Everyone desires a financially free retirement where one can relax in a nice beautiful beach.

To achieve this, you need to make your money work hard for you by investing in good dividend growth stocks that focuses on a stream of dividends received as passive income as well as capital gains.

We highlight 3 stocks with the potential to deliver both growth and dividends to help speed up your journey towards a happy retirement.

1. DBS Group Holdings

DBS has grown its revenue from S$9.8 billion in FY2014 to S$16.5 billion in FY2022 while dividends increased from 58 cents in 2014 to $2.00 in 2022.

DBS share price similarly has risen by 113.86% since 2005 and this excluding dividends collected! This is truly a stock to add to your retirement portfolio.

However, with the Singapore economy expected to slow down, investors to have to monitor DBS growth closely.

DBS CEO commented during the half year results that though there is some macroeconomic uncertainty, DBS prospects for the rest of the year are anchored on a franchise with a proven ability to capture business opportunities.

Our longstanding prudence in building general allowance reserves and maintaining strong capital ratios will position us well to withstand headwinds.

You can view DBS website here.

2. The Hour Glass Ltd

Another stock with growth and dividends that could add to one’s retirement portfolio is The Hour Glass. The Hour Glass is one of Asia’s luxury watch retail groups which has an established presence with over 40 boutiques in nine key cities in the Asia Pacific region.

The Hour Glass has seen its revenue grew from S$682.8 million in 2014 to S$1.12 billion in 2023. Net profit risen from S$56.3 million in 2014 to S$174.2 million in 2023.

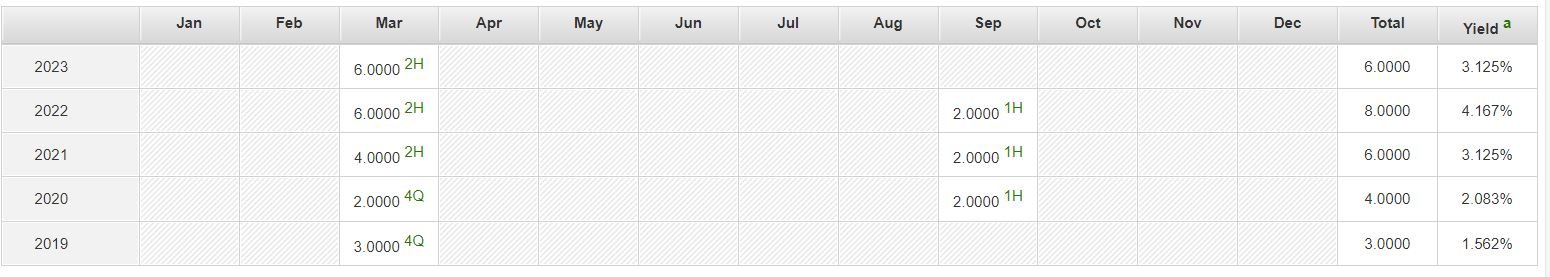

Its dividend increased from 3 cents in 2019 to 8 cents in 2022. Correspondingly, the share price has increased by an astonishing 519.35% since 2008! In fact, the share price increased by 190.91% in the past 5 years excluding dividends collected.

Though, prospects may dimmed due to economics uncertainties, luxury watches will still be in demand as the rich and poor divide gets wider. You can view the company website here.

3. Delfi Ltd

Delfi Ltd (Formerly known as Petra Foods Limited) markets and distributes its Own Brand of chocolate confectionery products in its core markets of Indonesia, Philippines, Singapore and Malaysia.

In addition, the chocolate confectionery products are sold in over 10 other countries including Thailand, Brunei, India, South Korea and Vietnam.

Delfi revenue growth has been relatively flat. The company revenue was S$665.9 million in 2014. In 2022, its revenue is S$649.4 million. Net profit was SS$64.3 million in 2014 while net profit in 2022 was lower at S$59.0 million.

However, the company dividend increased from 3.22 cents to 4.82 cents in 2022 excluding special dividends. Correspondingly, its share price grew at a much slower pace of 7.08% for the past 5 years.

On its future growth prospects, the company has made significant investments in R&D to build up its Own Brands portfolio including introducing brand extensions and new items targeted at Gen-Zs and Millennials as well as a healthier range targeted at more health-conscious consumers.

The company continued to manage a compelling range of Agency Brands to complement its Own Brands. Both segments are supported by an extensive network of distribution channels.

Hence, Delfi’s efforts has culminated in higher sales from both its Own Brands and Agency Brands segments across all its markets, particularly in the premium category which contributed to the 0.6 percentage point uptick in gross profit margin to 30.0% in 1H 2023.

In addition, Delfi’s revenue has seen its revenue grew by 16.2% to USD$ 286.2 million for the first half 2023. Hence, we might see higher dividends in future and thus driving up its share price.

You can view the company website here.

Conclusion

These are the 3 stocks with growth and dividends for your retirement portfolio. We can see from the above that investors need not bother whether to invest in growth or dividend stocks when they can invest in the best of both world which is dividend growth stocks.

With dividend growth stocks, investors can enjoy both capital appreciation as well as dividends!

To avoid investing in losing money S-REITs, join our latest Dividend Kaki membership as we show you a fuss-free way to invest in dividend stocks and REITs. Many people love dividend investing, but few truly know how to profit from it consistently. Click the link here to sign up and test drive to discover the secrets!