Over a period of time in your working life, you could have save a sum of money that you can choose to invest to let the money work harder for you.

One option is to allocate some of your savings to income-generation REITs that can help you to increase your passive income and if you invest in the correct REITs, you may get to enjoy capital gains as well.

I know many bloggers regard CapitaLand Integrated Commercial Trust (CICT) as a reliable and resilient Singapore REIT. However, the share price speaks otherwise! In fact, CICT share price dropped 6.4% year to date while the FTSE REIT index dropped lesser by 5.41%.

In fact ever since the merger of CapitaLand Mall Trust with CapitaLand Commercial Trust, it has clearly underperformed the REIT index. Is it still considered a resilient and reliable REIT to buy?

If I had S$20,00 here are 3 real reliable and resilient Singapore REITs I will consider investing for the long term.

Frasers Centrepoint Trust

Frasers Centrepoint Trust (FCT) is a retail REIT that focus on suburban retail malls.

It is more resilient in nature as the malls are situated close to the heartlands and with the trend of hybrid work and the rise of freelancers among the new generation where work can be done anywhere, heartland malls will be more popular.

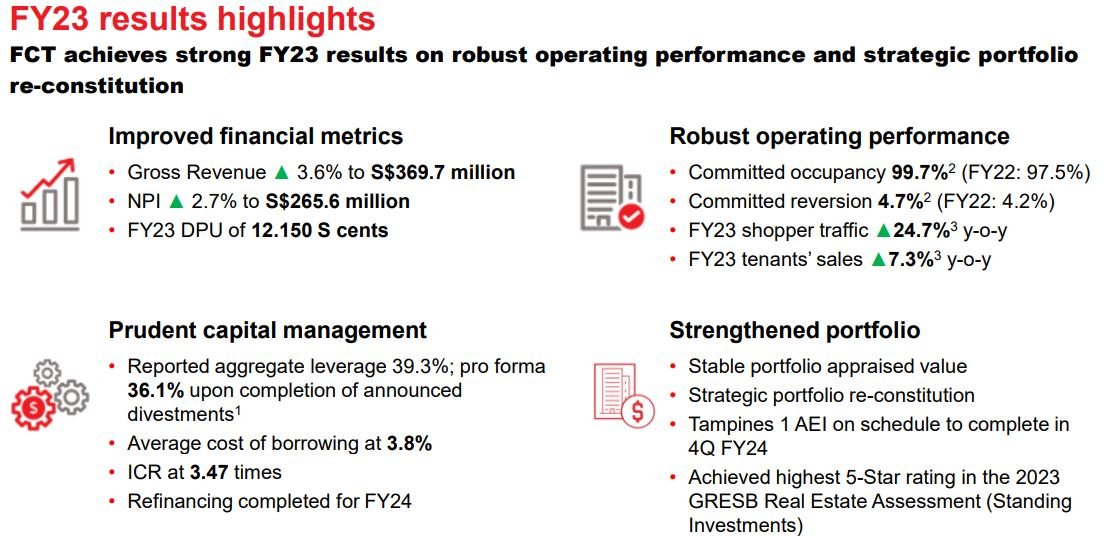

In its full year results ended 30 Sep 2023, NPI increased by 2.7% to S$265.6 million while portfolio occupancy is at 99.7% while tenant sales increased by 7.3%.

Gearing ratio is at 39.3% as at 30 Sep 2023. However, with the recent divestment of Changi City Point which has the lowest occupancy rate among its assets and together with the divestment of Hektar REIT, FCT gearing will reduced to 36.1%.

In times of high interest rates, instead of doing acquisitions just to increase AUM at the expense of shareholders, the REIT should instead focus on reducing gearing or through organic growth such as AEI.

Hence, given its focus on suburban malls and focusing on AEI and reducing gearing, FCT is definitely a reliable and resilient REIT. In fact, this is reflected in its share price with the share price up 7.73% year to date way outperforming the REIT index.

You can view the REIT website here.

AIMS APAC REIT

Despite not having a so called strong sponsor, AIMS APAC REIT (AA REIT) has proven to be reliable and resilient REIT. In fact, the share price is up 5.65% YTD which outperforms other big name REITs such as CICT, Mapletree Industrial Trust and Mapletree Logistics Trust this year.

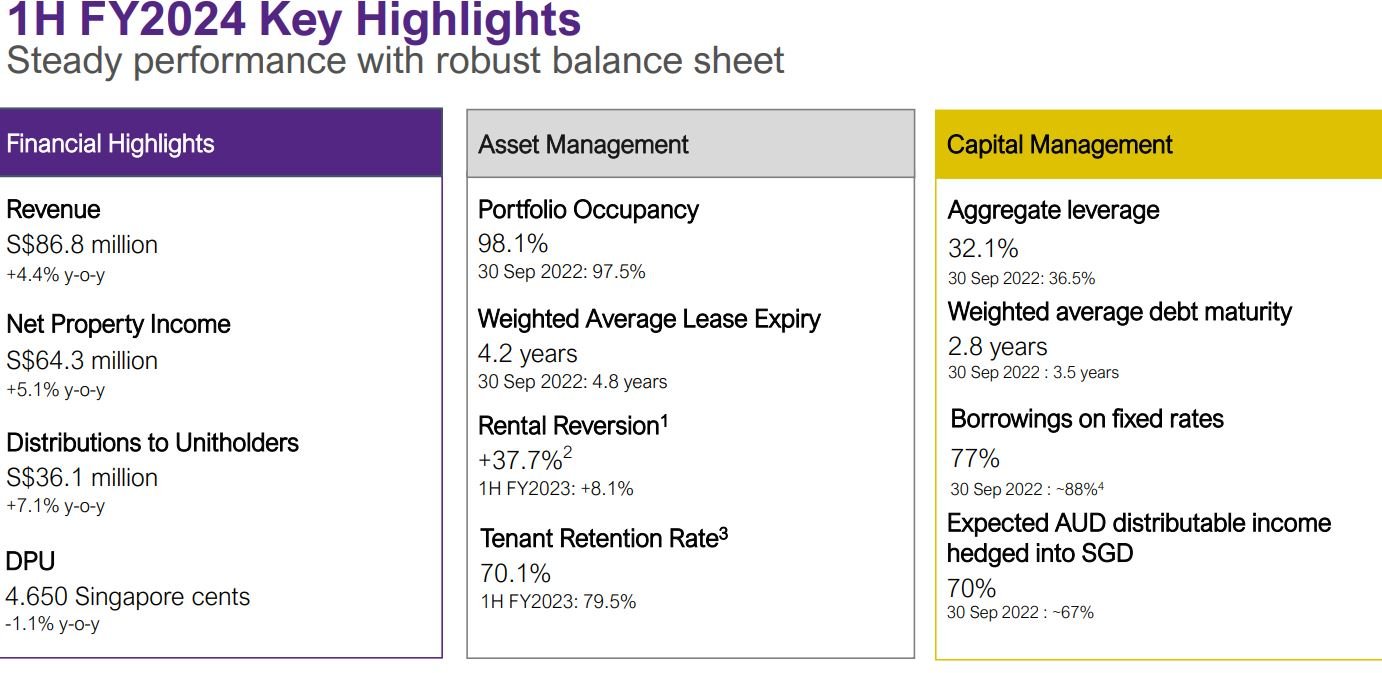

In its latest 1H FY2024 results end Sep 2023, AA REIT delivered a good set of results. Net property income is up 4.4% to S$86.8 million while DPU decreased by 1.1% to 4.65 cents due to the enlarged unit base. Rental reversion increased by an astonishing 37.7%!

Gearing ratio is relatively low at 32.1% with no refinancing requirements for FY2024. You can view the REIT website here.

Parkway Life REIT

Parkway Life REIT (PLife REIT) being a healthcare REIT is definitely a reliable and resilient REIT.

The REIT has un-interrupted DPU growth since its listing in 2007. Despite many investors shun this REIT due to its low yield and high premium to NAV, PLife REIT is able to outperform many other REITs in maintaining its DPU growth this year.

Its share price drop by 5.84% YTD underpeforming the FTSE REIT index.

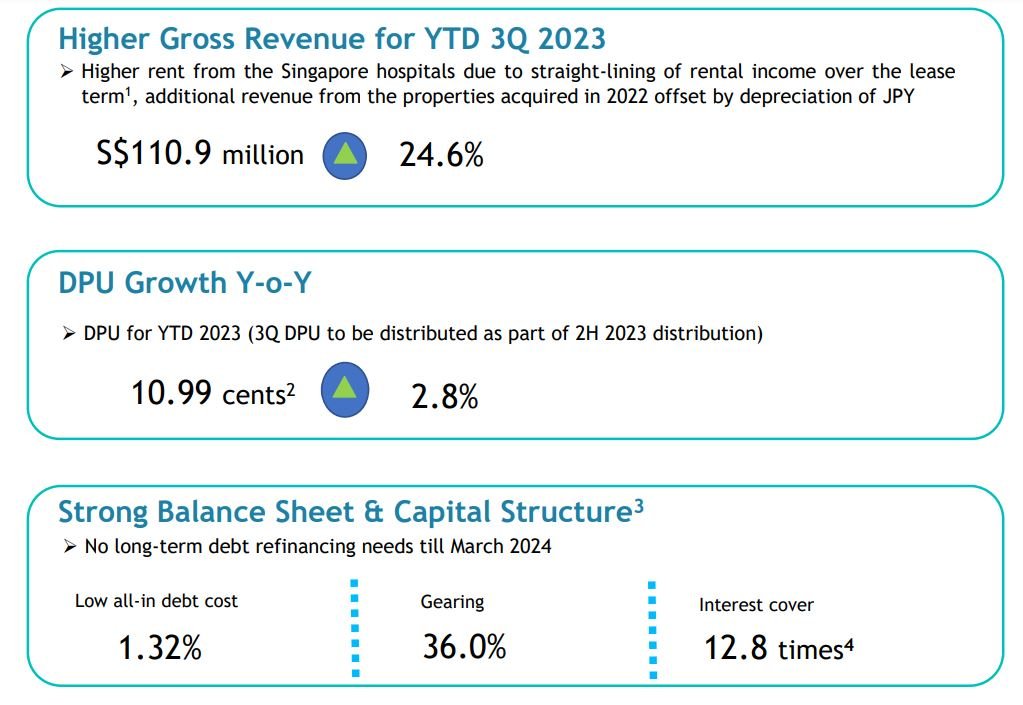

In its latest 3Q 2023 business update, PLife REIT as usual did not disappoint investors. Gross revenue increase 24.6% to S$110.9 million while DPU increase by 2.8% to 10.99 cents.

Gearing ratio remain relatively comfortable at 36.0% with interest cover of 12.8 times. With the recent renewal of the hospitals in Singapore, for a period of 20.4 years from 23 August 2022 till 31 December 2042, it provides income certainty for the REIT.

Parkway Life REIT will also re-balance and optimize its portfolio through asset recycling and development to ensure sustainable DPU for the REIT.

You can view the REIT website here.

Conclusion

These are the 3 Singapore REITs I will buy if I had S$20,000. Investors need to do their own research before buying these REITs. In addition, investors need to be aware of the type of REITs they invest and not just invest blindly due to the high yield or strong sponsor.

Not sure which REIT to put your money in? Join our latest Dividend Kaki membership as we show you a fuss-free way to invest in dividend stocks and REITs. Many people love dividend investing, but few truly know how to profit from it consistently. Click the link here to sign up and test drive to discover the secrets!

[…] Hospitality Trust (SGX: J85): 2023 Third Quarter Business Update by ViresInSolitudine 4) 3 Singapore REITs I Will Buy If I Had S$20,000 by SmallCapAsia 5) The Curious Case of Elite Commercial REIT Downfall and Rights Issue by Investment Income for […]