A good way to look at promising small cap stocks is to observe if their businesses are growing. If the company business keeps growing their business and profits, even though they could be small-caps currently, they might turn into blue-chips in future.

One good example is Venture Corporation. Venture was listed on the Singapore Exchange Securities Trading Limited (SGX) on 27 April 1992 on the SGX Sesdaq (now called Catalist). Can you guess its IPO price then? Haha, I bet you will never guess it. Its IPO price then was S$0.40!

Hence, never look down on small-cap stocks! However, many bloggers and investors will still continue to avoid small-cap stocks.

In this article, I will highlight 3 Small-Cap stocks posting higher profits and determine whether it should be in investors watchlist

CSE Global Ltd

CSE Global is a global system integrator operating in the Americas, Europe, the Middle East, Africa, Asia.

CSE provides state-of-the art, cost-effective total integrated industrial automation, information technology and telecommunication solutions to clients globally in the energy (Oil & Gas/Power), chemical/petrochemical, utilities, water and waste water, healthcare and public sectors.

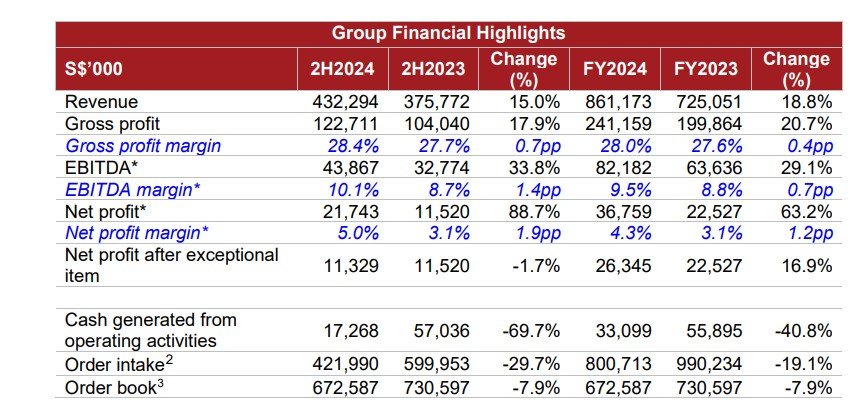

For the full year ended 31 Dec 2024, CSE Global reported revenue grew 18.8% year-on-year to S$861.2 million from S$725.1 million in the previous corresponding period, mainly driven by the Electrification and Automation business segments.

Correspondingly, gross profit increased 20.7% year-on-year to S$241.2 million. Net profit before exceptional items rose 63.2% year-on-year to S$36.8 million. The company declared a final dividend of 1.15 cents per share for 2024.

Together with the interim dividend of 1.25 cents per share paid in 2024, the total dividend payout is 2.40 cents for the full year. This translate to a dividend yield of 5.3%.

The company is well-positioned to benefit from the growing data centre demand in relation to the Electrification and Communications focused strategies. With the acquisition of RFC, the company penetrated the data centre communications market in the USA.

With a robust order book of S$672.6 million as at 31 December 2024, CSE Global is well positioned to achieve a healthy financial performance in 2025. Hence, CSE Global is one of the 3 Small-Cap stocks that you might wish to put in your watchlist. You can view the company website here.

Pan-United Corporation

Pan-United is a global leader in low-carbon concrete technologies catalysing change in the concrete space. Focused on concrete innovation and sustainability, it is one of Asia’s largest producers of low-carbon concrete, backed by world-class inhouse R&D capabilities and advanced digital technologies.

For the full year ended 31 Dec 2024, the company reported revenue increase by 5% to S$812.2 million while net profit increase by 15% to S$41.1 million. Balance sheet remains strong with a net cash position.

The company declared a final dividend of 2.3 cents per share bringing total dividend of 3 cents per share for the whole year. This translate to a decent dividend yield of 4.9%.

The Building and Construction Authority (BCA) projected Singapore’s total construction demand in 2025 to range between $47 billion and $53 billion, compared to its preliminary estimate of $44.2 billion in 2024.

This bodes well for the company and the company remains optimistic for the financial year 2025. Hence. Pan-United is definitely one of the 3 Small-Cap stocks posting higher profits that could be in your watchlist. You can view the company website here.

CNMC Goldmine Holdings

CNMC goldmine is engaged in the business of exploration, mining of gold and the processing of mined ore into gold dores. The Group is currently focusing on the development of its flagship project – the Sokor Gold Field Project which is located in the State of Kelantan, Malaysia.

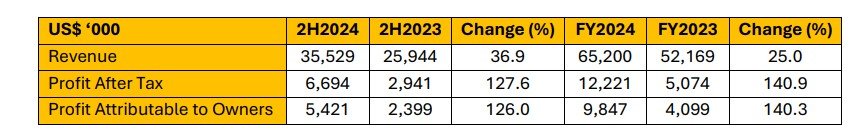

For the full year ended 31 Dec 2024, CNMC goldmine reported revenue rose 25% to US$65.2 million bolstered by higher gold prices and increased sales of lead and zinc concentrates.

The gold producer fetched an average selling price of US$2,661 for every ounce of gold in 2H2024 and US$2,455 in FY2024, substantially higher than the US$1,968 and US$1,960 in the respective corresponding periods a year earlier.

On a pre-tax basis, the Company made a profit of US$17.7 million for FY2024, a new record. Net profit after tax rose 140.3% to US$9.8 million also a record. Balance sheet remains strong and is in net cash position.

The company has declared a final dividend of 0.4 Singapore cent a share and a special dividend of 0.6 Singapore cent a share. Together with an interim dividend of 0.4 Singapore cent a share already paid in September last year, the total payout for FY2024 comes to 1.4 Singapore cents a share.

This translate to a dividend yield of 4.8%. The company is ramping up its production of gold so as to take full advantage of the run-up in gold prices. In addition, the outlook for gold price remain bullish due to geo-political uncertainties and the recent rush by the US to import gold from the vault in London.

Hence, CNMC goldmine is one of the 3 Small-Cap stocks posting higher profits that should be in your watchlist. You can view the company website here

Disclaimer: Please note that the stocks mentioned in this article are not a financial recommendation to buy and investors need to do their own research and due diligence before investing in any of these stocks.