Oh my! Are we heading into a global recession in 2023?

Two-thirds of economists surveyed in the World Economic Forum predict that there will be a global recession in 2023.

Global interest rates are high, while high commodity prices last year are feeding into business costs this year.

Singapore, in particular, is vulnerable to a downturn in the global economy. After all, exports account for about 185% of the gross domestic product in 2021.

Going for Stable aka Low-Beta Stocks

On this note, it may make sense to gun for low-beta stocks to weather the possible recession. Beta means the volatility of the stock compared to the overall market. A beta value that is less than 1.0 means that the security is theoretically less volatile than the market.

The lower the beta, the less sensitive it is to the overall market and a possible recession. For example, utility stocks often have low betas because they tend to move more slowly than market averages.

In this article, we take a look at 4 Singapore stocks with a beta lower than 0.5x and market capitalization >S$ 1 billion.

#1 Bukit Sembawang

Bukit Sembawang Estates Limited (BSE) is first on this list with only a beta of about 0.12x (wow!) and a market capitalisation of SGD1.1 billion.

BSE focuses on property development, investment, and other property-related activities.

BSE can be divided into 3 broad segments in which it is operating – property development, investment holding and hospitality.

Property development is the bread and butter of BSE, encompassing about 96.5% of its revenue and 87.3% of profits in 2022.

Meanwhile, hospitality services (which is basically the management of serviced apartments), generates about 3.2% of revenue but consists of 11.6% of profits.

However, investors need to take note that the higher profits were driven by a non-cash valuation gain of around S$13.4 million. If we take this into consideration, the hospitality segment would have made a loss of S$2.3 million.

BSE’s overall financial performance is dependent on the cycle of launch, sell and build properties. That means there will be certain years when there are no launches, BSE’s revenue and profits might suffer momentarily.

To give some context, BSE generated about SGD395 million on average from 2014 to 2015, but revenue subsequently declined to an average of SGD175 million from 2016 to 2018.

However, average revenue from the years of 2019 to 2021 roared back up to SGD436 million.

As revenue is declining back down again in 2022, this could just a be another cycle again before revenue regains again in the next 2 to 3 years.

That being said, the group has an undervalued land bank of over 240,000 sqm slated for coveted landed homes. That’s enough inventory to sell for the next decade, with the land pegged at extremely low historical costs.

In addition, the group’s strategy to pivot towards recurring income via investment properties is a nice call given the high i/r environment. On the valuation front, BSE is trading at around 0.7x compared to its historical average of 0.94x.

#2 AEM Holdings

Once a stock market darling, AEM Holdings has fallen out of favour from investors and its beta stands at 0.39x currently, with a market capitilization of ~S$1.0 billion.

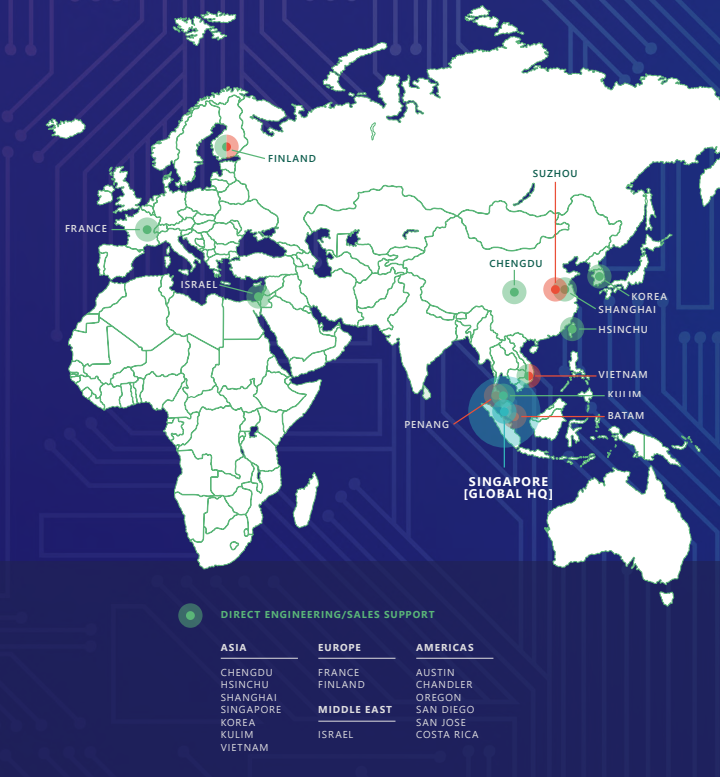

AEM provides testing and design services to semiconductor and electronic companies serving advanced computing, 5G and AI markets.

AEM’s business can broadly be divided into 3 main segments which are

- test cell solutions (TCS),

- instrumentation (INS), and

- contract manufacturing (CM).

To cut through the technicalities, test cell solutions is catered towards manufacturers to test their products before bringing to market, while instrumentation is for research and development services.

Contract manufacturing is for other manufacturers to utilise AEM’s facilities to produce electrical and electronic products.

TCS is the main driver of AEM’s business, consisting of 78.4% of revenue in 2022 – an increase from 76.8% in 2021.

CM comes next at about 20.7%, where this business segment has used to account for 22.5% in 2021. It seems there’s a shift for AEM towards TCS businesses.

It makes sense for AEM to focus on TCS as the profit margin is much higher at 19.7% compared to CM (9.1%).

In its overall financial performance AEM’s growth has been strong. Revenue grew by 42.2% from SGD565 million in 2021 to SGD870 million in 2022, driven mainly by its TCS business segment that grew by 57.2%. Likewise, profits grew by 38.2% to SGD127 million.

There is one thing to note about AEM’s geographical revenue and exposure.

Both Malaysia’s and Costa Rica’s revenue have almost doubled in 2022 from 2021, where the proportion of these 2 countries are 28.8% and 24.7% respectively.

The developments in these countries will be important to consider for AEM.

AEM is currently trading at a reasonable P/E ratio of 8.0x compared to the historical average of 12.0x as well as the Asian Semiconductor industry average of 21x!

Most market analysts have AEM at an OVERWEIGHT investment call with a average target price of SGD3.54 and an implied upside of 7.5%.

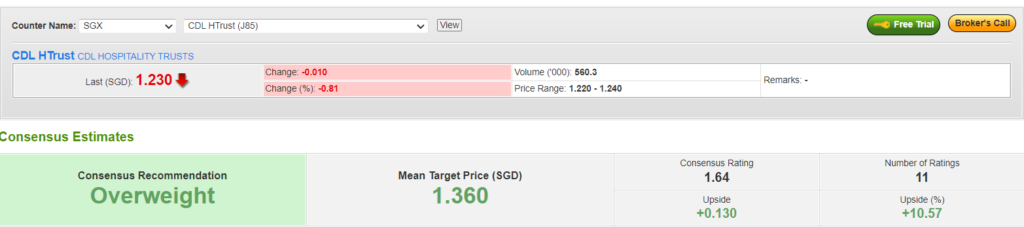

#3 CDL Hospitality Trusts

CDL Hospitality Trust (CDLHT) is currently trading at a beta of 0.43x, and has a market capitalization of S$1.5 billion.

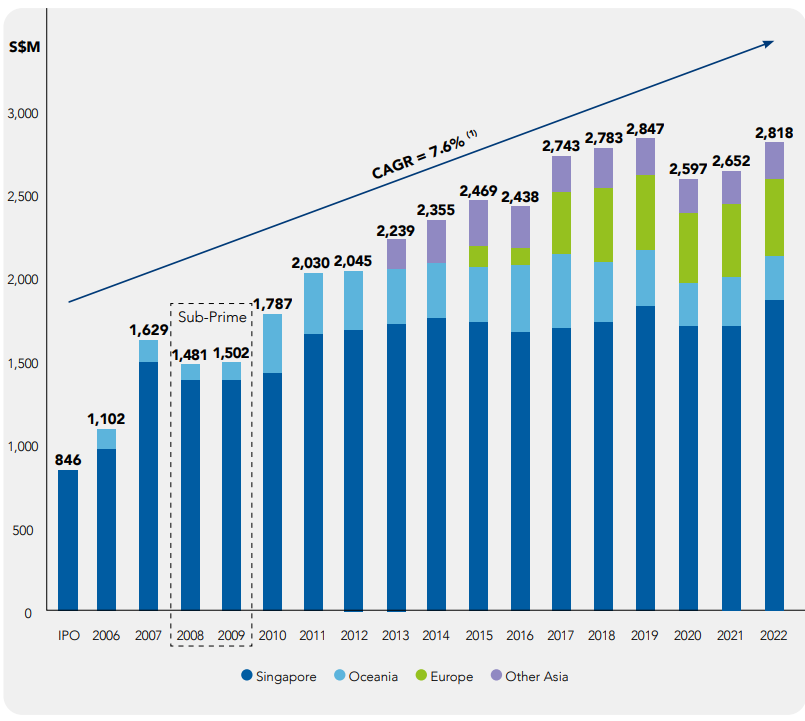

A quick background: CDLHT is a real estate investment trust mainly involved in the investments and management of hospitality assets such as hotels, serviced apartments, motels, student accommodations and other lodging properties.

Other than that, it also currently manages about SGD3.1 billion in assets, which consists of 16 hotels, 2 resorts, and 1 retail mall and spans countries such as Singapore, Maldives, Japan, Australia, New Zealand and Europe.

Its fair valuation of its assets have recovered back to its pre-pandemic levels after declining during the pandemic.

CDLHT’s portfolio is still mainly driven by its Singaporean properties at 66.3% of total valuation. European assets come in second at 16.6%, followed by Australia and New Zealand (9.5%).

In terms of contribution to revenue, Singapore still came in first at about 51.9% of total revenue, followed by Europe (24.0%) and Australia & New Zealand (12.2%).

It seems like the recovery in Singapore is in full swing, as revenue almost doubled from SGD68 million to SGD119 million.

CDLHT might be paying more attention to its Singaporean assets as the country yields the highest gross profit margin at around 64.4% compared to Europe (43.9%), and Australia & New Zealand (48.1%).

CDLHT’s revenue have grown by 45.4% in 2022, driven mainly by the higher contribution from its Singapore and European segments.

Net profit has also nearly doubled from S$41 million in 2021 to S$70 million in 2022, not taking the consideration of a gain in valuation of its investment properties of S$130 million.

A better way could be to look at the operating cash flow of CDLHT. Operating cash flow doubled from S$63 million in 2021 to S$116 million in 2022 – confirming the improvement of CDLHT’s financial performance.

In terms of valuation, CDLHT is trading at a slightly higher P/B ratio of 0.9x compared to its peers average of 0.7x.

Most analysts in the market have an OVERWEIGHT call on CDLHT, with an average target price of SGD1.36 and an implied upside of 10.1%.

CDLHT could be a second look due to its diversified holdings across Japan, Maldives, Australia and New Zealand. The return of Chinese tourists could provide a boost that can offset the impact of the loss in tourism from other countries.

Conclusion

The 3 stocks mentioned above are bigger in size and also less volatile compared to the market index.

All in all, having a defensive mindset in 2023 might not be a bad idea. We do not have a crystal ball to tell whether a recession will happen but it is always best to prepare for one.