Although Bitcoin came into existence almost a decade ago in early 2009, it was not until 2017 that governments around the world start scrambling for proper regulations for crypto assets.

The primary reason for that is because of the phenomenal rise in Bitcoin’s prices and the immense wealth it was making for Bitcoin holders all over the world. So much so that they have became Bitcoin millionaires and are even paying houses or cars using the Bitcoin cryptocurrency.

That said, global regulators are divided on how to keep up with the increased demand for crypto assets. These digital currencies are not backed by any central government and that naturally meant that each country can have different crypto regulations.

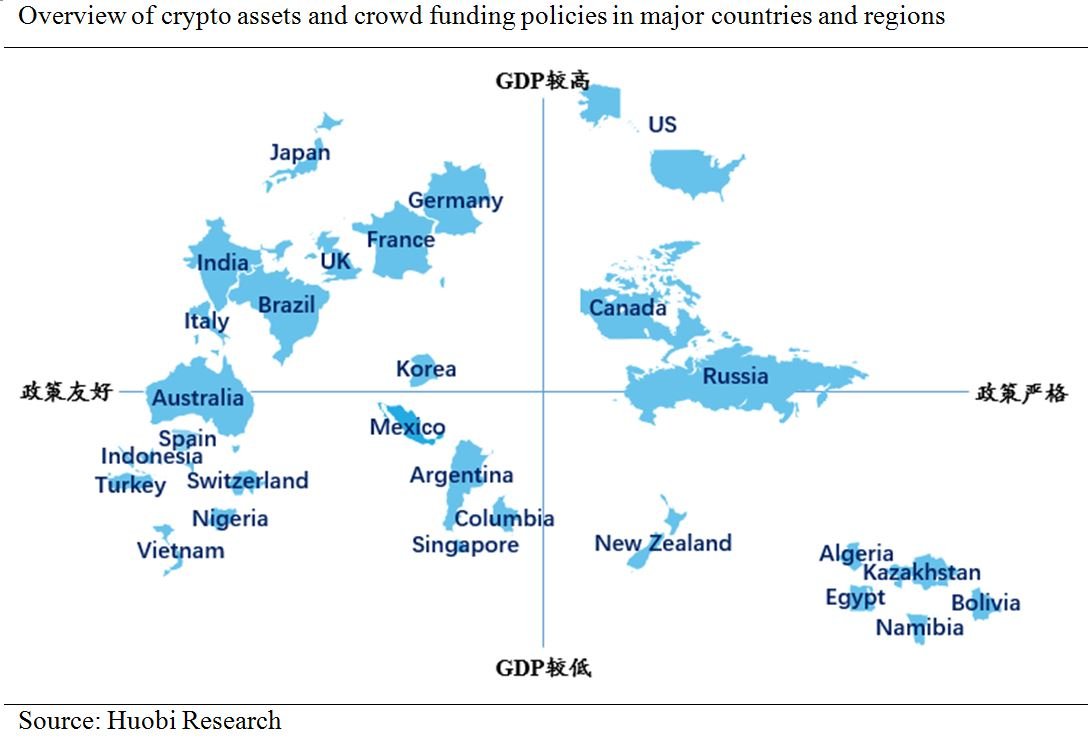

Huobi Research outlined the regulations based on each country in relation to their total 2016 GDP and related policies (updated to mid 2018) in its report. A concise summary is shown below.

For a quick background, Huobi Academy is a research institution focusing on technological research, industry analysis, and business consulting in the field of Blockchain. The report will first be made available to the attendees of Blockchain Festival Vietnam, proudly organized by Huobi Pro.

In addition, Huobi Research has also performed in-depth research and identified 3 important trends to pay attention to in the future.

3 Important Developments on Crypto Market Regulations

-

US becomes the yardstick for Crypto regulations

Since the start of 2018, U.S. Securities and Exchange Commission (SEC) is reinforcing its role as a regulator in the crypto market and formulating stricter compliance rules. In fact, US SEC is looking to apply securities laws to everything from cryptocurrency exchanges to digital asset storage companies known as wallets.

Recently in April 2018, the CEO of NASDAQ also announced that “they are open to becoming a crypto exchange once the regulation is smoothed out and the space matures”.

With the United States being one of the biggest economy in the world and actively crafting out regulations for the crypto sphere, Huobi Research believes that more countries may follow US’ lead going forward. This means that crypto assets will have a high chance being viewed as part of the security market too.

-

Centralized regulators and self-regulatory organizations to play important roles

Plenty of guidance and regulation is required given that many crypto assets are just created within these few years and comes with a high level of sophistication. For instance, U.S. aims to manage different crypto assets based on their characteristics of tokens, i.e. a security token or a utility token. In contrast, Japan is relatively lax as they adopts a fair and standard policy across all the crypto assets and has provided licenses for the setting up of crypto asset exchanges.

At the same time, smaller self-regulatory organizations can serve as supplements for centralized regulators, especially when mature compliance rules are not yet in place. One good example is during the recent hack of Coincheck, a bitcoin wallet and exchange service headquartered in Tokyo, Japan. 16 registered crypto currency exchanges quickly formed Japan Cryptocurrency Business Association (JCBA) and established a set of safety standards in the crypto market.

-

Global joint regulation among country unions.

During the G20 summit in March 2018, each country shared their own views towards how the crypto market should be regulated, but no concrete agreement can be finalized. In case you are not sure what the Group of Twenty (G20) is, it is an international forum that brings together the world’s 20 leading industrialised and emerging economies.

In fact, before the summit, Germany and France has already sent their proposal of joint regulation to the host country, trying to steer crypto regulations to the same level adopted by the Europe Union.

As we can see, it is not easy to cooperate on something so new and it is probably going to take them a long while before any joint regulations can be solidified. That said, Huobi Research thinks that leading countries and regions should ramp up their efforts in order to speed up the formation of these regulations.

A sneak peek into Singapore

Huobi Research’s premium report has done a breakdown of the crypto market’s regulatory policies of various countries and systematically evaluates their regulations on 4 levels:

- Whether crypto assets are permitted to be used as payment tool

- Whether crypto assets exchanges are permitted to operate

- Whether crypto assets crowd-funding is permitted

- Whether investments in crypto assets are permitted

In this section, we used the above criteria and did a simple evaluation of Singapore’s attitude towards crypto assets.

- Whether crypto assets are permitted to be used as payment tool

As early as in 2014, the Inland Revenue Authority Of Singapore (IRAS) had indicated that crypto assets such as Bitcoin are classified as commodities and non-monetary in nature.

The Monetary Authority of Singapore (MAS) also followed up and issued the second consultation draft of the “Payment Services Act (draft)” in November 2017. It is designed to consider crypto assets as payment tools and simplify the supervision of all payment services with the corresponding licenses.

- Whether crypto assets exchanges are permitted to operate

Singapore is one of the few countries that welcome the founding and operation of crypto asset exchanges domestically.

On November 14, 2017, MAS issued the “A Guide to Digital Token Offerings”, permitting the setting up of crypto assets-related intermediaries in Singapore. They only have to obtain a license for capital market service or to obtain a permission from the MAS.

- Whether crypto assets crowd-funding is permitted

Similarly, MAS also accepts crypto assets crowd-funding and defined a clear scope of supervision. Here is a summary:

“When the tokens belong to the capital market products defined by “Securities and FuturesAct (Cap. 289)”, the issuance of tokens will be regulated and authorized by the MAS. If the crypto assets do not belong to capital market products, they do not need to be supervised by the MAS, and only need to comply with conventional requirements such as anti-money laundering.”

In short, issuance of the tokens is allowed but would just fall under different jurisdictions depending on the type of tokens.

- Whether investments in crypto assets are permitted

This is the part where Singaporean crypto investors would be interested in.

All in all, Singapore has an open attitude towards crypto assets investments, and it does not levy tax on the investment return on crypto assets. However, Singapore government has repeatedly issued statements to warn investors on the potential risks of crypto assets investment.

All in all, Singapore’s stance on crypto assets is open and friendly. This is perhaps why Huobi Pro has decided to set up its main office here in Singapore. If you are keen to find out about your country’s regulations in the Huobi Research report, head down to the Blockchain Festival Vietnam where you will even receive goodies like a US$100K airdrop. Just take note to use the code WRITE50 for a 50% discount.