In times of great uncertainties and volatilities, investors tend to have a stronger preference for companies with large cash holdings in their balance sheets.

Because cash is the most liquid form of assets available, it can immediately be utilised for business activities ranging from settling monthly expenses to business expansion.

In essence, cash does not only provide a company with the necessary resources to pay off its debts when required but at the same time allows it the flexibility to embark on short-term investment opportunities or acquisitions.

On that note, strong cash flow or large cash holdings are often cited as a critical factor for the long-term success of businesses.

As the often-quoted saying “Cash is King” so aptly points out, businesses without sufficient cash on hand or depend heavily on credit have higher chances of facing cash flow issues or may even be forced into bankruptcy. As such, we take a look at three companies with huge cash piles.

Nobel Design Holdings – $0.60 Cash, Priced At $0.45

Nobel Design Holdings (Nobel Design) is a renowned furniture retailer mainly involved in the distribution and retailing of design furniture and fine imported European home furnishings, provision of interior design services for homes and commercial projects, as well as engaging in supply chain management bringing contemporary and classical furniture to major retailers in the United States of America (USA).

The group has business operations primarily in Singapore, USA, Malaysia and Brunei. Nobel Design’s core businesses are broadly classified into two business segments, namely its interior and furniture segment and also its supply chain segment.

From the group’s latest FY16 results, the former contributed 36.9 percent while the latter contributed 63.1 percent towards its FY16 total sales respectively.

Nobel Design Holdings Ltd in Singapore

From Nobel Design’s FY16 results, we also understand that the group’s revenue climbed 9.4 percent to $92.6 million, mainly attributable to improved sales of 18.4 percent in its supply chain division selling to the US market.

However, this is offset by lower recorded sales within its interior and furniture segment in line with the slow-down in Singapore’s residential property market segment.

Overall net profit dropped by 5.1 percent to $17.2 million primarily because of the start-up losses from newly opened Ibis Styles Hotel at Macpherson, the loss of rental from an anchor tenant at Tai Seng, as well as impairment provision for the UK development site.

Although Nobel Design’s profitability seems less than impressive, we are particularly excited about the group’s strong balance sheet.

As at 31 December 2016, Nobel Design was holding a total of $134.8 million of cash and bank balances, with $9 million of borrowings and $87,000 of obligations under finance leases.

This translates to a net cash position of $125.8 million, or equivalent to $0.58 per share. With Nobel Design’s last market price at $0.455 as of 10 April 2017, its current net cash as a percentage of share price stands at an irresistible level of 127.5 percent.

In other words, you can literally get almost $1.30 of cash for every dollar of Nobel Design’s shares which you purchase.

CDW Holding – Jumping onto The Semiconductors Bandwagon

According to the data released by Singapore Economic Development Board on 24 March 2017, Singapore’s manufacturing output in February 2017 rose 12.6% year-on-year, underpinned by strong growth in the electronics and precision engineering clusters.

Output of the electronics cluster jumped 39.8% mainly due to robust growth of 63.6% in the semiconductors segment. Meanwhile, output of the precision engineering cluster also expanded 26.2% attributable to higher export demand for semiconductor-related equipment.

Healthy growth in the semiconductors industry inadvertently helps to lift the stock price performance of relevant counters.

Specifically, we saw UMS Holdings’ share price rally from $0.61 on 3 January to $0.885 as of 10 April giving us a year-to-date (YTD) return of 45.1 percent, while Valuetronics Holdings registered a 49 percent YTD return surging from $0.52 to $0.775.

With its share price barely moved staying at $0.25 since the start of this year, CDW Holding (CDW) seems to lag far behind in comparison with the performances of its peers.

CDW is a Japanese-managed precision components specialist focusing on the production and supply of niche precision components for mobile communication equipment, gamebox entertainment equipment, consumer and information technology equipment, office equipment as well as electrical appliances.

With production centres and offices located within key industrial and commercial areas including Shanghai, Jiangsu, Dongguan, New Territories, Osaka and Kagawa, the group’s products are mainly sold to large Japanese corporations in the PRC and Hong Kong.

CDW’s core businesses are categorised into three main segments, namely LCD backlight units, LCD parts and accessories and office automation, each contributing 57.3%, 21.4% and 20.4% to the group’s FY16 revenue respectively.

Image taken from CDW Holding’s company website

From its latest financial results, CDW’s FY16 revenue slid 12.6 percent to US$103.2 million, mainly due to the group’s main customer continuing to place few orders as a result of it losing market share in the smartphone segment.

Coupled with the absence of an exchange gain from the disposal of a subsidiary in FY15, overall net profit plunged 94.9 percent to US$0.4 million.

Nevertheless, CDW continues to uphold a strict low gearing policy which leads to low finance costs kept under US$0.1 million.

As at 31 December 2016, the group has cash and bank balances of US$45 million, with total bank borrowings of US$6 million and obligation under finance leases of US$81,000.

This translates to CDW’s net cash position of US$38.9 million, or an equivalent of $0.23 per share.

In comparison to CDW’s last traded price of $0.25 as of 10 April, net cash as a percentage of share price stood at an elevated level of 92 percent.

Hai Leck Holdings – Large Cash Holdings with A High Yield

Established in 1975, Hai Leck Holdings (Hai Leck) is one of the leading companies that provide engineering, procurement and construction services to the oil and gas and petrochemical industries.

The group has presence in Singapore, Malaysia and Thailand, and its principal activities include structural steel, piping and plant equipment installation, maintenance and repairs, scaffolding erection services, thermal insulation services, fireproofing services as well as general civil engineering services.

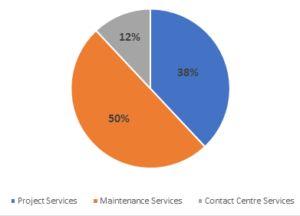

Hai Leck operates through three business segments namely project services, maintenance services and contact centre services, which as at 30 June 2016 contributed 38%, 50% and 12% to the group’s FY16 revenue respectively.

In 1H17, Hai Leck’s revenue inched up marginally by 1.9 percent to $46.9 million, mainly due to higher revenue contribution from its maintenance segment. Together with lower cost of sales and operating expenses, overall net profit jumped 39.4 percent to $4.8 million.

As at 31 December 2016, Hai Leck had cash and cash equivalents of $69.9 million, with $216,000 of finance lease obligation and zero debt. This effectively means Hai Leck had a net cash position of $69.7 million, or $0.34 per share. Comparing that with Hai Leck’s last traded price of $0.58 as of 10 April, net cash as a percentage of share price stood at an appealing level of 58.6 percent.

Apart from the large cash holdings, we are also attracted to its relatively high dividend payout, which distributed $0.05 per share in both FY16 and FY17. Should Hai Leck continue to maintain its current payout, the dividend yield for its share would be pretty tempting at 8.6 percent.

Conclusion

While we all cannot agree more that excessive debts is a bad thing for companies, but does it follow that huge cash piles are necessarily reflective of a good corporate performance?

Despite offering protection against the unexpected and thus putting cash-rich companies at an advantageous position, critics often have differing views citing reasons such as whether management is fully utilising its available resources, and if the extra cash could be put to better use.

Sitting on cash incurs an opportunity cost, and often signals the lack of investment opportunities for business expansion. If that is the case, returning the cash back to shareholders could be a better option instead of earning negligible interest from the banks in today’s low-interest rate environment.

That said, whether a large cash hoard is a boon or a bane for a company remains a well-discussed topic among analysts and investors alike, and as to how investors interpret cash reserves should ultimately be dependable on the business cash flows, nature of the business and its cycles, as well as future capital expenditures plans.

This article first appeared on SharesInv.com.

Fancy an Ebook that teaches you the hallmarks of multi-bagger stocks and how to find them? Simply click here to receive your copy of a brand-new FREE Ebook titled – “100 BAGGERS” by Christopher W. Mayer today!

Last but not least, do remember to Like us on Facebook too as we share the latest investing articles and stock case studies for you!