Many investors used a bottom-up approach to find stocks to invest. Bottom-up investing is an investment approach that focuses on analyzing individual stocks and de-emphasizes the significance of macroeconomic and market cycles.

This method can be effective if your search drills down into beaten-down stocks that investors are pessimistic about. By investing in such stocks, you may find attractive bargains that can potentially earn attractive gains.

Here are 3 beaten-down stocks for your portfolio.

Mapletree Logistics Trust

Mapletree Logistics Trust has been one of the worst performing REITs in this current bear market for REITs. In fact, MLT has dropped more than 12% year to date and is now languishing at $1.13 despite being a so-called strong sponsor REIT.

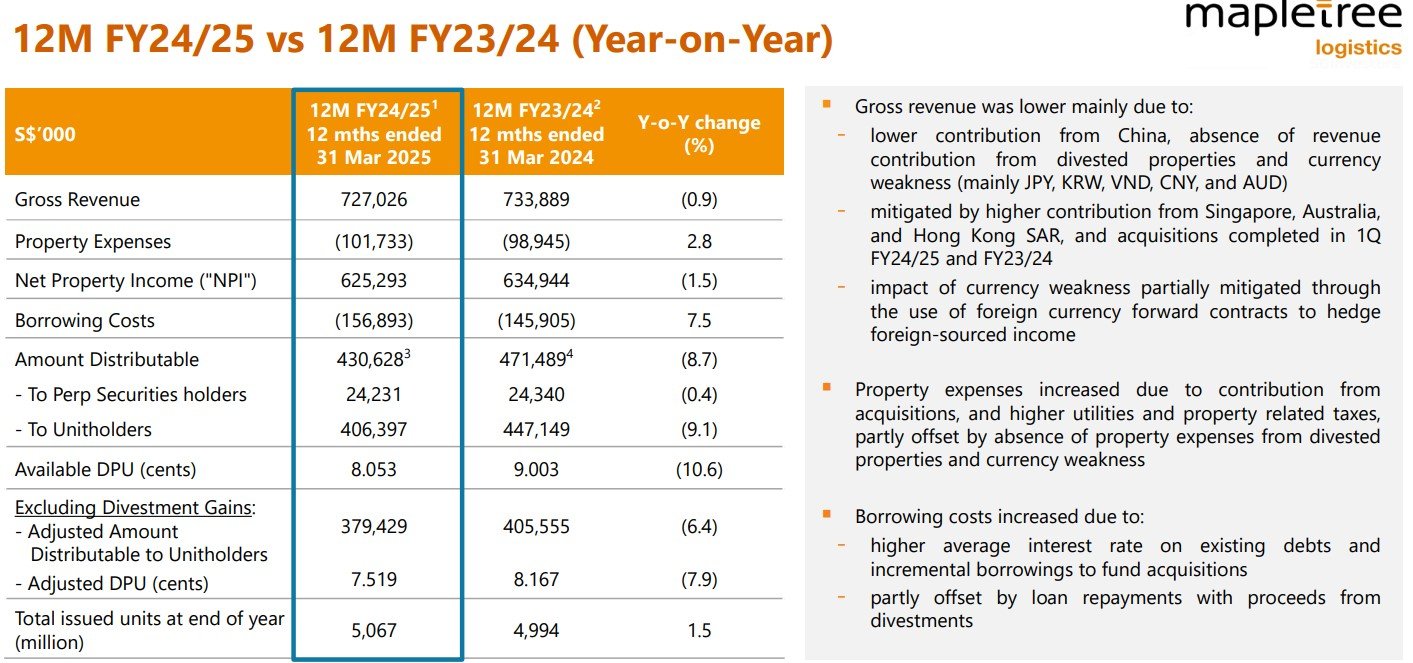

For the full year ended 31 March 2025, MLT reported gross revenue dipped by 0.9% to S$727 million while net property income decreased by 1.5% to S$625.2 million.

Total DPU for the full year came in at 8.053 cents which was 10.6% lower compared to the previous year. This translate to a dividend yield of more than 7%. Gearing ratio remained above 40% at 40.7% with 81% of debts fixed into fixed rates.

Average debt to maturity is 3.8 years. Portfolio occupancy is 96.2% with average portfolio rental reversion of 5.1%. Given that MLT share price has dropped to such low levels, it could be one of the 3 beaten-down stocks for your portfolio.

However, investors need to be wary of the risks involved in investing such a REIT. You can view the REIT website here.

Singapura Finance Ltd

Singapura Finance, formerly Singapura Building Society Ltd was incorporated in 1969 as a public company to take over the undertakings and operations of Malaya Borneo Building Society, the oldest finance company in Singapore, established in 1950.

Today, the Company continues to provide home loans and has expanded its financial services to include financing for commercial and industrial properties, property developments, shares, vessels, hire purchase of vehicles and equipment, factoring and agency services for some statutory bodies’ staff housing loan schemes.

For the full year ended 31 Dec 2024, interest income and hiring charges was up 12.1% to S$53.9 million while net profit after tax was down 1.0% to S$6.09 million. Balance sheet remains strong. A first and final dividend of 2 cents plus a special dividend of 1 cent per share was declared.

Year to date, Singapura Finance share price was unchanged. However, its share price of 68 cents remained near 52 week low of 64 cents. Hence, Singapura Finance is one of the 3 beaten-down stocks for your portfolio. You can view the finance company website here.

APAC Realty Ltd

APAC Realty is a leading real estate services provider that holds the exclusive ERA regional master franchise rights for 17 countries and territories in Asia Pacific.

The Group currently operates in 13 countries and territories including Australia, Cambodia, China, Indonesia, Japan, Korea, Laos, Malaysia, Philippines, Singapore, Taiwan, Thailand and Vietnam.

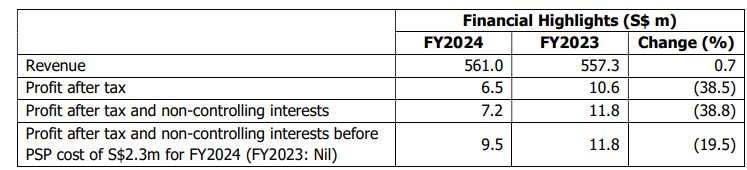

For the full year ended 31 Dec 2024, APAC Realty reported revenue was up just 0.7% to S$561.0 million while net profit after was down 38.5% to S$6.5 million. Balance sheet remains strong with healthy cash balance of S$40.0 million as at 31 December 2024.

However, the company remains optimistic with robust pipeline of 29 upcoming residential projects in Singapore, representing over 15,000 new homes launched and expected to be launched in 2025.

The company declared a final dividend of 1.2 Singapore cent per share, representing a payout ratio of 78.7% (including interim dividend of 0.9 cents). The company share price is up 2.56% year to date. However, at its current share price of 40 cents, it remains languishing near 52 week low of 36 cents.

Hence, APAC Realty Ltd is one of the 3 beaten-sown stocks for your portfolio. You can view the company website here.

Disclaimer: Please note that the stocks mentioned in this article are not a financial recommendation to buy and investors need to do their own research and due diligence before investing in any of these stocks