A number of REITs has reported its business updates for quarter ended 30 September 2024. However, the results released by REITs were pathetic with a number of them reported a declined in DPU.

As a result and plus a rising 10 year treasury yield to a current 4.3%, it has seen REITs prices fallen recently. In fact, the FTSE REIT index has dropped to levels last seen in August 2024.

Many financial bloggers and analysts expects that the twin headwinds of high inflation and elevated interest rates may be abating soon.

However, I doubt this optimistic scenario will materialize as Mr Donald Trump will most likely win the US Presidential Election. He is known as “Mr Tariffs” man. Once more tariffs are imposed, US consumers will suffer as a result of higher cost of goods and services.

Hence, the FED may not be able lower interest rates to the levels seen before the pandemic. With REITs prices fallen to attractive levels, I sieve out 3 Singapore Blue-Chip REITs offering at least 5% dividend yield.

Mapletree Industrial Trust

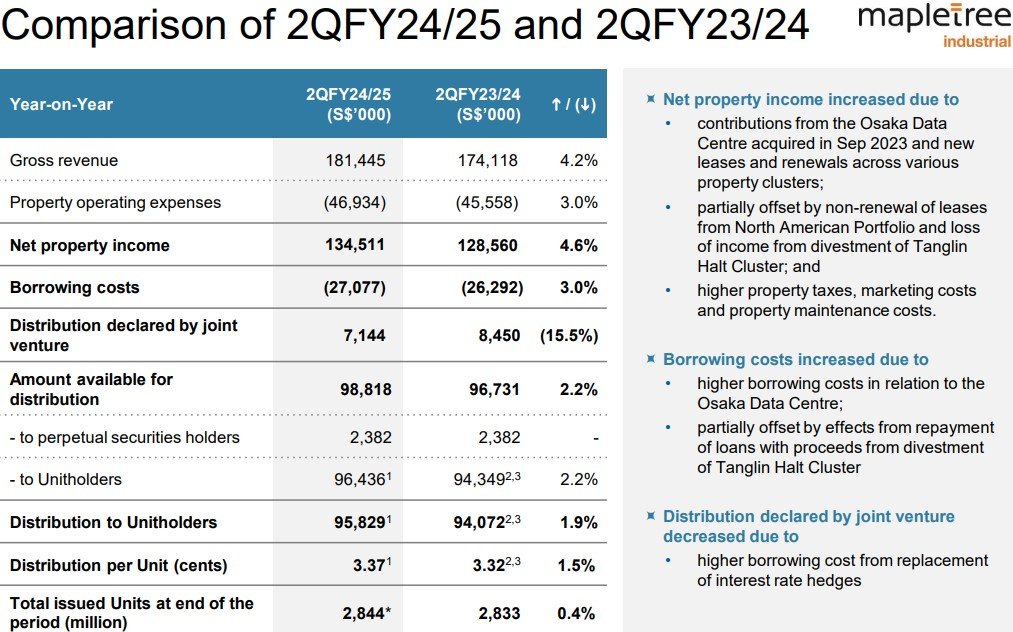

Mapletree Industrial Trust (MIT) reported its 2QFY24/25 results on 29 Oct 2024.

Net property income is up 4.6% to S$134.5 million for 2QFY24/25 while DPU is up 1.5% to S$3.37 cents. This translates to an annualized dividend yield of 5.6%.

This is due to contributions from the Osaka Data Centre acquired in Sep 2023 and new leases and renewals across various property clusters.

Gearing ratio remains below 40% at 39.1% with average debt to maturity of 3.4 years. 80.4% of the debts are on fixed rates with healthy interest cover of 4.3 times. Mapletree Industrial trust share price is down 4% year to date. You can view the REIT website here.

CapitaLand Integrated Commercial Trust

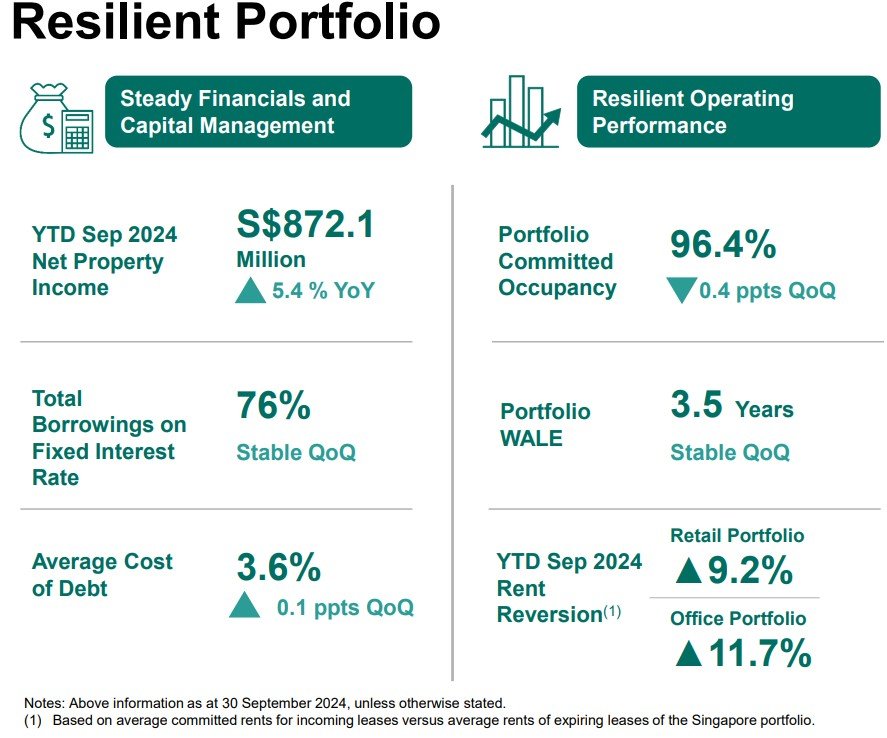

CICT reported its 3Q 2024 business update on 5 Nov 2024.

Net property income is up 5.4% to S$289.8 million. Portfolio occupancy remains healthy at 96.4% with well diversified tenant base. In fact, no single tenant contributes more than 5.2% of CICT’s total gross rental income.

Year to date rental reversion is up 9.2% for retail portfolio while office portfolio rental reversion is up 11.7%. Gearing is at 39.4% with interest coverage of 3.0x.

No dividend is declared as CICT pay dividends only twice a year. For 1H 2024, DPU declared was 5.43 cents which translate to annualized dividend yield of 5.3%.

Hence, CICT is definitely one 3 Singapore blue-chip REITs offering at least 5% dividend yield. You can view the REIT website here.

Frasers Centrepoint Trust

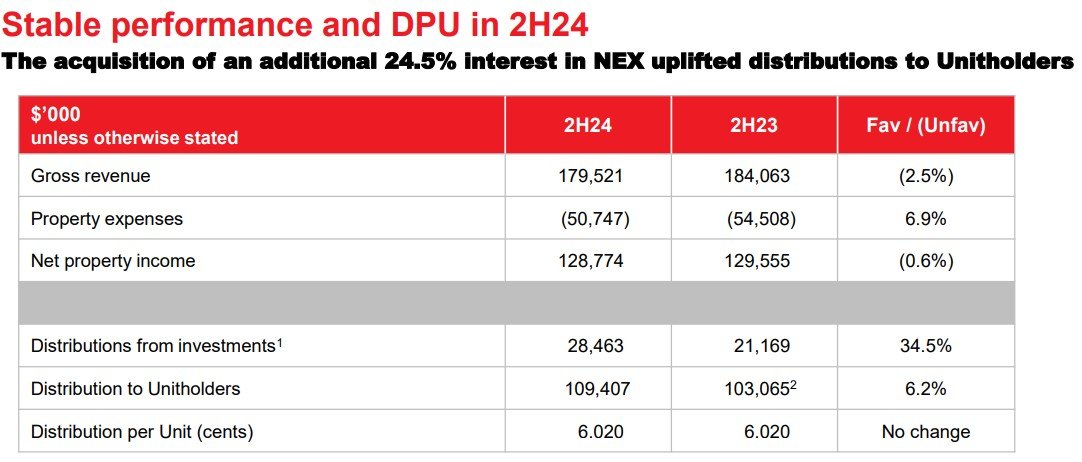

Frasers Centrepoint Trust reported a set of stable results for its 2H24 and FY24 results on 25 Oct 2024.

For 2H24, FCT reported net property income decreased by 0.6% to S$128.7 million. DPU remain stable at 6.02 cents. For FY24, DPU came in at 12.042 cents which translate to a dividend yield of more than 5.3%.

Hence, FCT is definitely of the 3 Singapore blue-chip REITs offering at least 5% dividend yield. Gearing ratio remains healthy at 38.5% with average cost of debt of 4.1%

Interest cover is at 3.41 times with 71.4% of the debts are on fixed rate of interest. FCT should be able to maintain its stable results in the future since it owns the more resilient suburban malls. Its share price is unchanged year to date thereby reflecting its resiliency.

You can view the REIT website here.

I have highlighted 3 Singapore blue-chip REITs offering at least 5% dividend yield. However, investors need to do their due diligence. In addition, be prepared for the resurgence of inflation and tough times ahead in 2025 and 2026.