The REIT sector has continued to remained depressed since the start the year. This is due to persistent high 10 year treasury yield which remain above 4%. For the past 2 years, many REITs DPU have taken a hit due to the high yield.

Many investors will be wondering why that the FED has start to cut interest rates and yet REITs prices have remained depressed. In addition, REITs DPU continue to drop.

This is because as I have mentioned many times in my previous articles that as long as the US 10 year remain above 4%, REITs prices will remain depressed and that DPU will remain stagnant or even fall.

Hence, do not be misled by bloggers and analysts who said that FED has cut rates, we could see daylight in REITs DPU growth. In this article, I will write about 3 Singapore industrial REITs with dividend yields of 6.0% and above

Mapletree Industrial Trust

As at 31 December 2024, MIT’s total assets under management was S$9.2 billion, which comprised 56 properties in North America (including 13 data centres held through the joint venture with Mapletree Investments Pte Ltd), 83 properties in Singapore and two properties in Japan.

MIT’s property portfolio includes Data Centres, Hi-Tech Buildings, Business Park Buildings, Flatted Factories, Stack-up/Ramp-up Buildings and Light Industrial Buildings.

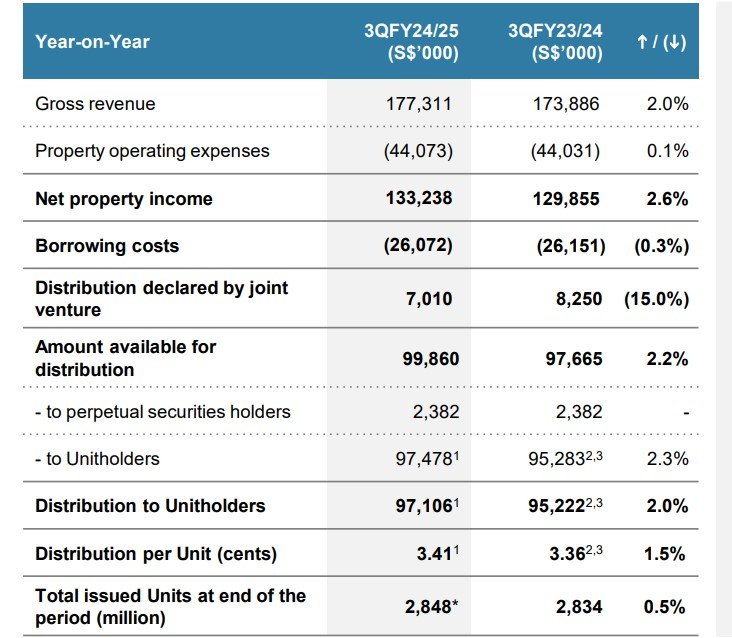

MIT reported its 3Q FY24/25 results on 22 Jan 2025.

Gross revenue is up 2% to S$177.30 million while net property income is up 2.6% to S$133.20 million. DPU is up 1.5% to 3.41 cents. Portfolio occupancy is still healthy at 92.1%. However, MIT’s portfolio occupancy for its light industrial buildings is a cause for concern. The occupancy is very low at 52.0%.

Gearing ratio is at 39.8% with 78.3% of debts on fixed rates. Interest coverage ratio is 4.7 times with average borrowing cost of 3.1%. Given MIT current price of S$2.06 and annualized dividend yield of 6.5%, it is definitely one of the 3 Singapore industrial REITs with dividend yield of 6.0% and above.

You can view the REIT website here

AIMS APAC REIT

As at 31 March 2024, AA REIT’s portfolio comprises 28 properties, of which 25 properties are located across Singapore and 3 properties located in Australia, with a total portfolio value of S$2.16 billion.

AA REIT reported its 3Q FY2025 business update on 28 Jan 2025.

Revenue is up 5.7% to S$139.1 million while net property income is up 1.9% to S$99.6%. 9 month DPU is up 1.1% to 7.07 cents. AA REIT is one of the better industrial REIT that increase its DPU compared to other REITs.

Portfolio occupancy remained high at 94.5% with weighted average lease expiry of 4.7 years. AA REIT reported an excellent positive rental reversion of 21.2% with tenant retention rate of 76.3%.

Gearing is very low at 33.7% and 70% of the borrowings is in fixed rates. AA REIT has an annualized dividend yield of 7.3%. As one of the better industrial REIT, AA is definitely one of the 3 Singapore industrial REITs with dividend yields of 6.0% and above. You can view the REIT website here.

Sabana Industrial REIT

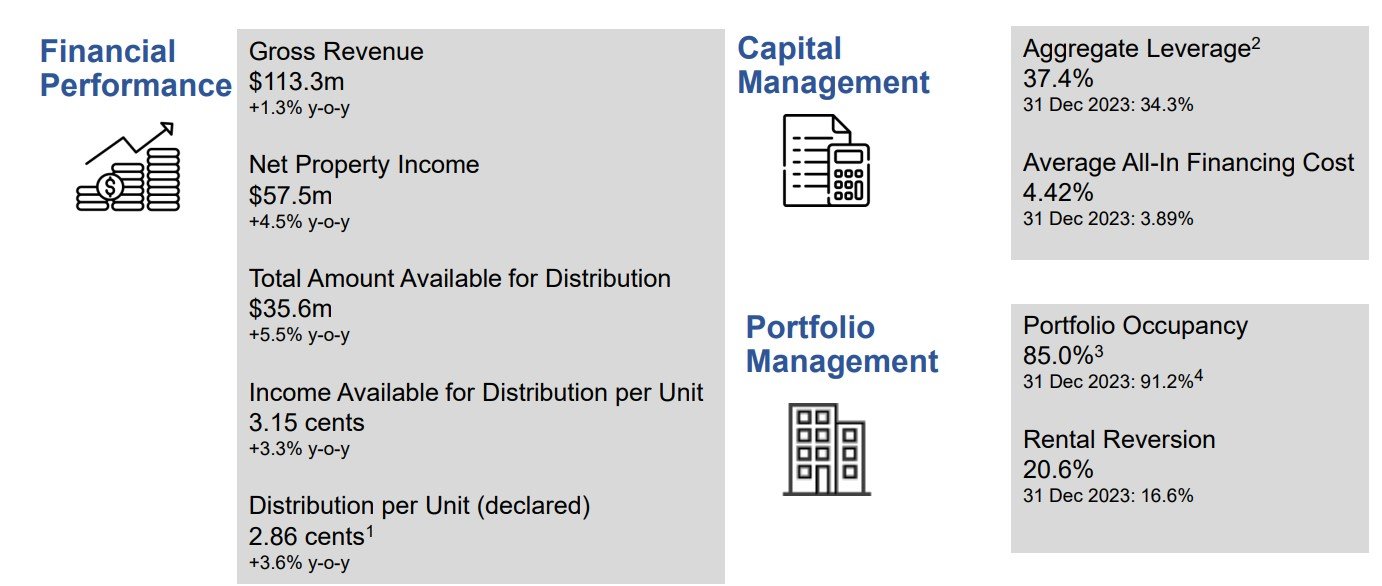

Sabana Industrial REIT has a diversified property portfolio valued at $885.7 million as at 31 December 2022, comprising 18 properties located across Singapore. Sabana REIT reported its full year results on 21 Jan 2025.

Gross revenue is up 1.3% to S$113.3 million while net property income is up 4.5% to S$57.5 million. Full year DPU is up 3.6% to 2.86 cents. Portfolio occupancy is low at 85.0% which could a cause for concern. However rental reversion is a whopping 20.6%.

Gearing ratio is 37.4% with average financing cost of 4.42%. With a dividend yield of 7.83%, Sabana REIT qualifies as one of the 3 Singapore industrial REITs with dividend yield of 6.0% and above. You can view the REIT website here.

Given the uncertainty in the US with Trump imposing tariffs as well as the 10 year treasury yield staying above 4%, it is important that investors do their research on the external macro environment before investing in REITs

Disclaimer: Please note that the REITs mentioned in this article are not a financial recommendation to buy and investors need to do their own research and due diligence before investing in any of these REITs.