It is useful to always keep a little spare cash in your as your war-chest especially when presented with attractive investment opportunities that you can immediately pounce on.

As an income investor at heart, I look for REITs that can pay me consistent dividends and with capital appreciation or at least capital preservation.

Assuming if I have S$20,000, here are 3 Singapore REITs that I will park my money in… read on to find out more!

1) Parkway Life REIT

True to its mission of delivering regular and stable distributions and achieve long-term growth for its Unitholders, Parkway Life REIT (PLife REIT) has never suffered a drop in DPU since its listing on SGX in 2007.

Its share price has appreciated 238% since its listing excluding dividends collected!

The REIT has never done any equity fund raising too. This is an amazing feat compared to other REITs.

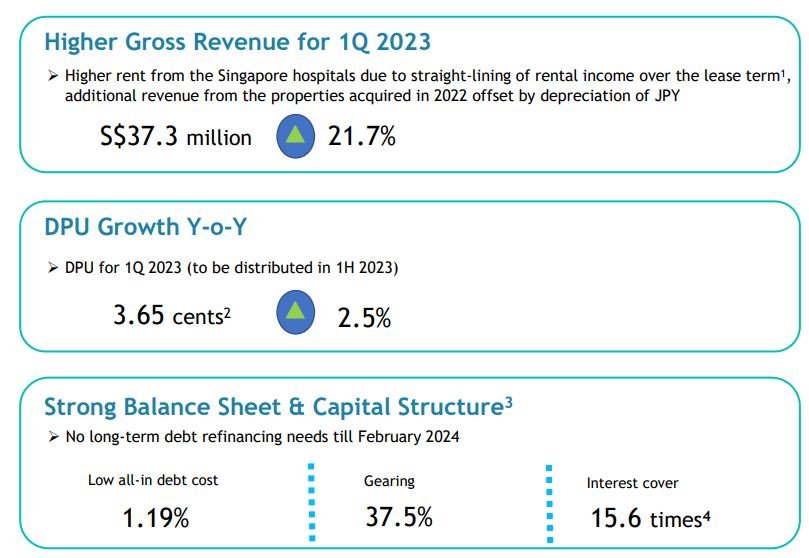

In its latest business update for first quarter ended 31 March 2023, PLife REIT did not disappoint investors as usual. The REIT achieved higher gross revenue up 21.7% to S$37.3 million while DPU grow 2.5% to 3.65 cents.

It has a strong balance sheet with gearing at a comfortable level of 37.5%. The cost of debt is also low at 1.19% with interest cover of 15.6 times.

Many investors shun this REIT due to its low yield. However, investors need to be aware that the main lure here is the REIT giving higher DPU every single year and capital appreciation without asking shareholders’ for money (no rights issue etc!).

You can view the REIT website here.

2) Frasers Centrepoint Trust

Frasers Centrepoint Trust (FCT) share price has appreciated 70.54% since its listing in 2006 excluding dividends collected.

Being the largest suburban retail mall owner in Singapore, its Singapore retail portfolio include Causeway Point, Century Square, Changi City Point, Hougang Mall etc.

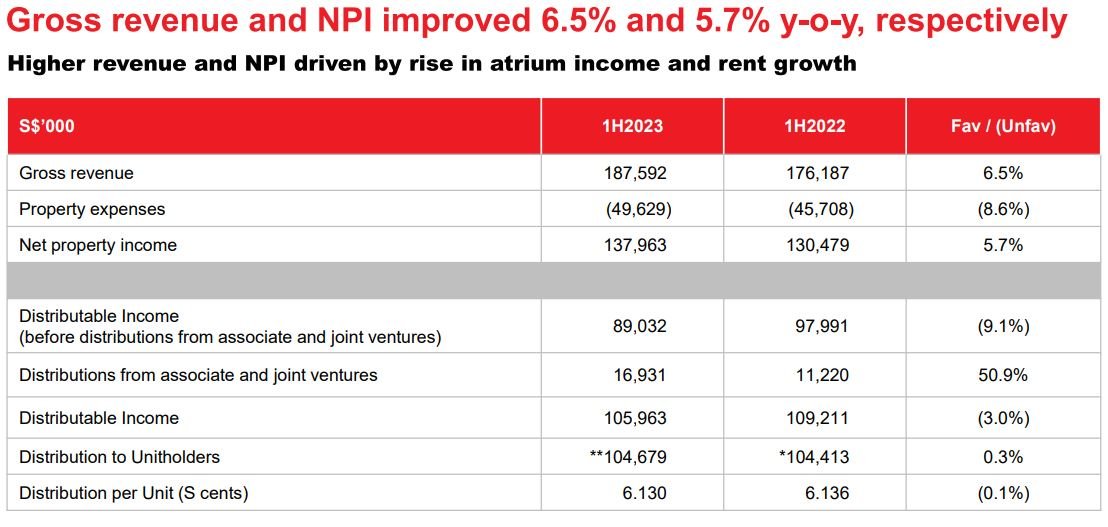

In its half year results ended 31 March 2023, net property income is up 5.7% while DPU dipped slightly to 6.13 cents. Its gearing ratio is 39.6% while interest cover is healthy at 4.39 times.

It achieved a positive average rental reversion of 4.3% with well spread debt maturity thereby mitigating the risk of higher interest rates.

With a 98.7% committed portfolio occupancy rate, ongoing AEI and a dominant position in suburban retail space, it warrants a spot in my imaginary $20,000 pot.

Check out its corporate presentation here.

3) Mapletree Logistics Trust

Mapletree Logistics Trust (MLT) share price has appreciated 64% since its listing in 2005.

The REIT invests in a diversified portfolio of logistics properties in the fast-growing Asia-Pacific logistics sector.

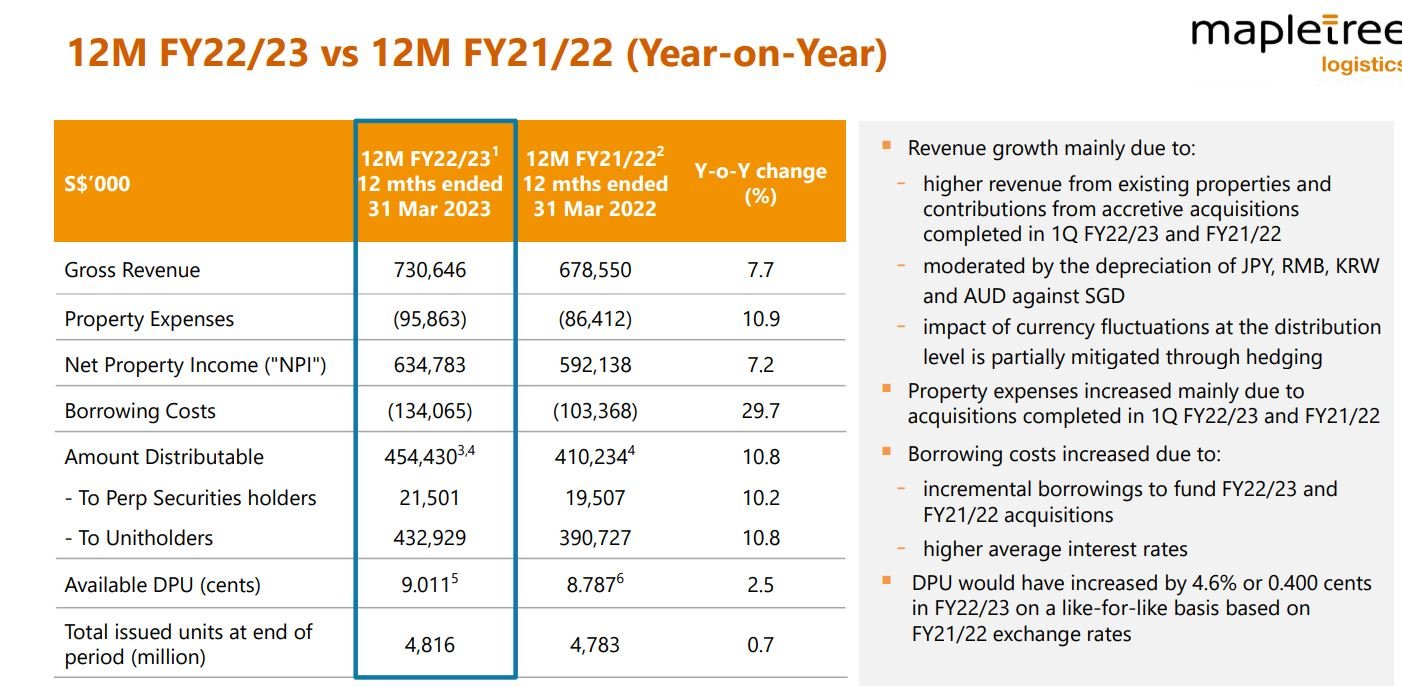

In its full year results ended 31 March 2023, MLT reported net property income increase by 7.2% to 634,783 million mainly due to the contributions from accretive acquisitions and higher revenue from existing properties. DPU increased by 2.5% to 9.01 cents.

It has a healthy gearing of 36.8% with interest cover of 4 times with well-staggered debt maturity profile.

Given the growing demand for logistics space due to the rise of E-commerce, MLT is well placed to ride this trend and increase value for its shareholders.

You can view the REIT results presentation here.

Conclusion

In conclusion, these are the 3 S-REITs I will park my money in to take advantage of their consistent DPU growth and share price performance since listing.

On a side note, investors need to take note that DPU growth and share price performance are the key metrics to look at when investing in REITs. Inconsistent DPU usually result in share price underperformance.

For example, Suntec REIT share price dropped more than 17% since 2007 and Keppel REIT dropped more than 60% since 2007 as they have had bouts of inconsistent DPU since their IPOs.

Long story short, do not simply yearn for the high yields and low Price/NAV in REITs as they may hurt your portfolio performance instead i.e. US Office REITs.

[…] Result by ViresInSolitudine 3) Cory Diary : Mapletree Log Trust Review by CoryLogics 4) 3 Singapore REITs to Buy with $20,000 by SmallCapAsia 5) Mapletree Industrial Trust’s Q1 FY2024 Earnings: What Dividend Investors Need to Know by […]

Good recommendation. Sleep well at night stocks. Well done!

Always almost the same stock. No other stick mentioned much