2023 has ended. We are now in 2024. Let us recap on the REITs performance in 2023. 2023 indeed has not be kind to REITs.

The FTSE REIT index hit a low of 614.26 in October before rebounding strongly to end the year at 727.04 up 0.21% in 2023. From the above table, not all REITs are created equal. Some REITs way outperform the index while others way underperform the index.

I wrote this article 4 REITs that could outperform in 2023 in Feb 2023. I mentioned that Capitaland Ascendas Trust, Fraser Centrepoint Trust, AIMS APAC REIT and First REIT could outperform the FTSE REIT index in 2023.

Out of the 4 REITs I mentioned, only First REIT underperform the REIT index. However, if you have just these 4 REITs in equal weightage at the start of 2023, your portfolio would have outperform the index. Also, if you notice, First REIT outperform its bigger peer, Parkway Life REIT.

Are your REITs portfolio in the gainers or losers list? If most of your REITs are in the losers portfolio, then it is time that you rebalance your portfolio to better REITs

To do so, you can invest in REITs that look poised to increase their DPU in 2024. Here are 3 Singapore REITs you can keep your eye in 2024.

CapitaLand Ascendas REIT

CapitaLand Ascendas REIT (CLAR), is Singapore’s largest listed Business Space and Industrial REIT. In its 3rd quarter business update, CLAR managed to improve its portfolio occupancy to 94.5% with average portfolio rent reversion of 10.2% in 3Q 2023.

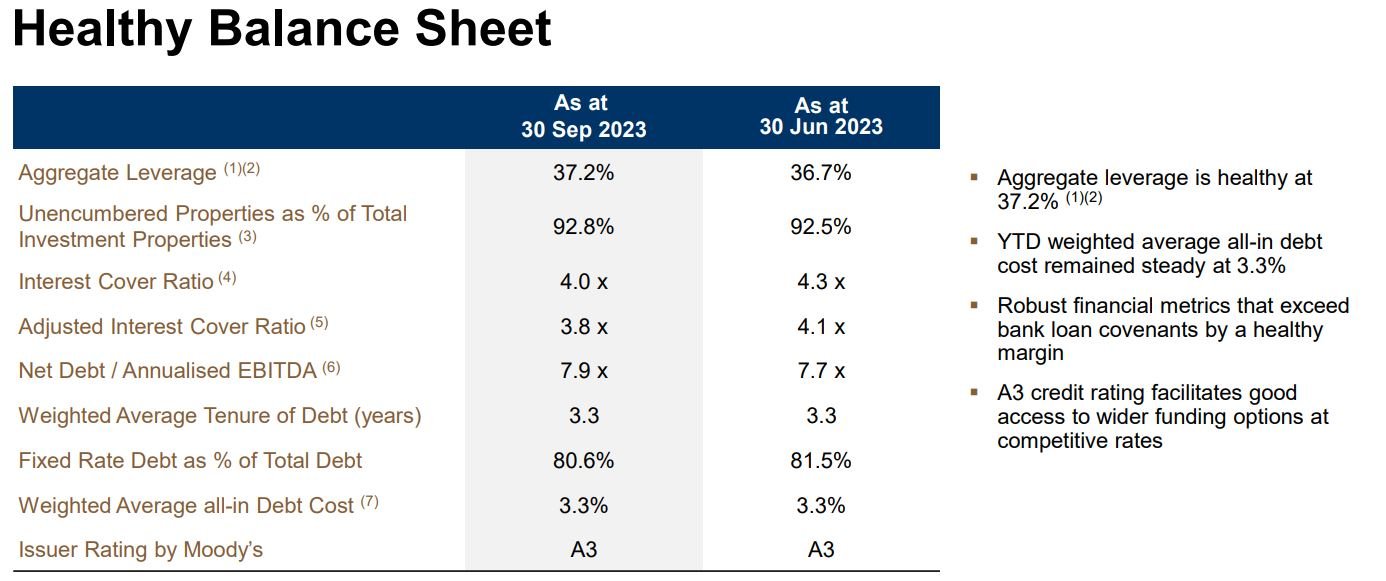

Gearing ratio is healthy at 37.2% while interest cover ratio dipped slightly to 4.0x. Cost of debt remained steady at 3.3% with well-spread debt maturity profile. 81% of their debts are on fixed rates.

The management cited high interest rates, inflation, and global economic uncertainties will pose challenges to the REIT. These ongoing challenges may have an impact on tenants’ businesses as well as on CLAR’s operating costs.

However, with a prudent management and a well diversified portfolio, CLAR will still be one of the 3 Singapore REITs to keep an eye on in 2024. You can view the REIT website here.

Parkway Life REIT

Parkway Life REIT (PLife REIT) is one of Asia’s largest listed healthcare REITs. It invests in income-producing real estate and real estate-related assets used primarily for healthcare and healthcare-related purposes.

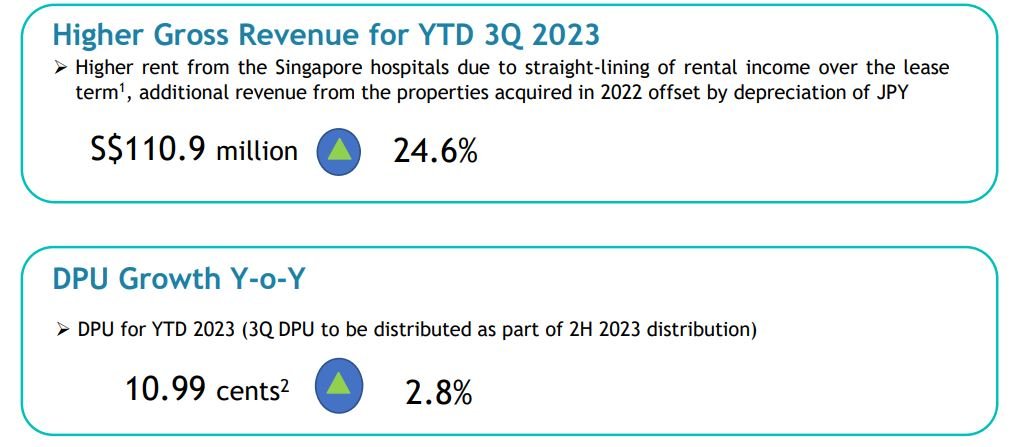

In its 3Q 2023 business update, as usual Parkway Life REIT did not disappoint investors. Gross revenue up 24.6% to S$110.9 million while DPU increased by 2.8% to 10.99 cents.

PLife REIT has a strong balance sheet with gearing ratio of 36.0% and a low all-in debt cost of 1.32%. In addition, it has a long WALE of 16.5 years.

Its growth strategy include sustaining revenue, grow revenue organically and support generation of new revenue. The REIT will also re-balance and optimize its portfolio and build sustained pipelines.

You can view the REIT website here.

ESR-Logos REIT

ESR-LOGOS REIT is a leading New Economy and future-ready Asia Pacific S-REIT.

As at 30 June 2023, ESR-LOGOS REIT holds interests in a diversified portfolio of logistics properties, high-specifications industrial properties, business parks and general industrial properties with total assets of approximately S$5.5 billion.

Shareholders of ESR-Logos REIT has suffered losses for the past one year as the share price has dropped more than 14% for the past one year.

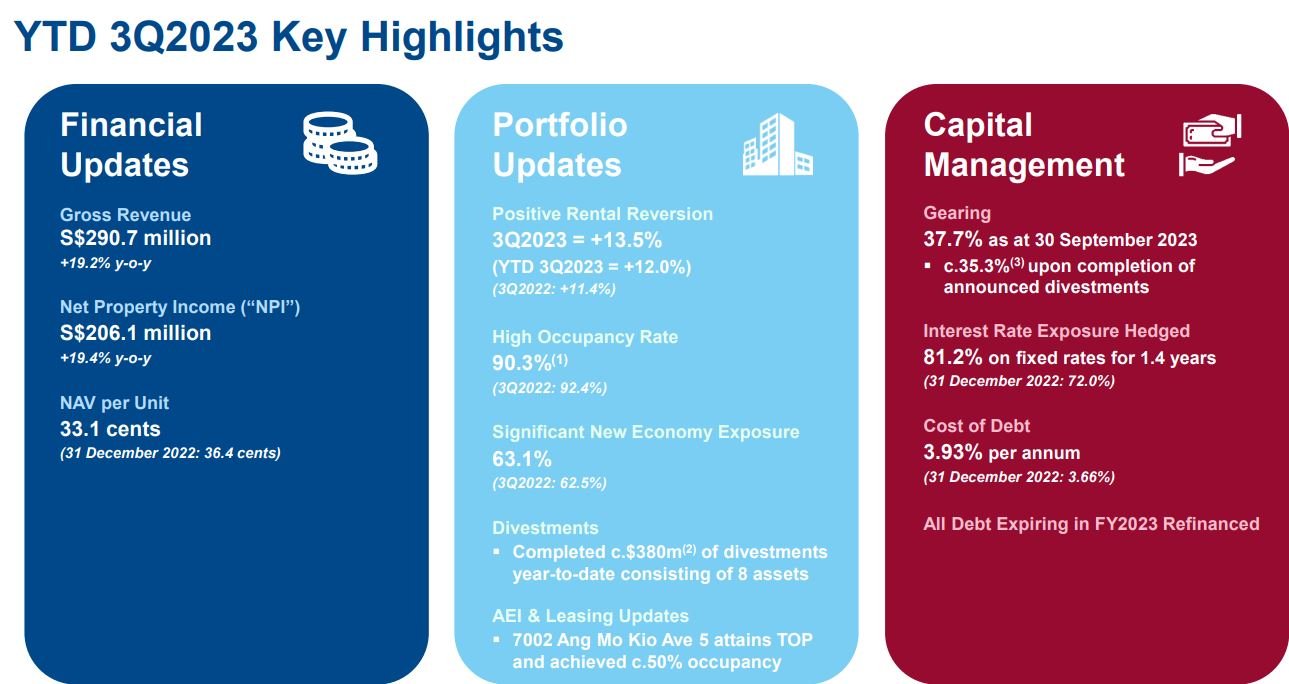

However, we might just see a turnaround for the REIT this year. In its latest business update for 3Q2023, net property income increase by 19.4% while positive rental reversion was a double-digit of 13.5%.

Gearing is at 37.7% with 81.2% of the debt on fixed rates. Portfolio occupancy is 90.3%

With a significant reduction in gearing together with a double-digit rental reversion, the DPU could increase and thereby providing an uplift to the share price.

ESR – Logos REIT is also positioning for its next growth phase with its 4R Strategy which is to rejuvenate asset portfolio, recycle capital, recapitalise for growth and reinforce sponsor commitment.

Hence, ESR-Logos REIT could be of the 3 Singapore REITs to Keep an Eye on in 2024. You can view the REIT website here.

Conclusion

These are the 3 Singapore REITs you can put in your watchlist in 2024. However, investors need to do their own due diligence before investing in them especially so given the uncertainties in market outlook.

[…] first mentioned in this article here. In their last business update, net property income increase by 19.4% to S$206.1 million while NAV […]

[…] by My Stock Investing 3) 4 Singapore REITs That Raised Their DPU in 2023 by The Smart Investor 4) 3 Singapore REITs to Keep an Eye on in 2024 by SmallCapAsia 5) These 3 S-REITs May Outperform in 2024 by Dr Wealth 6) Share Prices of These 5 Singapore REITs […]