With all the upheaval in world stocks market, upcoming rate hikes and potential recession, many companies have started to tighten their purse strings and even conducted massive layoffs.

Amidst all the gloom and doom, there is still another way to “foresee” that the company’s management has faith in the own company through insider buying.

Here are 3 stocks where the company’s top brass have been buying back its own shares.

Stock #1 – Centurion Corporation Limited

Centurion Corporation Limited owns and manages quality:

- Purpose-Built Workers Accommodation assets in Singapore and Malaysia, and

- Purpose-Built Student Accommodation assets in Australia, South Korea, UK and the U.S.

As at 31 December 2021, the Group’s portfolio of 36 operational accommodation assets comprises approximately 79,713 beds.

Centurion’s established portfolio of workers accommodation assets are managed under the “Westlite Accommodation” brand.

It comprises 9 workers accommodation assets in Singapore as well as 8 workers accommodation assets in Malaysia.

The Group’s student accommodation assets are managed under the “dwell” brand, with 10 assets in the UK, two assets in Australia and one asset in South Korea.

For its latest 1Q FY2022, Centurion’s revenue increased by a remarkable 47% YoY to S$45.1 mil attributable to the 3 reasons below:

- New PBWA capacity and revenue streams that came into operations

- Improved performance in Singapore PBWA accommodation assets

- Recovery of occupancies in UK and Australia PBSA portfolio

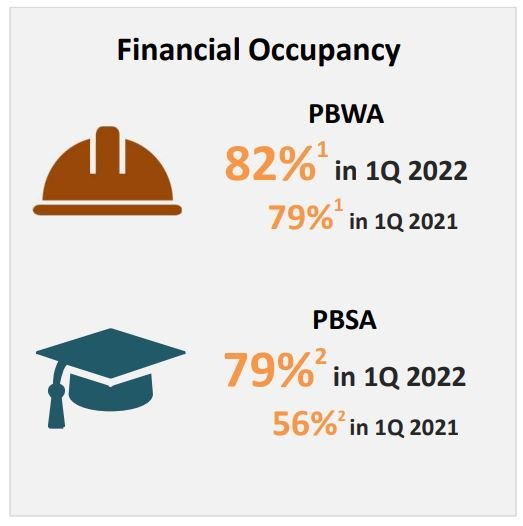

Occupancy rates have also rebounded strongly as Covid-19 fears subside and there is an uptick of migrant workers and international students.

That said, there’s still room for growth to reach full occupancy, ~20% to be exact. In addition, free cash flow for its whole year 2021 was also positive at $43.4 million – demonstrating the steady cashflow offered by the rental properties.

On that note, CEO David Loh has acquired more than 2 million shares of Centurion from 20th May to 22 Jun 2022. The trades were mainly transacted between S$0.350-0.355 per share and have increased the total deemed interest of David from 55.35% to 55.42%.

Centurion Corp last closed at S$0.35 which values it at a P/B ratio of 0.44x and an estimated dividend yield of 1.41%.

Stock #2 – Silverlake Axis

Silverlake Axis (Silverlake) is the market leader in core banking software in ASEAN.

It deploys its proprietary software to major organizations in the banking, insurance, payments, retail, and logistics industries.

According to the BT article, Silverlake Axis has many renowned Asean banks as its customers, including Singapore’s OCBC and UOB, as well as CIMB, Bank Raya and Siam Commercial Bank.

As of its 9M FY2022, the firm’s sales increased by 18% YoY to RM530.4 million, contributed by strong growth in new project licenses and professional services.

Its net profits followed suit, growing 27% to RM134.8 million. On top of that, it boasts of a strong cash balance of RM492.65 million as of the half year mark.

Apart from offering banking solutions, the company ventured into the insurtech space by launching Fermion Group in February 2022.

Fermion works with about 150 insurance companies by offering data as well as end-to-end digital engagement solutions, such as customer onboarding, claims, and renewals.

Fermion came about the combination of 2 existing companies:

- Merimen, which first started offering software-as-a-service for the motor insurance industry and

- Cyber Village, which provides digital engagement solutions for financial institutions.

On 17th June 2022, CEO Goh Peng Ooi takes his insider buying to the next level by acquiring 28.738 million shares for an eye-popping consideration of S$9.2 million.

At an average price of S$0.32 per share, this effectively increased his total interest in the company to 74.20%.

Silverlake Axis last closed at $0.385 which values it at a trailing P/E of 18.8x and a dividend yield of 1.37%.

Stock #3 – Propnex Group

Propnex is an integrated real estate services group and provide market-leading services in real estate brokerage and project marketing.

It saw a growth of 26.4% in the number of salespersons from 8,918 as at 1 Jan 2021 to 11,268 as at 11 Apr 2022.

In March 2022, PropNex launched the Chinese version of PropNex’s official website and is also ramping up content creation on Chinese social media platforms such as WeChat (@博纳产业 PropNex).

These moves will expand its reach to the mainland Chinese audience and offer Mandarin-speaking users more local real estate content on the platform.

As its latest quarterly report, Propnex’s revenue increased slightly by 9.5% to $241.6 million. Its net profit however decreased slightly by 8.0% to $14.86 million. This was at the back of higher staff costs, likely due to continued expansion of the company.

Cash flow from operating activities came in at $21.9 million. Cash balance of the company increased to an incredible $161.91 million, testament of its asset light business model.

From 24th May 2022 onwards, Propnex Executive Director Kelvin Fong has acquired 451,000 shares of the company for a consideration of S$674,800 at a price between $1.58 – $1.71.

This increased his total interest in the from 8.64% to 8.73%.

Propnex last closed at $1.52 which values it at a P/E of 9.5x and a dividend yield of 8.22%. Investors should take note that the record high dividend yield was probably due to a housing boom post-Covid.

Billionaire Warren Buffett is arguably the most successful investor of all time.

Learn the secrets to Warren Buffett’s investment success by downloading the Free Guide below: