A number of REITs have announced their results recently.

And as expected, most of the REITs have shown a decrease in DPU mainly due to higher borrowing costs given the high interest rates environment.

Manulife REIT even has to suspend their DPU distribution for half year ended June 2023!

REITs DPU may show further downside if interest rates continue to remain at high level especially those that require re-financing this year.

However, despite these headwinds, there are 3 REITs which still managed to announced increase in DPU…

1. AIMS APAC REIT

It was mentioned in this article that AIMS APAC REIT (AA REIT) could be one the REITs that will outperform in 2023.

Indeed, AA REIT did not disappoint in their recent first quarter results , which show an increase in DPU of 1.3% to 2.31 cents.

In fact, net property income increased by 4.2% to $32,301 million while rental reversion increase by a whopping 38%!

That said, many investors felt that AA REIT did an $100M Equity Fund Raising (EFR) recently without any acquisition was a bad move as it will dilute shareholders’ value.

However, in my view, it was a shrewd move by the management to do an EFR just for AEI and to lower gearing. The gearing has dropped to 32.9% compare to 37.0% previously. This will lower its borrowing costs and there is also no re-financing requirements till FY2025.

This will give AA REIT the financial leverage to make future acquisition at attractive valuation especially if the Singapore economy were to enter a recession next year.

Given the increase in DPU and lowered gearing, the share price of AA REIT has outperformed the FTSE REIT Index. The REIT Index dropped 4.15% year to date compared to AA REIT which dropped only 1.61%.

2. Keppel DC REIT

It was mentioned in this article that Keppel DC REIT (KDC) looks attractive at current valuation. Since then, the share price was up 17.32% year to date.

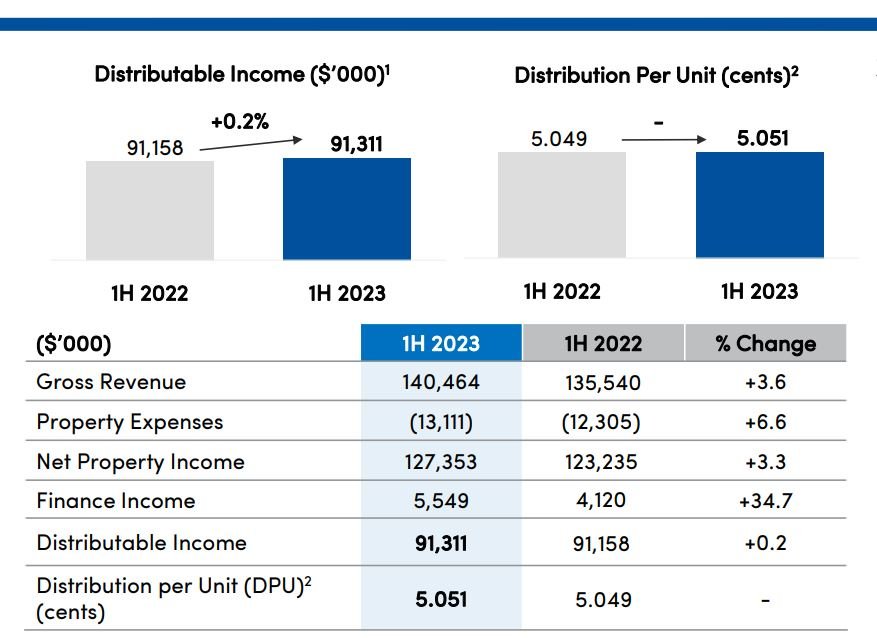

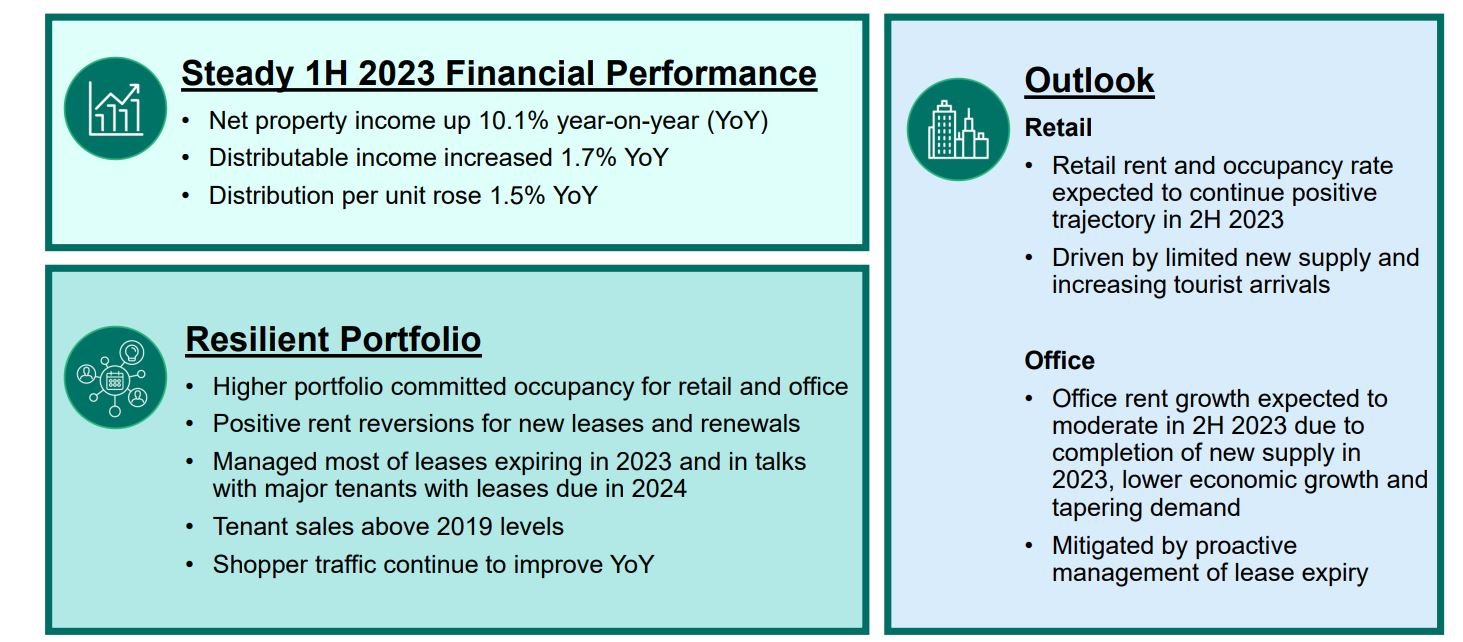

For their half year results ended 30 June 2023, Net property income increase by 3.3% to $127,353M while DPU eked out a small increase to 5.051 cents. Gearing remains relatively comfortable at 36.3%.

Despite the macroeconomic headwinds, the data-centre demand is expected to remain resilient. Structure Research forecasts that the global data centre co-location and interconnection market will grow 12% year-on-year to US$72.7 billion in 2023.

Continued expansion by hyperscalers, adoption of cloud computing, digital transformation initiatives; and artificial intelligence (AI) & machine learning (e.g. generative AI including ChatGPT) will support demand for data centres as well.

KDC is well-positioned to make attractive acquisitions based on their relatively lower gearing.

3. CapitaLand Integrated Commercial Trust

CapitaLand Integrated Commercial Trust (CICT) achieved a respectable first half performance with DPU up 1.5% to 5.30 cents.

Net property income increased by 10.1% to $353.2M over the same period. In addition, rental reversion for the retail portfolio is up by 6.9% while for the office portfolio is up 9.6%.

However, its gearing is relatively high at 40.4%, which may limit CICT to make acquisitions to grow DPU unless the acquisition is partly financed by rights issues or the purchase has to be in bite-size.

Given the cloudy Singapore economy outlook and hybrid work becoming the new normal, CICT could face headwinds in their continued growth in DPU. It has been reflected in the REIT share price with a drop of 6.4% year to date underperforming the REIT index drop of 4.15%.

You can view the REIT website here.

Conclusion

So far, among the REITs that has announced their results, these are the 3 REITs that have shown an increase in DPU. There is only 1 other REIT that increased its DPU namely – Mapletree Logistics Trust.

Hence, it is imperative for investors to able to invest in REITs that will continue their DPU growth so as to avoid capital losses like Manulife REIT.