Inflation is on the decline but remains elevated. Singapore’s core inflation rose to 2.7 per cent year-on-year in August 2024, the first time it has increased in six months.

Hence, REIT investors looking to beat inflation should scour for dependable REITs with attractive dividend yields. With the interest rates poised to decline further after the FED cut interest rates by 0.5% in September, REITs could outperform the market too.

Here are 3 REITs with attractive dividend yields to help you beat inflation

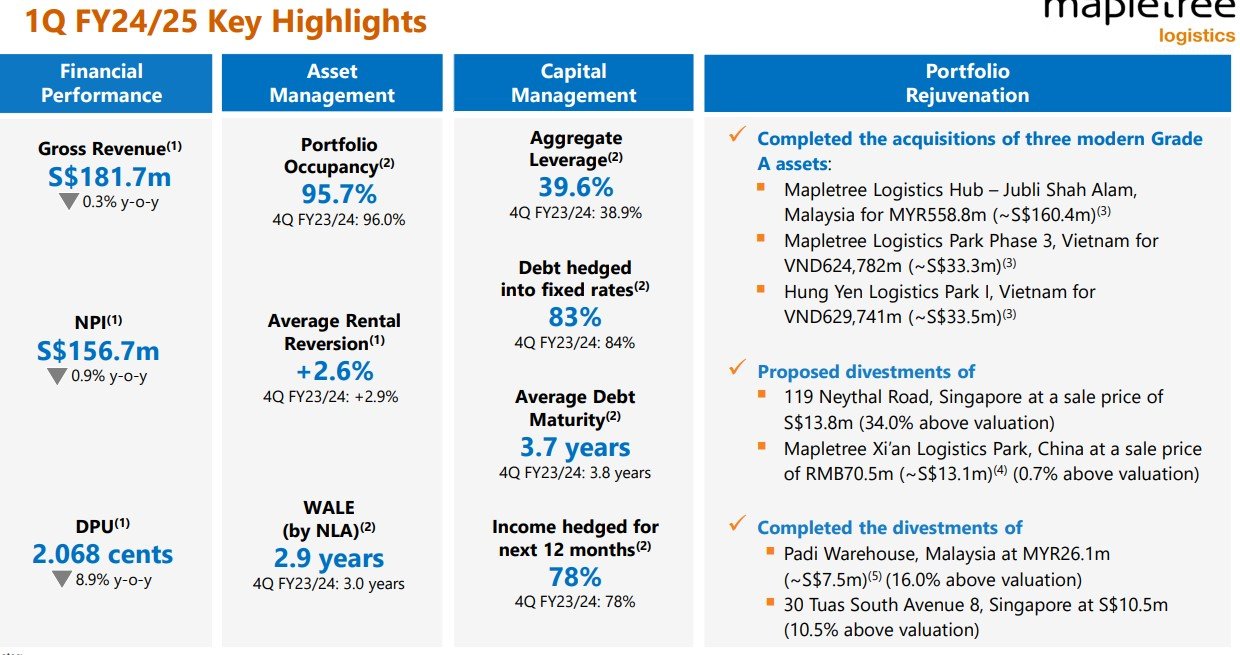

Mapletree Logistics Trust

Mapletree Logistics Trust reported its 1Q FY24/25 results in July. Revenue is down 0.3% to S$181.7 million while net property income is down 0.9% to S$156.7 million.

DPU was down 8.9% to 2.068 cents which translate to an annualized dividend yield of more than 6%. Portfolio occupancy remains healthy at 95.7%. However, rental reversion is meagre positive 2.6%.

Gearing ratio edged up to 39.6% which is on the high side. Fixed rate debt is high at 83% and this may not allow Mapletree Logistics Trust to take advantage of the lower rates when FED cut rates further.

With an dividend yield of more than 6%, Mapletree Logistics Trust is definitely one of the 3 REITs with attractive dividend yield to help you beat inflation. You can view the REIT website here.

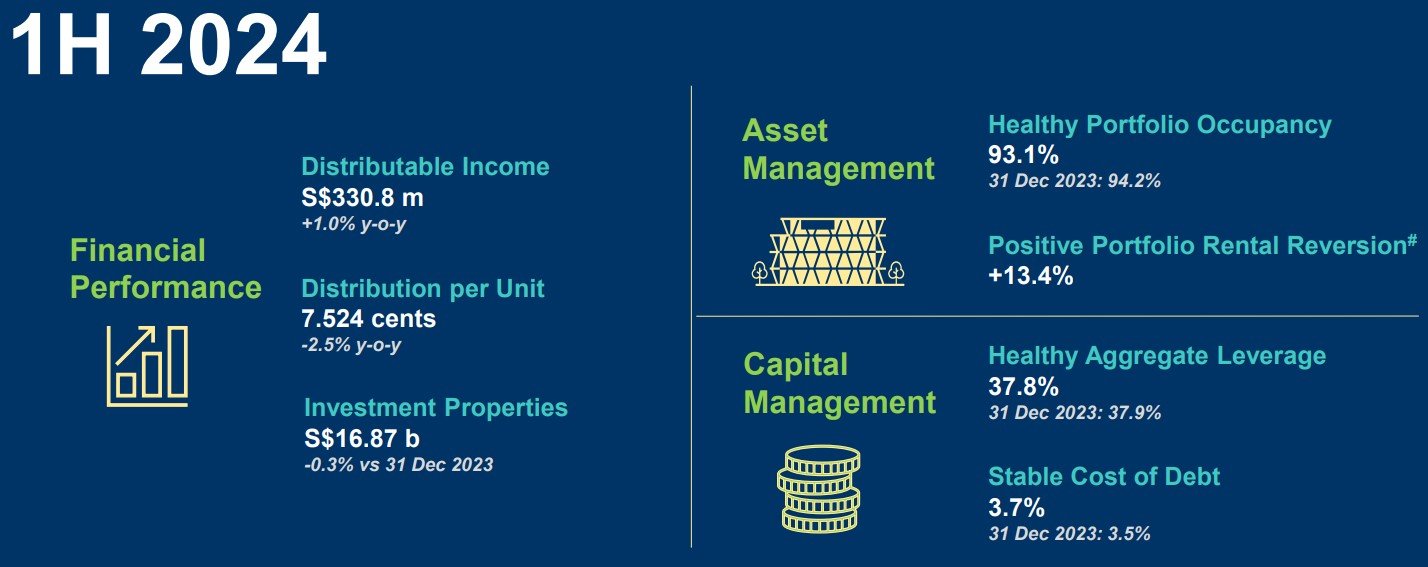

CapitaLand Ascendas REIT

In its latest half year results, CapitaLand Ascendas REIT reported revenue is up 7.2% to S$770.1 million while net property income is up 3.9% to S$528.4 million.

DPU is down 2.51% to 7.524 cents which translated to an annualised dividend yield of more than 5%. Portfolio occupancy is still high at 93.11% with positive rental reversion of 13.4%.

Gearing ratio is healthy at 37.8% with cost of debt of 3.7%. Interest cover is 3.7x with fixed rate debt of 83.0%. With decent dividend yield of more than 5%, CapitaLand Ascendas REIT is one of the 3 REITs with attractive dividend yield to help you beat inflation.

You can view the REIT website here.

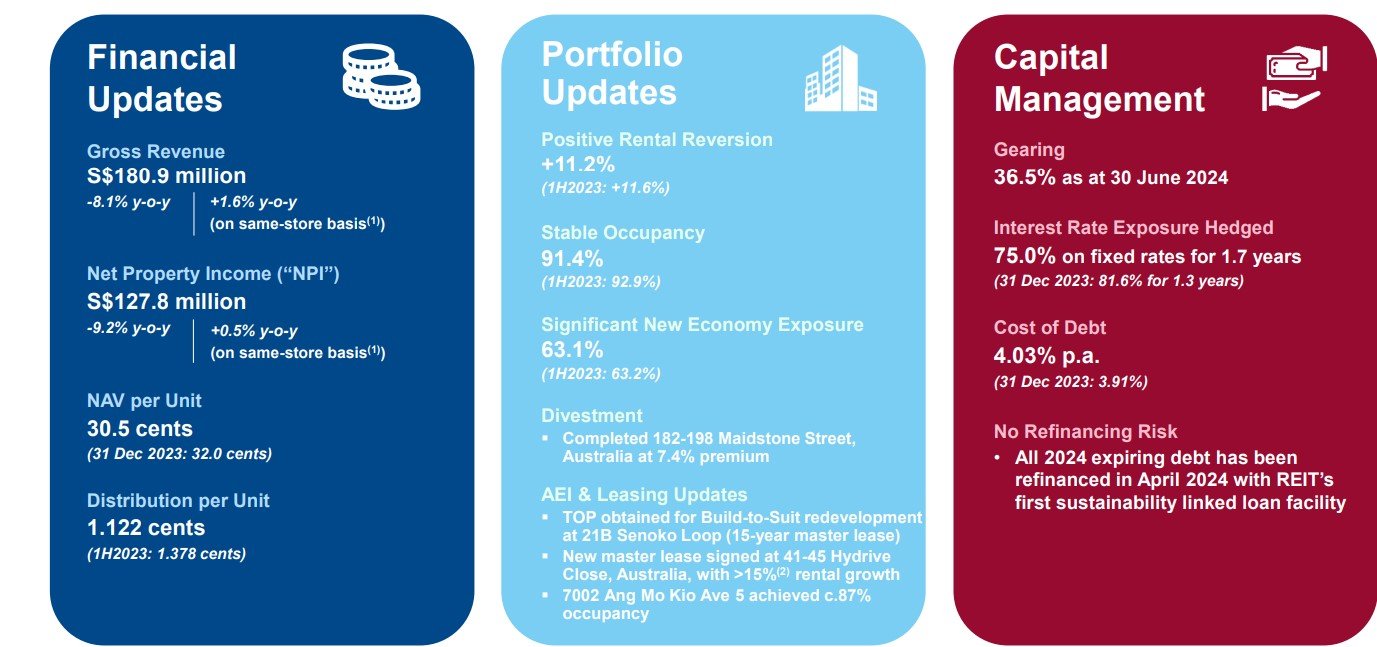

ESR-Logos REIT

In its half year results ended 30 June 2024, ESR-Logos REIT reported gross revenue down 8.1% to S$180.9 million. Net property income decreased by 9.2% to S$127.8 million while DPU decreased to 1.122 cents from 1.378 cents in the previous year.

This translated to an annualized dividend yield of about 8%. Portfolio occupancy was stable at 91.4% with positive rental reversion of 11.2%. Gearing ratio is healthy at 36.5% with 75% of debts on fixed rates.

With a decent dividend yield of 8%, ESR-Logos REIT is one of the 3 REITs that could be added to your watchlist to help cope a potential reignition of inflation again in the future. You can view the REIT website here.

Conclusion

These are the 3 REITs with attractive dividend yield to help you cope with inflation. Though inflation has come down significantly in recent months, it may remain elevated and sticky. This could be due to the FED cutting rates again as well possible food shortage next year.

Hence, investors should buy stocks or REITs that are able to beat inflation.