Healthcare stocks are usually seen as defensive plays in times of economic uncertainty. However, the healthcare sector has underperformed the STI index this year.

The iEdge Singapore All Healthcare Index delivered total returns of 6.81% year to date. In comparison, the benchmark Straits Times Index is up 7.92% over the same period.

Raffles Medical Group

Raffles Medical Group is a leading integrated private healthcare provider in Asia, operating medical facilities in 14 cities in Singapore, China, Japan, Vietnam and Cambodia.

It is the only Singapore-owned private medical provider in Singapore that owns and operates a fully integrated healthcare organisation comprising a tertiary hospital, a network of family and dental clinics and TCM clinics.

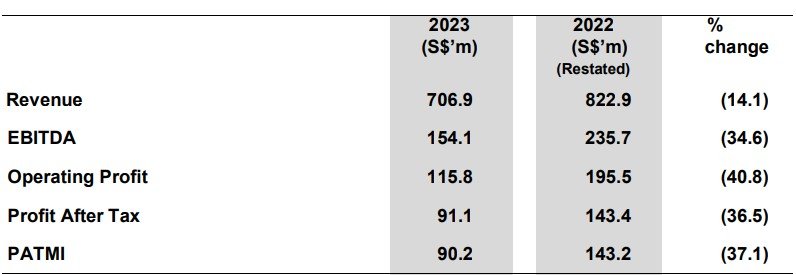

In its full year results ended 31 Dec 2023, Raffles Medical saw its revenue dropped by 14.1% to S$706.9 million while profit after tax declined by 36.5% to S$91.1 million.

The drop in revenue and profit is mainly due to the discontinuance of COVID-19 related activities in FY2023. The company declared a final dividend of 2.4 cents which translate to a dividend yield of 2.3%.

The company is cautiously optimistic in its FY2024 outlook as there is a growing demand for quality healthcare services in Singapore and the region.

The CEO commented that Raffles Medical operational strengths and agility enable the company to meet the evolving healthcare and wellness needs of people in Asia. You can view the company website here.

Tianjin Pharmaceutical Da Ren Tang

I believe not many investors know about this healthcare stock. Tianjin Pharmaceutical Da Ren Tang was formerly known as Tianjin Zhong Xin Pharmaceutical Group. It is the core pharmaceutical manufacturing arm of Tianjin Pharmaceutical Holdings Co.

With green Chinese traditional medicine as its core business, Da Ren Tang Group is equipped with a complete industry chain, product chain and talent chain integrating production, management and scientific research.

Its business covers a number of areas including research, development and manufacturing of Chinese herbal medicines, proprietary Chinese

medicines, chemical raw materials and preparations and nutritional and health products as well as pharmaceutical commerce.

Tianjin Pharmaceutical Da Ren Tang reported full year revenue flat at RMB8.22 billion while net profit increase by 11% to RMB990 million. The company declared a final dividend of CNY1.28 per share which is equivalent to SGD0.237 per share.

This translate to a dividend yield of 7.1%! Tianjin Pharmaceutical Da Ren Tang share price is up more than 18% year to date and is definitely one of the 3 healthcare stocks with upside potential.

The company is optimistic about its outlook. The pharmaceutical industry is an important component of China’s national economy, closely linked to the people, the economy, and the nation.

In recent years, with the rapid development of China’s economy and the continuous improvement of people’s living standards, the future development prospects of the traditional Chinese medicine industry are promising. You can view the company website here.

ISEC Healthcare

ISEC Healthcare is a comprehensive medical eye care service provider with ambulatory surgical centres in Malaysia and Singapore.

The doctors are specialised in the fields of cataract and refractive surgery, vitreoretinal diseases, corneal and external eye diseases, glaucoma, uveitis, oculoplastics, facial cosmetics and aesthetics surgery, adult strabismus and paediatric ophthalmology.

For the full year ended 31 Dec 2023, ISEC reported revenue increase by 11% to S$69.9 million while net profit increase by 3% to S$13.1 million. The company declared a final dividend of 0.85 cents per share.

Together with interim dividend of 0.76 cents per share, the full year dividend is 1.61 cents per share. This translate to a dividend yield of 4.18%.

ISEC will continue to seek suitable opportunities in the markets including Cambodia, Vietnam and Myanmar while strengthening their existing presence in markets of Singapore and Malaysia. You can view the company website here.

Conclusion

Healthcare stocks are often seen as defensive in nature and will be resilient when an economic recession happens sometime next year. The above are 3 healthcare stocks with strong upside potential. Investors need to do their due diligence before investing.

If you want to start building your multi-bagger portfolio such as Oiltek and Multi-Chem, be sure to check out our brand new Modern Value Program here!