Singapore stocks are well-known for investors who are investing for income. These stocks are included by many investors as a form of additional cash flow in addition to their employment income.

Hence, investors need to invest in stable stocks with businesses that exhibit stability and offer a measure of certainty that they can weather various economic cycles.

Stable stocks are great investments as they pay out regular dividends that can form part of an investor’s income portfolio. We lined up 3 stable stocks that could potentially raise their dividends.

Centurion Corporation

Centurion Corporation (Centurion) develops and manages quality, Purpose-Built Workers Accommodation (PBWA) assets in Singapore and Malaysia, and Purpose-Built Student Accommodation (PBSA) assets in Australia, South Korea, the United Kingdom and the United States.

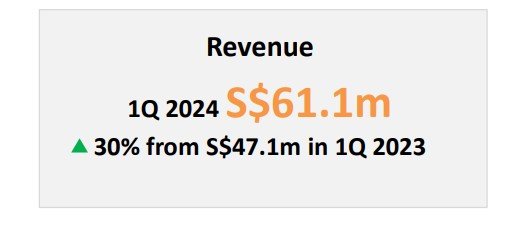

For 1Q 2024 business update, Centurion reported revenue increase by 30% to S$61.1 million. The increase in revenue is due to positive rental reversions across all the PBWAs and PBSAs and healthy and sustained occupancies across all the PBWAs.

Occupancy for PBWA is at 98% while occupancy for PBSA is 97%. Net gearing ratio is at 36% with interest cover of 4.7x. The management is optimistic on the company growth prospects.

Hence, it is a high possibility that the company will declare a higher interim dividend compared to the previous year and could be one of the 3 stable stocks that could potentially raise their dividends. You may wish to view the company website here.

Food Empire Holdings

Food Empire Holdings (Food Empire) is a food and beverage manufacturing and distribution group headquartered in Singapore.

With a portfolio spanning instant beverages, snack food, and a growing presence in food ingredients, Food Empire’s products are sold in over 60 countries across North Asia, Eastern Europe, South-East Asia, South Asia, Central Asia, Middle East, and North America.

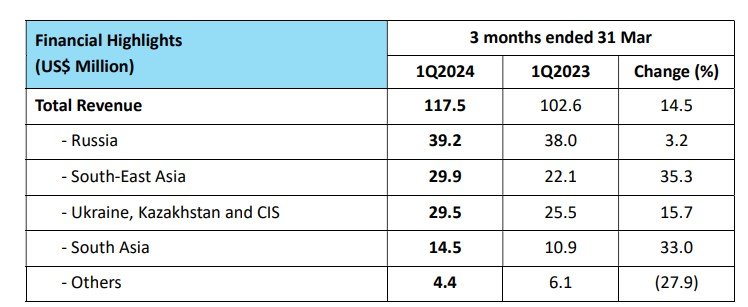

In its 1Q 2024 business update ended 31 March 2024, Food empire reported revenue increase by 14.5% to US$117.5 million. Revenue was lifted by the positive impact of increased marketing and promotional activities in certain markets.

The company expects outlook to be optimistic as it moves ahead with capacity expansion and market penetration efforts to capitalise on increasing brand recognition and consumer acceptance and demand for its products.

The company pays out dividend only once a year. For FY 2023, Food Empire declared a first and final dividend of 5 cents and a special dividend of 5 cents which was higher than the dividend declared in FY 2022.

With capacity expansion in its ingredients business to reinforce its leading position in existing markets, Food Empire is well poised to pay higher dividends in FY 2024. You can view the company website here.

Boustead Singapore

Boustead Singapore (Boustead) was established in 1828 and is a global Infrastructure-Related Engineering and Technology Group. The company main business includes niche engineering and development of key infrastructure to support sustainable shared socio-economic growth.

Its suite of engineering services under our Energy Engineering Division and Real Estate Division centres on energy infrastructure and smart, eco-sustainable and future-ready real estate developments.

In addition, the company provide technology-driven transformative solutions to improve the quality of life for all walks of life. Its Geospatial

Division provides professional services and exclusively distributes Esri ArcGIS technology.

For the full year ended 31 March 2024, Boustead reported revenue increase by 37% to S$767.6 million. Net profit increase by 42% to S$64.2 million. The company has a strong balance sheet and is in a net cash position.

The company declared a dividend of 5.5 cents which is higher than the previous year. Mr Wong Fong Fui, Chairman & Group Chief Executive Officer of Boustead is optimistic on the company Geospatial Division which continues to surpass previous milestones.

This division achieved a new division record for revenue and profitability even in the face of significant currency exchange headwinds. The division also had a record deferred services backlog at the end of FY2024 which will act as growth driver for the company.

Hence, Boustead could be one of the 3 stable stocks that could potentially raise their dividends for FY2023. You can view the company website here.

Conclusion

Other than REITs, investors can look for other stable income stocks that will give consistent and increasing dividends. Investors need to do their due diligence before investing in any of these companies