It’s almost every Singaporean’s dream to own a physical property perhaps because of the way how our parents/grandparents have made their fortunes in this area.

Moreover, REITs investing is often tagged as a more stable method of investing which requires less time monitoring – suitable for high income earners in Singapore.

And the icing on the cake is that many ‘middle-class’ Singaporeans may not be able to afford private properties which may cost over $1 million – and REITs investing fulfill that desire with a much lower quantum!

With that in mind, lets look at the 10 pros and cons of REITs Investing.

Advantages of REIT Investing

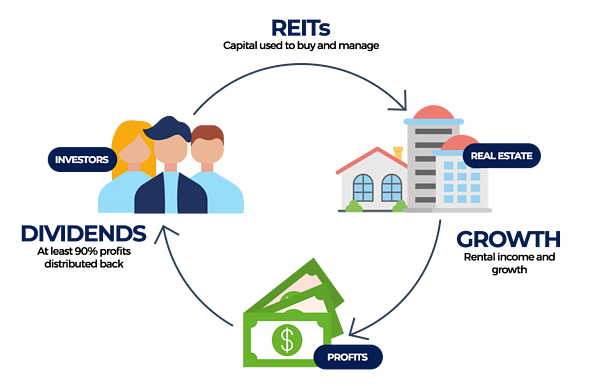

1) 90% Income paid out by Law

By law, REITs are stipulated to pay out 90% of their profits as distributions to shareholders. (That’s you!)

This requirement means your REIT investment will offer you enticing yields, often above fixed deposits and endowment policies.

2) Like Cash Machines

The dividend income of REITs works like a perpetual cash machine generating passive income.

That’s why retirees love this asset class so much.

They free up their time and just gives them ‘pocket money’ on a regular basis throughout the year.

3) Low Capital Outlay

You don’t need a 6-figure down-payment to own a physical property. REITs investing only requires you to start off by purchasing min. 100 shares of a REIT.

Depending on which type of REIT you invest in, you can already own a diversified portfolio from the various types of properties inside a REIT.

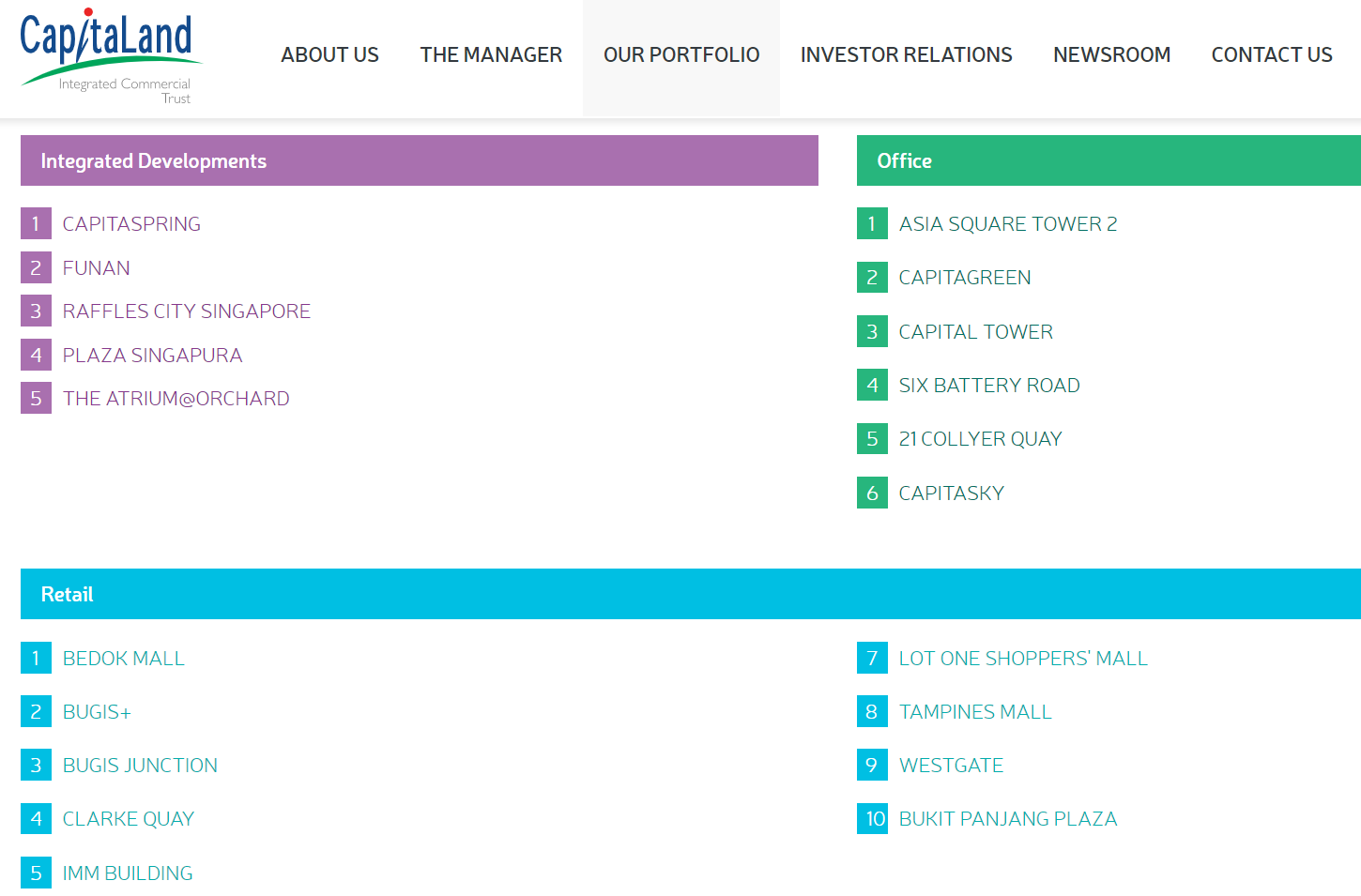

For instance, if you look at CICT, its portfolio comprises of Integrated Developments, Office and Retail assets.

Based on its share price of $2.11 at the time of writing, purchasing 100 shares would only costs $211 — definitely an easy way to get started.

4) Diversification

Again, you can potentially get instant diversification because some REITs like CICT or MIT do not just buy into one type of properties.

You can’t do that if you own a physical property which means getting a huge chunk of your monies locked in a single property.

5) Lower costs, Higher Liquidity

The cost of owning REITs is lower than that of owning a private property. To invest in REITs, you just need to pay for brokerage comm/fees. But property investing will involve high agents fees and stamp duties from government.

In addition, there is higher liquidity in REITs – you can divest them within days if you sense something wrong or face regulatory risks – such as high interest rates environment.

But this is not the case for properties. Cooling measures and accelerating interest rates can cause intense stress for property investors.

6) Less Hassle

Some investors find the micromanagement of their buildings to be an exciting part of ownership.

For those who find it to be an absolute grind, REITs offer a chance to own real estate without all the nitty gritty of managing it.

It is much easier to sell your stocks in a REIT than it is to sell a physical building. If you feel like getting out, you simply sell your shares to a someone interested in purchasing.

Compare that with the option of paying property taxes for months while buyers tour your commercial building.

Disadvantages of REIT Investing

On the flip side, there are also dis-advantages of REIT Investing that investors need to be aware of.

7) Low growth

In essence, capital growth of REITs may be limited because 90% of its profits go to distributions. This means that only a mere 10% of its profits goes into re-investments.

Hence, the relatively small amount left over makes it difficult for REITs to grow without forcing managers to issue shares or take on increased debt in the long run.

8) Tied to the real estate market

An obvious disadvantage to REITs are their tether to the real estate market.

Rising vacancy rates, lower rent prices and other variables will all affect the success of your REIT investment.

Your dividends are not guaranteed, meaning any hit to the real estate market will be a blow to your pockets as well.

9) High Leverage

As previously mentioned, REITs are highly leveraged – you cant expect a whole property worth billions of dollars to be backed by cash right?

Essentially, the REITs’ bottom line may be affected when there is a surge in interest rate.

10) Lack of control

While passive income can be pleasant, you’re ceding direct control over how your properties are handled.

Trust managers are the ones who make the important decisions concerning your properties and you cant really agree or disagree – you can only exit your positions if anything else goes wrong.

Conclusion

There you have it – 10 Pros and Cons of REIT Investing… The recent hike in i/r has shown that it is not as straightforward as before but as always, REITs are still be able to generate passive cashflow for many income investors.

[…] gearing ratio is relatively high at above 40%. As mentioned in our other REIT articles such as this and this, any ratio above 40% could be a cause for […]

[…] 4) CapitaLand Investment distributes Ascott Trust units, more to come? by Dr Wealth 5) 10 Pros and Cons of REITs Investing by Small Cap Asia 6) 4 Singapore REITs Paying out Dividends in March by The Smart […]