Many investors shun small cap stocks. They definitely do not have a good history such as the 2013 penny stock crash involving blumont. There also other case of pump and dump of penny stocks such as Mid-Continent Equipment in 1998.

Small-cap stocks usually does not pay dividend and they do not have a track record of good profits. However, there are also other small cap stocks which has good profits and growing dividend. One good example is Oiltek which I have written an article on it here.

In this article, I review 3 small-cap stocks that might have explosive gains.

LHN Ltd

LHN Limited is a real estate management services group with the ability to generate value for its landlords and tenants through its expertise in space optimisation.

The Group currently has four (4) main business segments:

- Space Optimisation Business

- Property Development Business

- Facilities Management Business; and

- Energy Busines

The Group has business operations in Singapore, Indonesia, Myanmar, Cambodia and Hong Kong.

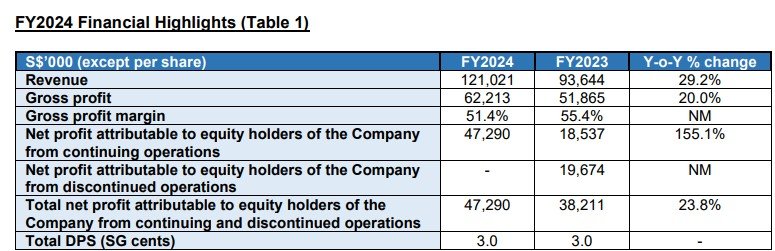

For FY2024, LHN reported revenue increase by 29.2% to S$121 million while net profit is up 23.8% to S$47.2 million. Total dividend for FY2024 is 3 cents per share which translate to a dividend yield of 6.9%!

LHN is poised to capture robust market demand for co-living spaces with its growing number of keys under management. Coupled with its balanced approach to capital recycling, the Group is able to deliver long-term sustainable value to shareholders.

You can view the company website here.

Grand Banks Yachts Ltd

Grand Banks Yachts Ltd is a global brand known for its vast experience in manufacturing and selling luxury motor yachts. Grand Banks is recognized for superior quality and craftsmanship, and has built some of the most highly sought-after yachts available in the market today.

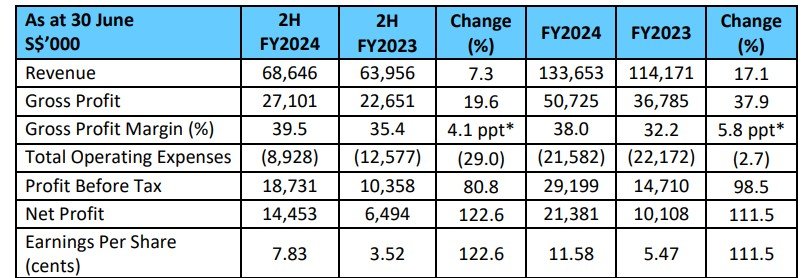

For FY2024 ended 30 June 2024, Grand Banks reported revenue is up 17.1% to S$133.6 million while net profit surge 111.5% to S$21.3 million. Balance sheet remains strong and company is in net cash position.

Grand Banks Yachts declared total dividend of 1.5 cents for FY2024 which is higher than 1.0 cents declared in FY2023. Share price is up 95% year to date. Grand Banks could be one of the 3 small-cap stocks for explosive gains in the future. You can view the company website here.

LMS Compliance Ltd

LMS Compliance has over 15 years of experience in the testing and/or certification business. Their business segments comprise the following:

- Provision of testing and assessment services;

- Provision of certification services;

- Trading of laboratory equipment, laboratory chemicals, and laboratory solutions; and

- Distribution of conformity assessment technology.

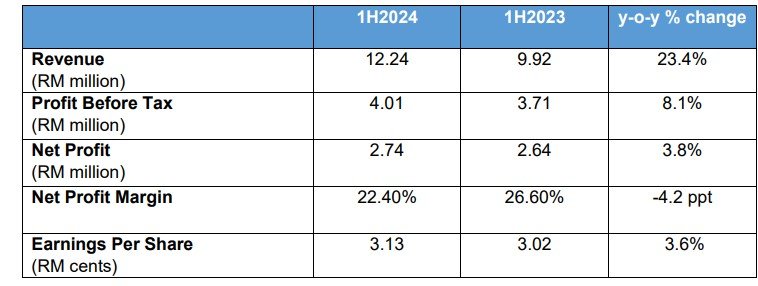

For 1H2024, LMS Compliance reported revenue is up 23.4% to RM$12.24 million while net profit increase by 3.8% to RM2.74 million. Balance sheet remains strong with minimal debt and company is in net cash position.

No interim was declared as company declare dividend once a year. For FY2023, LMS compliance declared total dividend of 1.32 cents.

The Asia-Pacific Testing, Inspection, and Certification (TIC) market is projected to grow at a compound annual growth rate (CAGR) of approximately 5.5% from 2024 to 2029 from S$75.62 billion to US$98.83 billion.

This growth is underpinned by the region’s economic expansion, increasing consumer product consumption, and the robust industrial sector. Hence, this bodes well for LMS compliance and could be one of the 3 small-cap stocks for explosive gains.

You can view the company website here.

In this article, I list out 3 small-cap stocks that have explosive gains. Investors should not generalize all small cap stocks are bad and to be avoided. There are great small cap stocks that are able to generate profits and grow their dividends every year.

Disclaimer: Please note that the stocks mentioned in this article are not a financial recommendation to buy and investors need to do their own research and due diligence before investing in any of these stocks.