In 2024, REITs performed poorly with the FTSE REIT index dropping more than 11% to close the year at 641.12 points. This is due to expectations that FED may halt cutting rates and the persistent high 10 year treasury yield.

As we enter 2025, many investors are hoping for better days in REITs as many REITs has dropped to attractive valuations. However, I do not think REITs will perform well this year once US enter into a recession or stagflation this year or latest next year. to

Nonetheless, investors who still want to have REITs in their portfolio can look for reliable REITs that should pay consistent dividends in 2025. Here are 3 reliable Singapore REITs for 2025.

CapitaLand Integrated Commercial Trust

CapitaLand Integrated Commercial Trust (CICT) released its 3Q 2024 business update on 5 Nov 2024.

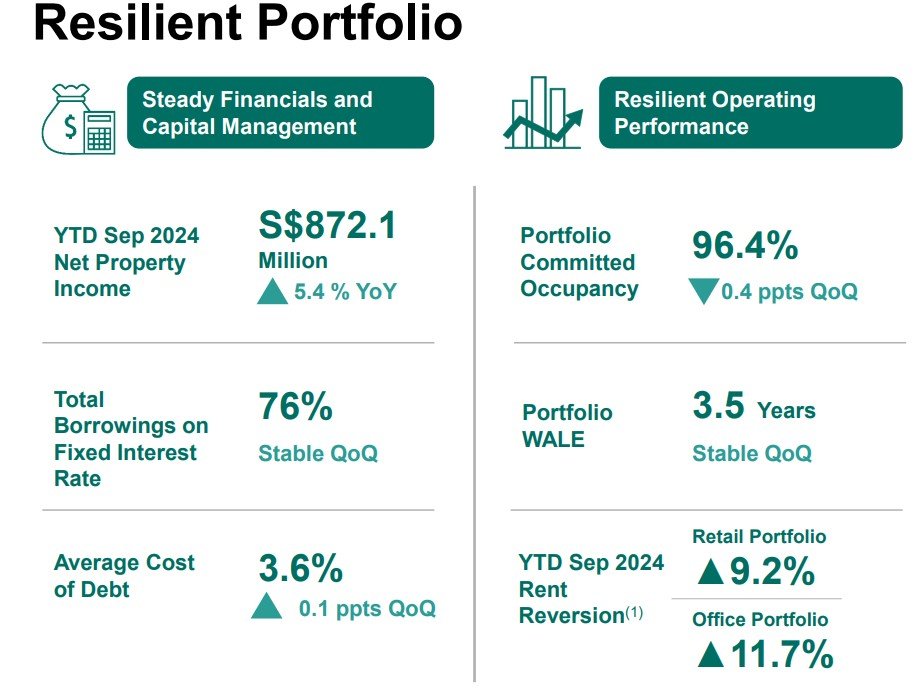

For 3Q 2024 ended 30 Sep 2024, CICT reported net property income was up 5.4% to S$872.1 million. Portfolio occupancy remains high at 96.4% with average WALE of 3.5 years. YTD rent reversion is up 9.2% for retail portfolio while office portfolio has a rent reversion of 11.7%

76% of borrowings are on fixed rates with average cost of debt of 3.6%. Gearing ratio remains below 40% at 39.4% and interest cover is at 3.0x.

Though CICT office portfolio has a higher rent reversion compared to its retail portfolio, investors need to be aware that its office portfolio occupancy is lower than its retail portfolio.

In the event of a recession, the office portfolio will be harder hit than the retail portfolio. However, CICT is still considered as one of the 3 reliable Singapore REITs for 2025 as its retail portfolio is more resilient towards economic cycles. You can view the REIT website here.

Parkway Life Real Estate Investment Trust

Parkway Life Real Estate Investment Trust (PLife REIT) released its 3Q 2024 business update on 16 October 2024.

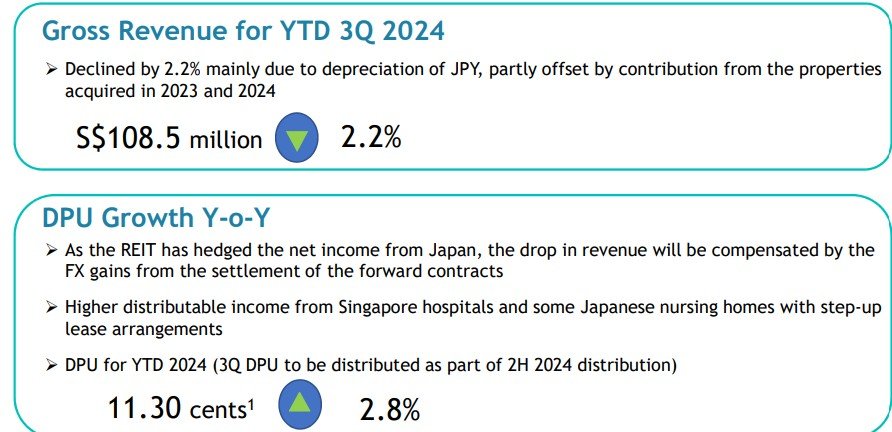

For 3Q 2024, PLife REIT reported gross revenue was down 2.2% to S$108.5 million while net property income was down 2.1% to S$102.3 million. YTD DPU was up 2.8% to 11.3 cents.

PLife REIT has a strong balance sheet and capital structure with gearing ratio of 37.5% and interest cover of 10.2 times. PLife REIT has a very low cost of debt of 1.36% which put PLife REIT in a very comfortable position even if Japan central bank start to increase interest rates.

Many investors shun PLife REIT due to its low yield of below 4%. However, during the finance crisis of 2008, PLife REIT still increase its DPU while other REITs saw DPU fall.

Hence, even if there is a recession this year or next year, PLife REIT is definitely one of the 3 reliable Singapore REITs for 2025. You can view the REIT website here.

Frasers Centrepoint Trust

Frasers Centrepoint Trust (FCT) released its full year results on 25 Oct 2025.

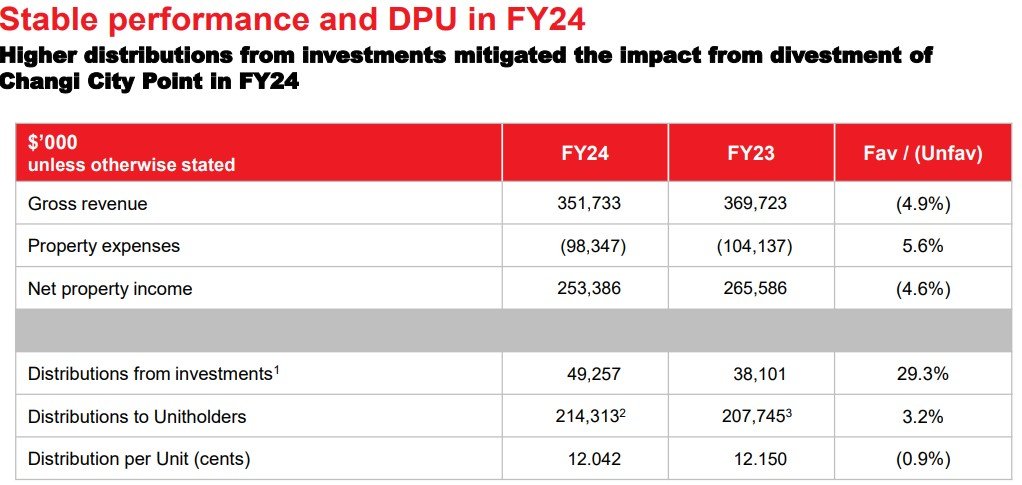

FCT reported for full year ended 30 Sep 2024, gross revenue was down 4.9% to S$351.7 million while net property income was down 4.6% to S$253.3 million. DPU for FY 2024 remained stable at 12.042 cents which translate to a dividend yield of 5.6%.

Portfolio occupancy remains high at 99.7% with positive rental reversion of 7.7%. FY24 tenants’ sales and shopper traffic was up 1.2% and 4.2% y-o-y respectively. Gearing ratio was at 38.5% with cost of debt of 4.1%.

Average debt to maturity is 2.56 years while 71.4% of borrowings are on fixed rates. FCT being the owner of suburban malls is more resilient to economy cycles due to the supermarkets which act as anchor tenant and also the many food establishments located in the malls.

Hence, FCT is definitely one of the 3 reliable Singapore REITs for 2025. You can view the REIT website here.

I have mentioned in my previous article, that the US will fall into a recession or stagflation after 2nd half 2025 or latest 2026. As REITs investors, it is imperative that we have resilient REITs in our portfolio to ensure that we receive stable distributions even when the economy is in recession.

Disclaimer: Please note that the REITs mentioned in this article are not a financial recommendation to buy and investors need to do their own research and due diligence before investing in any of these REITs.