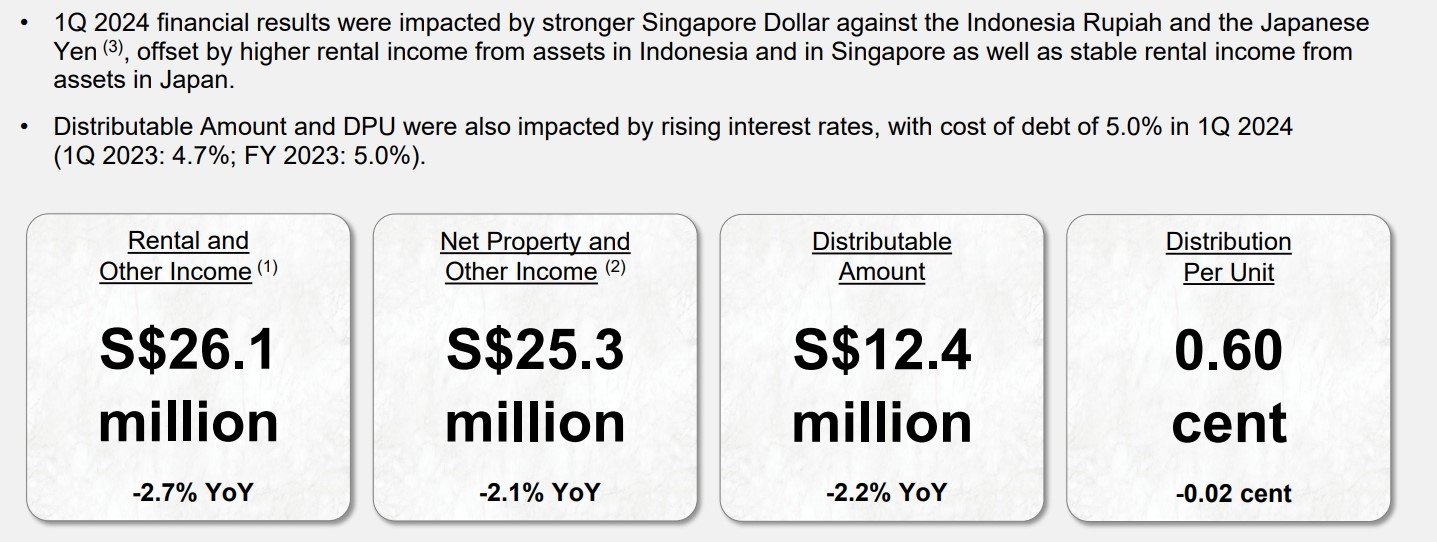

For 1Q 2024 business update, First REIT reported net property income down by 2.1% to S$ 25.3 million while DPU dropped by 0.02 cent to 0.60 cent.

The dropped income and DPU were impacted mainly by stronger Singapore Dollar against the Indonesia Rupiah and the Japanese Yen. Gearing ratio is at 38.8% while interest coverage ratio is at 4.0 times.

87.1% of the debts are on fixed rates while cost of debt is at 5.0%. Despite not having a strong sponsor, First REIT is able to punch its weight with share price down just 3.85%.

On the other hand, some bloggers recommend Mapletree Pan Asia Commercial Trust stating that it has a strong sponsor and DPU increase. However, its share price has proven otherwise.

First REIT is in the resilient healthcare business and hence could be one of the 3 top Singapore REITs to consider now. You can view the REIT website here.

Conclusion

These are the 3 top Singapore REITs you can consider putting in your watchlist. As US is most likely enter into a recession next year and 2026, it is imperative for investors to focus on REITs in the resilient business.

However, investors need to do their due diligence before investing in any REIT.