Looking to earn higher returns than your Singapore Savings Bonds? These three REITs will provide you with that opportunity. Singapore Savings Bonds is a great way to put your money and earn interest.

It is capital guaranteed and it can be withdrawn any time with no penalty. However, this risk-free investment current yield is at 3.33% and and may not keep up with inflation.

There is good news, though. We showcase 3 Singapore REITs with dividend yields higher than Singapore Savings Bonds that you can consider adding to your portfolio.

Lendlease Global Commercial REIT

Lendlease Global Commercial REIT (LREIT)’s portfolio comprises of two properties in Singapore namely Jem and 313@somerset as well as Grade A office buildings, Sky Complex, in Milan.

Other investments include a stake in Parkway Parade and development of a multifunctional event space on a site adjacent to 313@somerset.

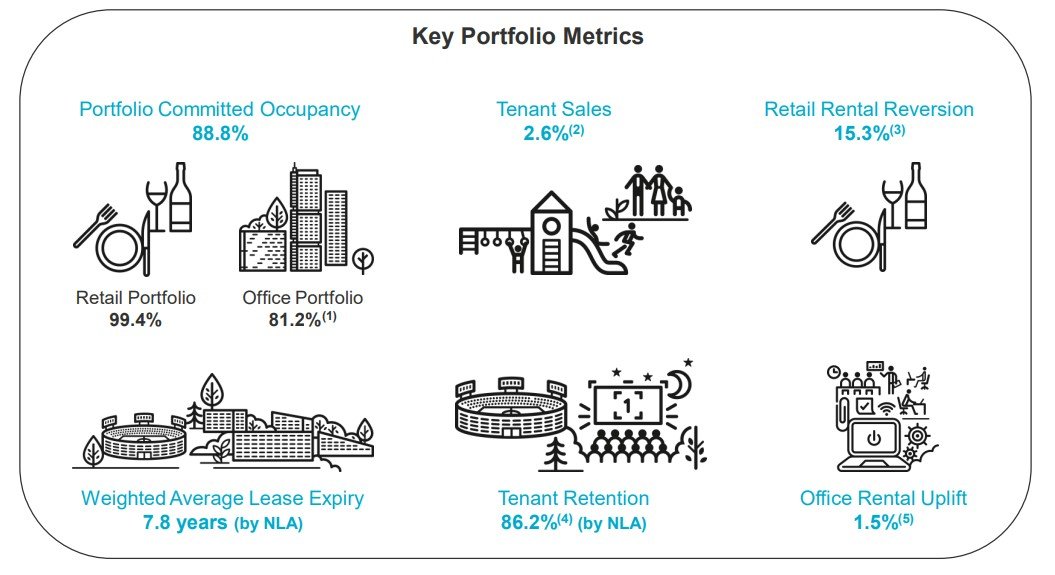

In its latest business update for 3Q FY2024, LREIT reported portfolio committed occupancy of 88.8%. Its retail portfolio has an occupancy of of 99.4% compared to the office occupancy of 81.2%.

Rental reversion for the retail property is healthy at 15.3% while the office rental reversion is a measly 1.5%. The office portfolio is definitely a worrying sign for LREIT and investors need to monitor closely.

Gearing ratio is at 41.0% which is higher than the previous quarter. Interest coverage ratio is at 3.4x which is lower than previous quarter of 3.8x.

LREIT does not declare quarterly dividends. For the full year ended FY2023, LREIT declared DPU of 4.7 cents which is lower than the previous financial year which translate to 8.39% yield.

The distribution yield of 8.39% is much higher than Singapore Savings Bonds of 3.3%. You can view the REIT website here.

Frasers Centrepoint Trust

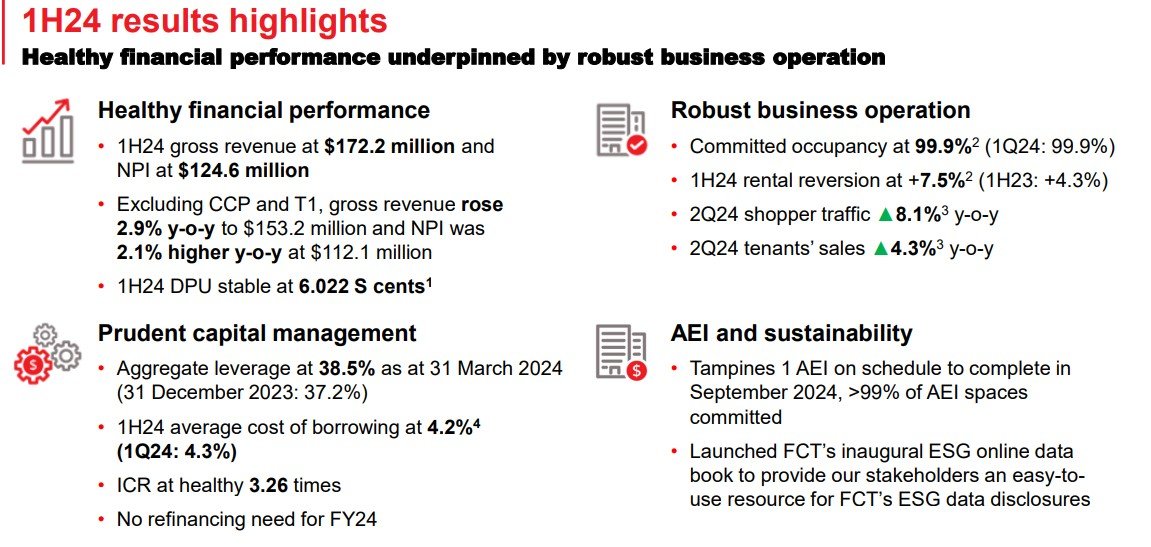

Frasers Centrepoint Trust (FCT) FCT is one of the largest suburban retail mall owners in Singapore. For the half year ended 31 March 2024, FCT reported net property income declined by 8.4% to S$124.6 million.

DPU dipped by 1.8% to 6.022 cents. FCT also reported healthy rental reversion of 7.5% with portfolio occupancy of 99.9%. Tenants’ sales increase by 4.3% y-o-y.

Gearing ratio is at a comfortable level of 38.5% with interest coverage ratio of 3.26x. FCT DPU has been very consistent over the years with dividend yield of about 5.5%.

The consistency in DPU is mainly due to the fact that FCT properties are mainly suburban malls which is more resilient in nature. At 5.5% yield, FCT dividend yield is higher than Singapore Savings Bonds. You can view the REIT website here.

Mapletree Industrial Trust

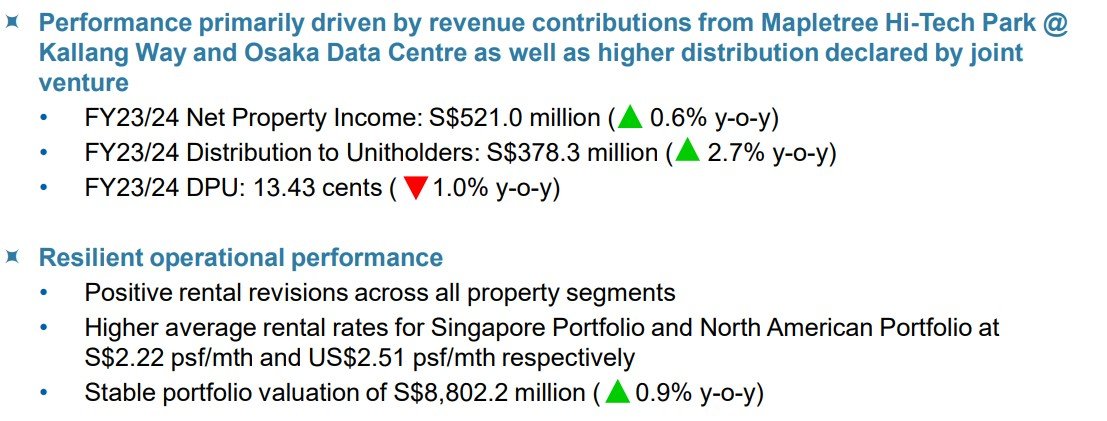

Mapletree Industrial Trust (MIT) owns a diversified portfolio of industrial properties and data centres. For the full year ended FY23/24, net property income increase slightly by 0.6% to S$521.0 million.

DPU dipped by 1% to 13.43 cents with positive rental reversions across all property segments. This translate to a dividend yield of more than 6%. Hence, MIT is one of the 3 Singapore REITs with dividend yields higher than the Singapore Savings Bonds.

Gearing ratio remained healthy at 38.7% with 84.6% of the total debt is on fixed rates. Adjusted interest coverage ratio is comfortable at 4.3x.

MIT mentioned that operating environment remained challenging in view of global uncertainties and this may impact DPU going forward. You can view the REIT website here.

Conclusion

These are the 3 Singapore REITs with dividend yields higher than the Singapore Savings Bonds. However, investors need to note that Singapore Savings Bonds are risk free assets compared to REITs which are now suffering from higher interest rates.

Hence, given the high interest rates environment, investors need to ensure the pros and cons of investing in REITs vs Singapore Savings Bonds not just blindly invest because the REITs yield is higher than Singapore Savings Bonds