Income like REITs as they pay either half-yearly or quarterly dividends. Even though, the 10 year treasury yield has shot up to above 4.5% at the point of writing, income investors are unfazed as income stocks has the joy of receiving cashflow consistently to their bank account.

We highlight 3 Singapore REITs with quarterly dividend payouts to consider for your portfolio

Mapletree Industrial Trust

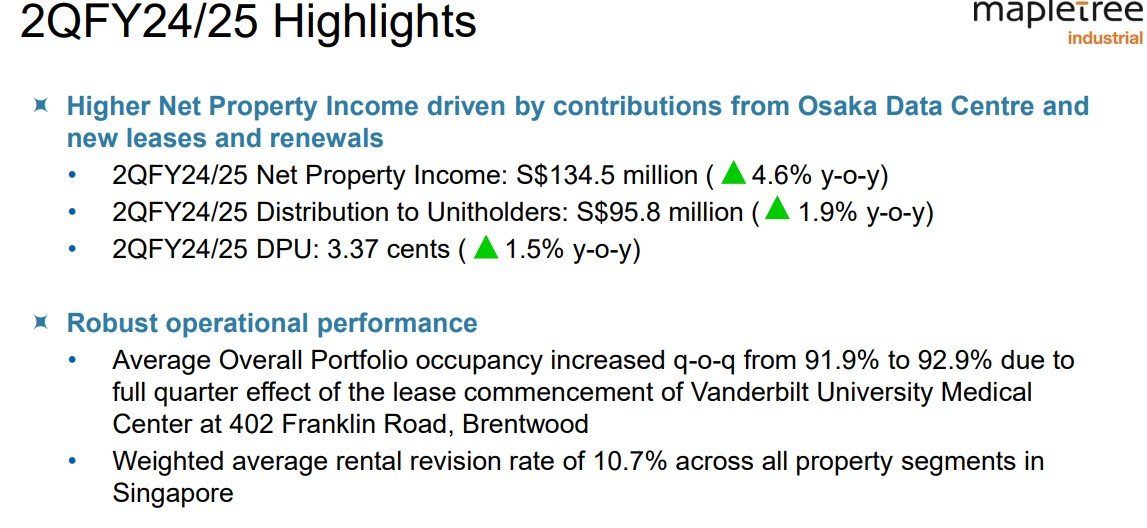

Mapletree Industrial Trust(MIT) reported its 2QFY24/25 results on 29 Oct 2024.

Net property income is up 4.6% y-o-y to S$134.5 million driven by contributions from Osaka Data Centre and new leases and renewals. DPU is up 1.5% to 3.37 cents. Portfolio occupancy is at 91.9% with average rental reversion of 10.7%.

Gearing ratio is at 39.1% with a comfortable interest cover of 4.7 times. MIT share price is down 13.2% year to date. However, it pays quarterly dividend and hence is one of the 3 Singapore REITs with quarterly dividend payouts to consider for your portfolio.

You can view the REIT website here.

First Real Estate Investment Trust

Many REIT investors do not like First Real Estate Investment Trust (First REIT). Firstly. it is a small cap REIT. In addition, some investors may have bad experience in the past regarding First REIT and also First REIT does not have a strong sponsor.

However, First REIT share price has been relatively stable for the past 2 years and is down only 1.92% year to date compared to some big cap such as CapitaLand Ascendas REIT which is down 12.75% year to date.

Hence, First REIT share price performance has proven many investors and bloggers they were wrong.

First REIT reported its 9M FY 2024 business update on 30 Oct 2024. Rental & other income is down 5.3% to S$77.0 million while DPU dropped 4.3% to 1.78 cents.

3Q 2024 DPU came in at 0.58 cents. Assuming, DPU remained constant at 0.58 cents, this give an annualized dividend of 2.32 cents which is translate to dividend yield of 8.9%.

Gearing ratio remains below 40% at 39.3% with cost of debt of 5%. Interest cover is at 3.9x with 86% of debts on fixed rates. First REIT pays quarterly dividend and hence is one of the 3 Singapore REITs with quarterly dividend payouts to consider for your portfolio.

You can view the REIT website here.

Mapletree Pan Asia Commercial Trust

Mapletree Pan Asia Commercial Trust reported (MPACT) its 2Q FY 24/25 results on 24 Oct 2024.

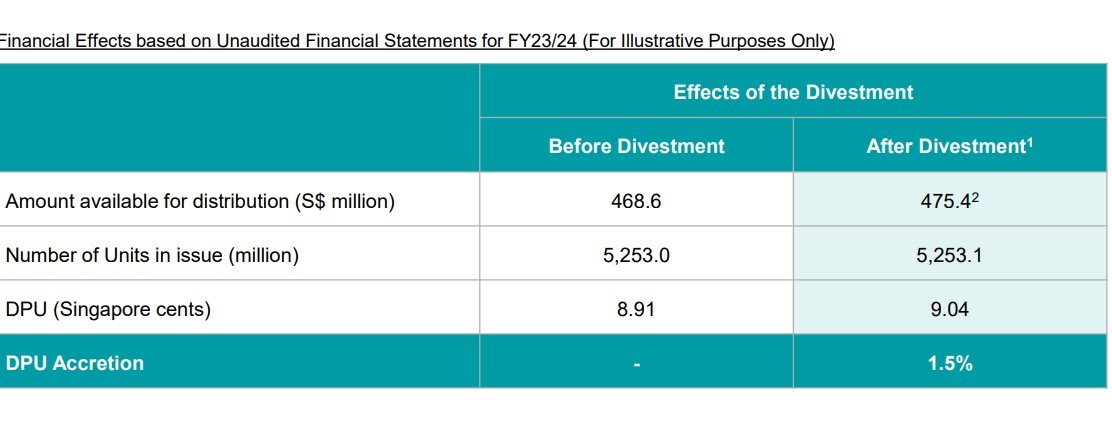

Net property income is down 8.5% to S$167.6 million due to Mapletree Anson’s divestment and lower overseas contributions. DPU dropped 11.6% to 1.98 cents. What a let down MPACT management!

It was stated on 30 May 2024 regarding the disposal of Mapletree Anson that it would be DPU accretive to MPACT unitholders. However, it turn out otherwise. Investors who followed analysts reports calling a buy following the sale would have been licking their wounds now.

Hence, investors should never trust fully REIT management presentation but do their own research.

MPACT share price is down 22.73% year to date due to falling DPU. However, MPACT pays quarterly dividend and hence it qualifies as one of the 3 Singapore REITs with quarterly dividend payouts to consider for your portfolio. You can view the REIT website here.

In this article, I highlight 3 Singapore REITs with quarterly dividend payouts to consider for your portfolio. However, investors need to consider that stagflation might be a likely scenario in the US and this will put the FED in a difficult position to cut rates.

This will result in REITs prices to continue to remain depressed.

Disclaimer: Please note that the REITs mentioned in this article are not a financial recommendation to buy and investors need to do their own research and due diligence before investing in any of these REITs.