With an AI driven economy in the future, the semiconductor industry could do very well in the future. In fact, the outlook for the semiconductor industry appears to be promising.

According to SEMI, Global spending on 300mm fab equipment is expected to reach a record US$400 billion from 2025 to 2027, SEMI highlighted in its quarterly 300mm Fab Outlook Report.

The robust spending is being driven by the regionalization of semiconductor fabs and the increasing demand for artificial intelligence – (AI) chips used in data centers and edge devices.

Worldwide, 300mm fab equipment spending is projected to grow by 4% to US$99.3 billion in 2024, and further increase by 24% to US$123.2 billion in 2025, surpassing the US$100 billion level for the first time.

With such robust outlook, here are 3 semiconductor stocks that could soar in 2025.

Grand Venture Technology Ltd

GVT offers precision manufacturing solutions for the semiconductor, life sciences, electronics, aerospace and medical industries. The range of services include precision machining, sheet metal fabrication and assembly & testing.

For 3Q24 ended 30 Sep 2024, GVT posted an excellent set of results. Revenue was up 52.8% to S$43.5 million. Net profit after tax rose 51.3% to S$2.0 million. No interim dividend was declared.

With a growing demand for HBM, the market for equipment manufacturers is expected to grow in tandem. GVT expects to capitalize on this uptrend, as it is in active engagement with blue-chip customers across the semiconductor value chain.

GVT is confident in achieving the higher end of previous target revenue guidance between S$80 million and S$86 million for the second half financial period from 1 July 2024 to 31 December 2024.

Hence, GVT is definitely one of the 3 semiconductor stocks that could soar in 2025. You can view the company website here.

UMS Integration Ltd

UMS is a precision engineering group which specializes in manufacturing high precision front-end semiconductor components and perform complex electromechanical assembly and final testing services.

Included in our core business is the production of modular and integration systems for original semiconductor equipment manufacturers.

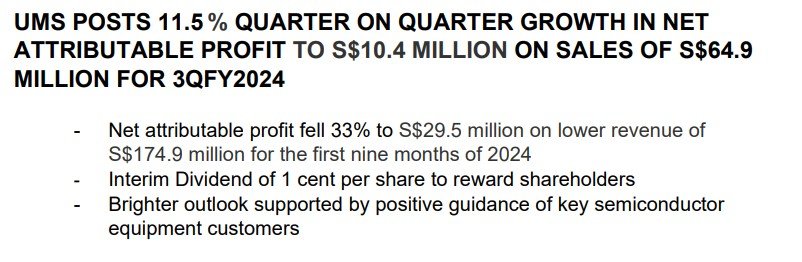

For 3Q24, UMS reported revenue fell 9% Y-o-Y to S$64.9 million in 3QFY2024 from S$71.3 million in 3QFY2023. However, it rose 16.1% Q-o-Q from S$56 million in 2QFY2024.

Net profit drop 32% to S$10.4 million in 3QFY2024 from S$15.3 million in 3QFY2023. The Group remained financially healthy during the nine-month period. It registered $31.2 million (vs $48.6 million in 9MFY2023) positive net cash from operating activities. Interim dividend of 1.0 cent was declared.

The Group remains confident of working closely with its key customers to benefit from rapidly rising demand for wafer fabrication equipment to produce high-value artificial intelligence (AI) chips which are experiencing phenomenal growth in global markets.

Signalling improving chip demand, the Group’s new key customer has requested UMS to ramp up production in the coming months. Therefore, UMS is definitely one of the 3 semiconductor stocks that could soar in 2025. You can view the company website here.

Micro-Mechanics (Holdings) Ltd

Micro-Mechanics designs, manufactures and markets high precision parts and tools used in process-critical applications for the semiconductor and other high technology industries.

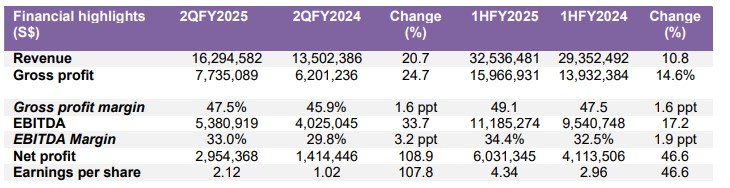

For half year ended 31 Dec 2024, Micro-Mechanics reported revenue up 10.8% to S$32.5 million. Net profit was 46.6% higher at S$6.0 million. Interim dividend of 3.0 cents was declared. Balance sheet remained strong with net cash S$20.2 million.

The Group remains focused on its goal to become a leading Next Generation Supplier of high precision tools and parts used in process-critical applications for the wafer-fabrication and assembly processes of the semiconductor industry heading into 2HFY2025.

The Group remains cautiously optimistic of the continued recovery of the semiconductor industry. Consequently, Micro-Mechanics should be one of the 3 semiconductor stocks that could soar in 2025. You can view the company website here.

Semiconductor is critical in an AI driven economy and is definitely a period 9 industry. However, investors need to be aware of the coming recession later this year or early next year which will affect semiconductor demand.

Disclaimer: Please note that the stocks mentioned in this article are not a financial recommendation to buy and investors need to do their own research and due diligence before investing in any of these stocks.